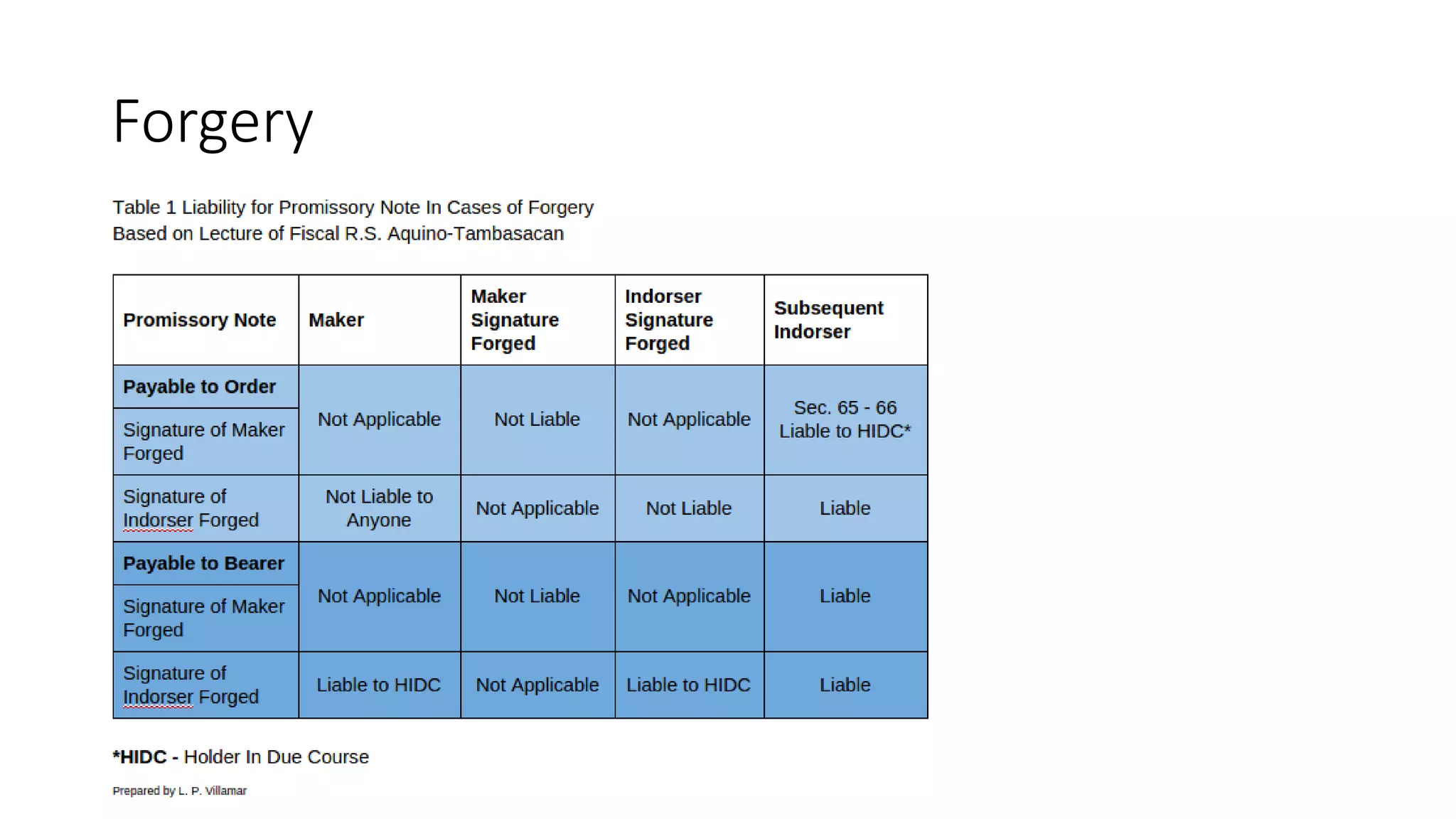

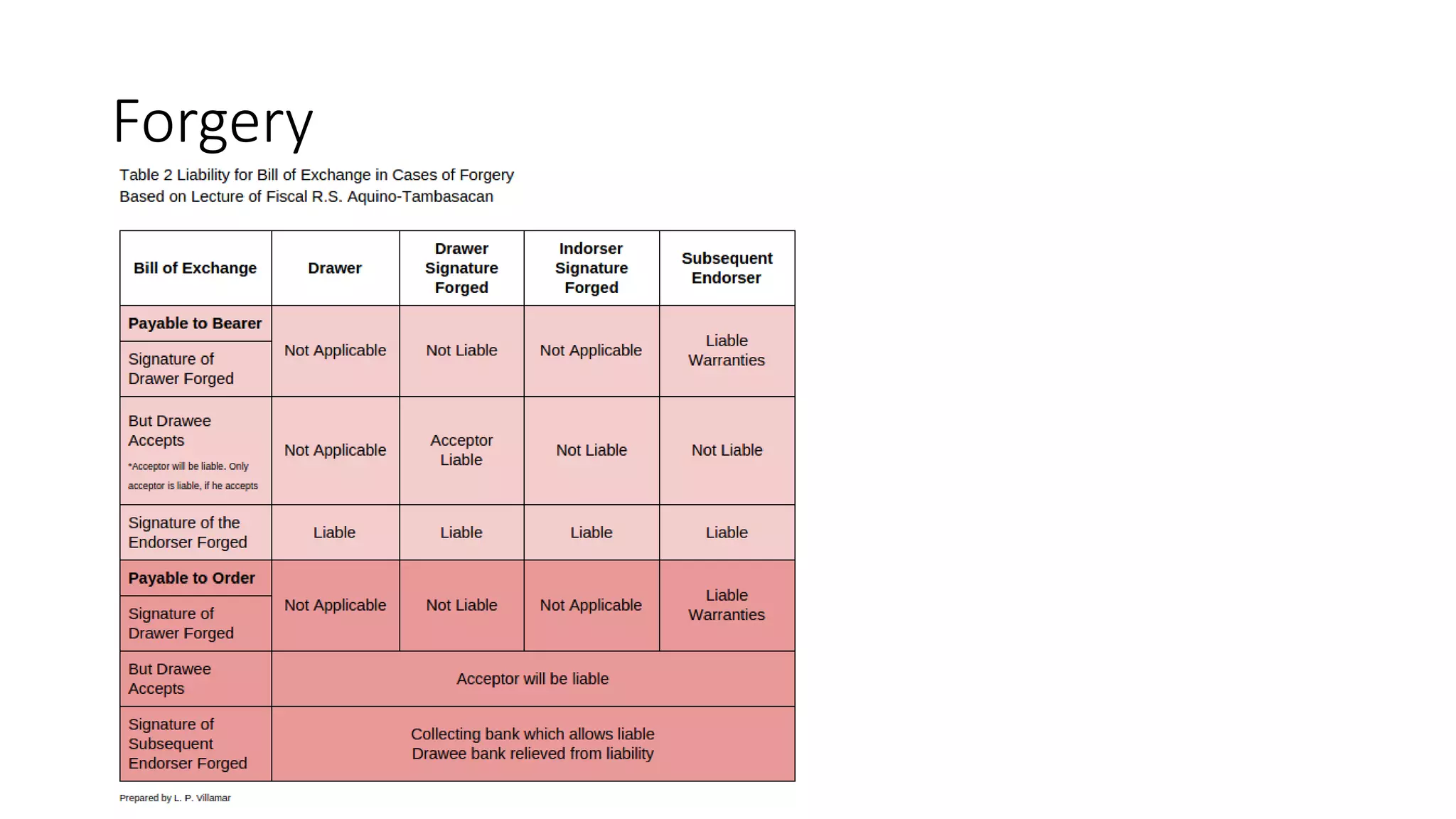

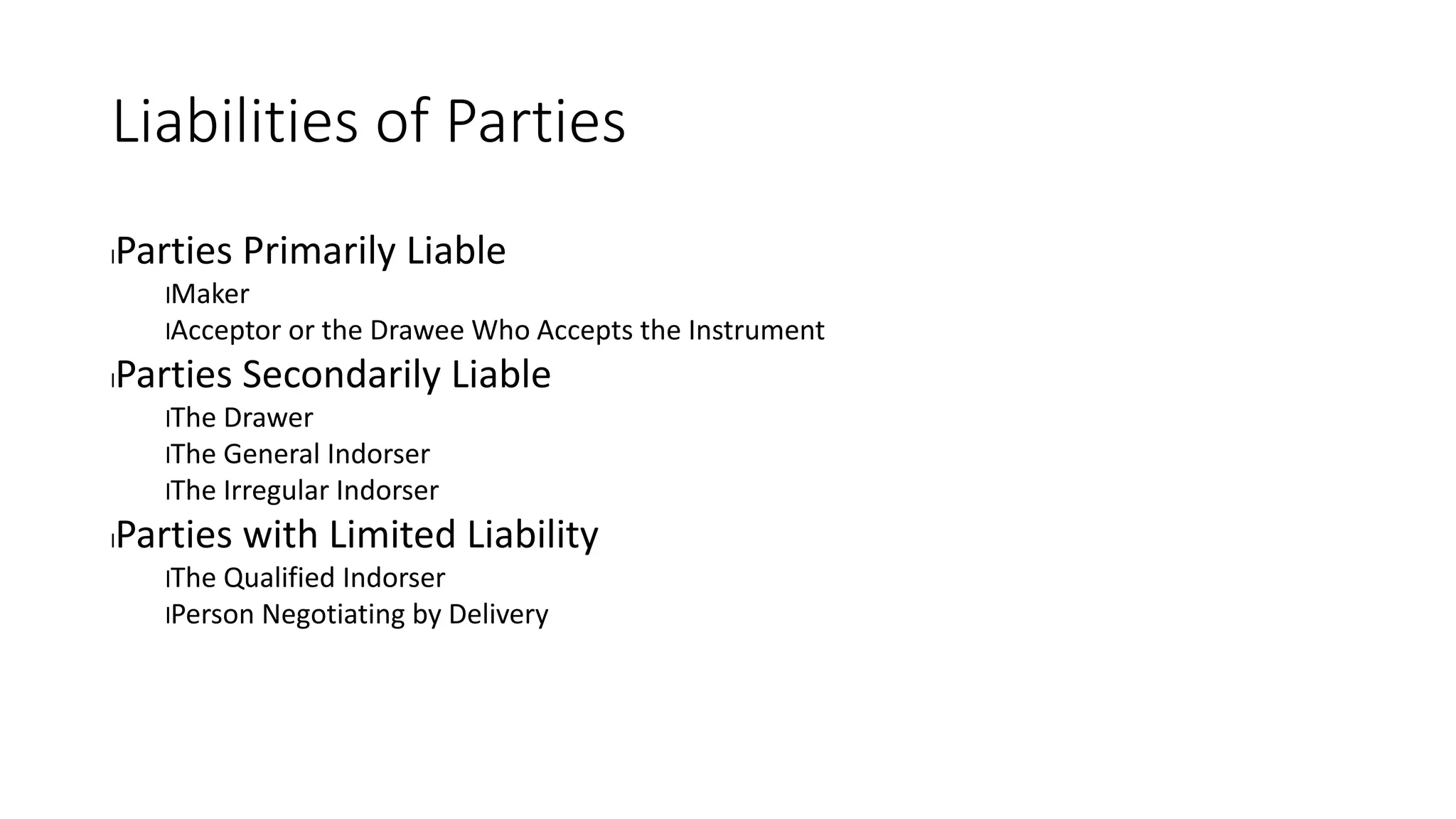

This document is a comprehensive review of negotiable instruments law, structured according to the 2015 bar exam syllabus. It synthesizes various references and lecture notes to cover fundamental concepts such as the requisites of negotiability, types of negotiable instruments, and related legal principles. The content serves as a brief guide for law students, emphasizing important legal distinctions and definitions within commercial law.