The document discusses key aspects of negotiable instruments under the Negotiable Instruments Act of 1881 in India. It covers:

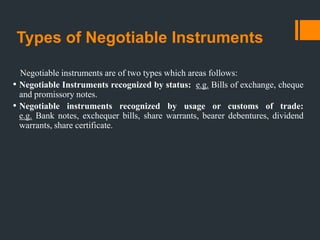

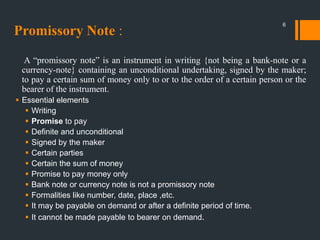

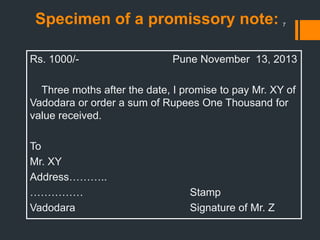

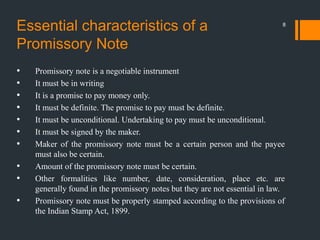

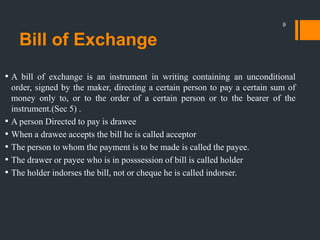

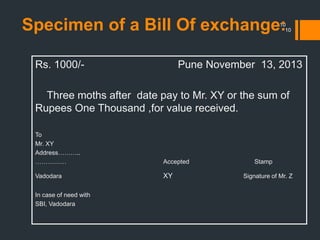

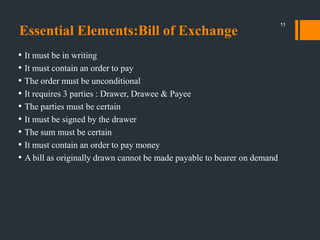

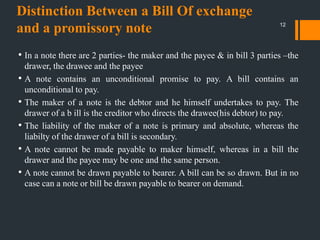

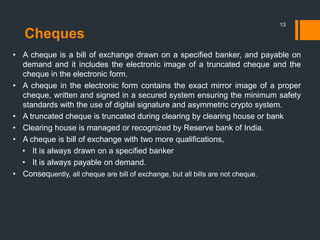

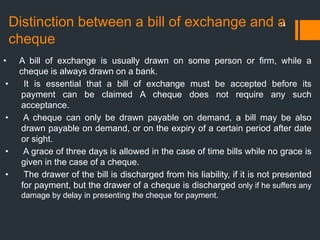

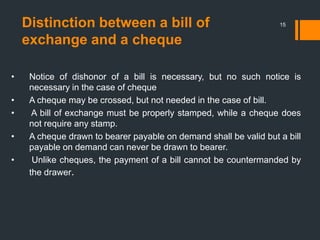

1) The main types of negotiable instruments like promissory notes, bills of exchange, and cheques. It explains their essential elements and differences.

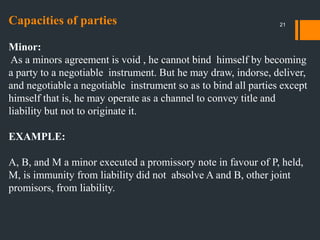

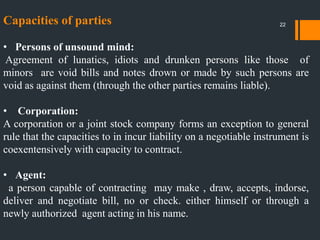

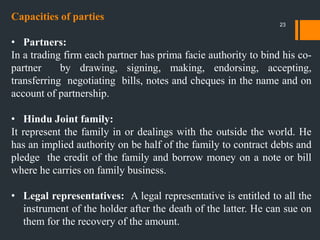

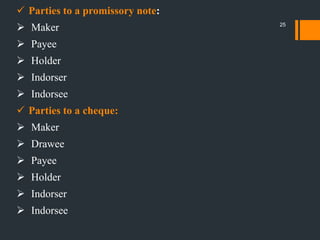

2) Key parties to negotiable instruments like drawers, drawees, makers, payees, holders, and endorsers. It also discusses capacities of different parties.

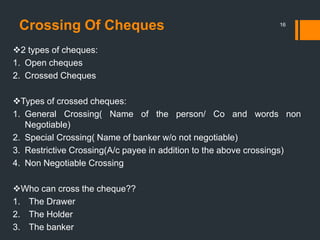

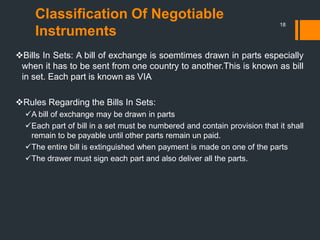

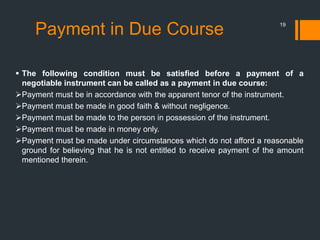

3) Important concepts like crossing of cheques, classification of instruments, presumption of consideration, and distinction between payment in due course vs other payments.

4) The characteristics and requirements to qualify as a holder in due course, who has additional rights

![d. He must become a holder of the negotiable instrument in

good faith:

Here the term „good faith‟ implies that he should not accept the

instrument after knowing about the defect or defects in the title to

the instrument. A thing is done in good faith when it is done

honestly. It is the duty of a person [who takes a negotiable

instrument] to examine its contents thoroughly. If the negotiable

instrument contains any material alteration or if it is incomplete,

he will not become a holder in due course. Thus, he must become

a holder and must take the negotiable instrument complete and

regular on its face.

31](https://image.slidesharecdn.com/the-negotiable-instruments-act-18812-140328130744-phpapp02/85/The-negotiable-instruments-act-1881-2-31-320.jpg)

![• Thus delivery of a negotiable instrument is a voluntary transfer of

possession of the negotiable instrument. When an instrument is negotiated

by delivery it is not necessary for a transferor to put his or her signature on

the instrument and therefore, there is no privacy of any contract between

the transferor and any subsequent transferee.

• Negotiation by endorsement and delivery:

• Subject to the provision of section 48 [which is stated earlier] a promissory

note, cheque or a bill of exchange payable to order is negotiable by the

holder by endorsement and delivery thereof [section 48]

• Thus the delivery is the common element between the two modes of

negotiation i.e. negotiation by mere delivery and negotiation by

endorsement and delivery.

36](https://image.slidesharecdn.com/the-negotiable-instruments-act-18812-140328130744-phpapp02/85/The-negotiable-instruments-act-1881-2-36-320.jpg)