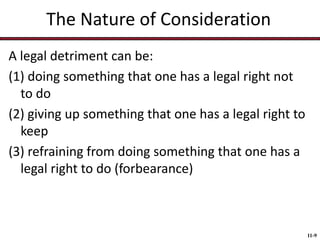

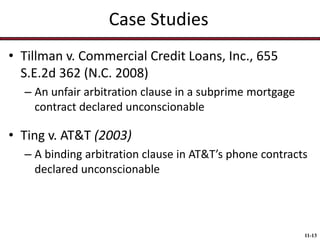

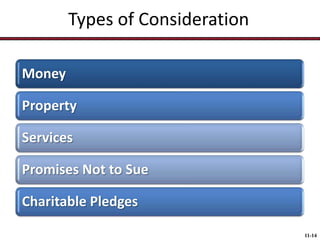

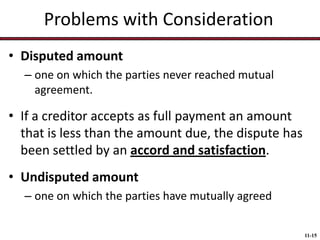

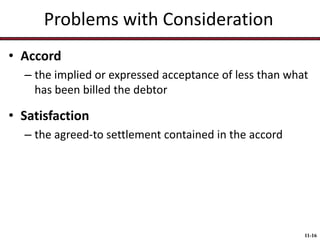

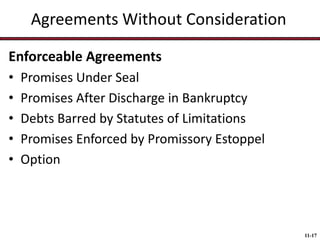

This document discusses consideration in contracts and cyberpayments. It defines consideration as a bargained-for exchange between parties where each party provides benefits and suffers detriments. Consideration must involve a legal detriment like doing something one is not required to do or refraining from something one can legally do. The document also discusses issues like adequacy of consideration, bargained exchanges, and exceptions to consideration like promissory estoppel. It analyzes cyberpayment options and security issues in light of EU privacy directives.