This document provides an overview of key concepts in corporate governance, including:

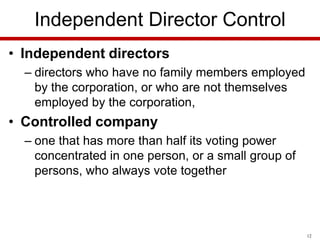

- The five main theories of corporate governance: special interest group control, governmental control, independent director control, managerial control, and shareholder democracy.

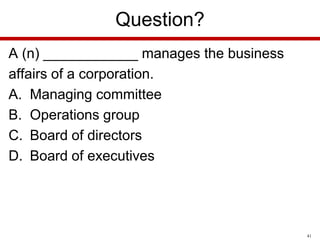

- The roles and responsibilities of directors, officers, and shareholders. Directors manage the corporation, officers operate it, and shareholders own it.

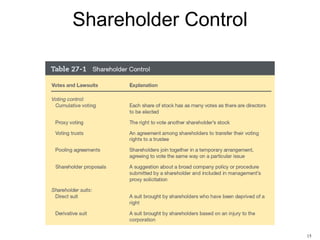

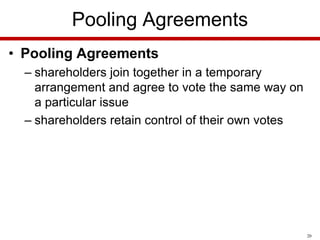

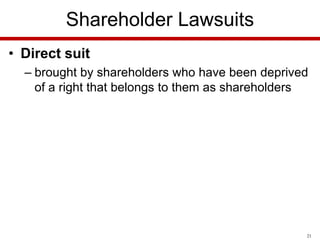

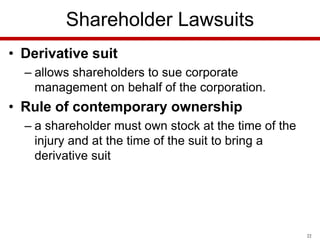

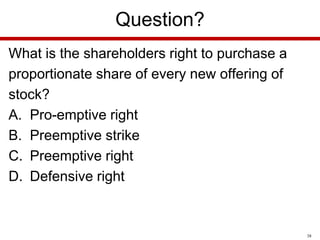

- Shareholder rights like examining records, receiving dividends, transferring shares, and preemptive rights to purchase new stock offerings.

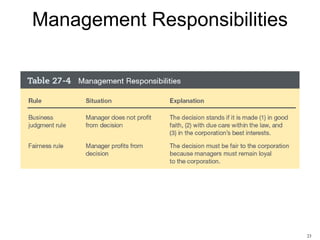

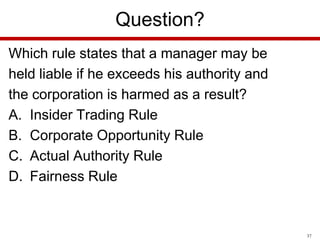

- Laws and rules governing management responsibilities, like the business judgment rule, fairness rule, and Sarbanes-Oxley Act requiring directors to monitor legal compliance.