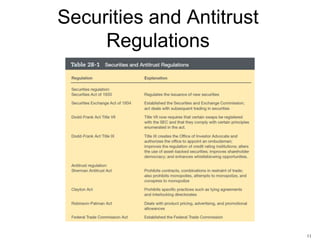

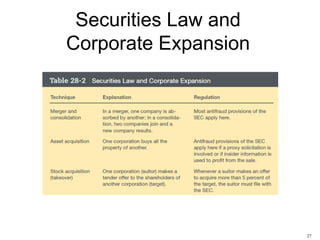

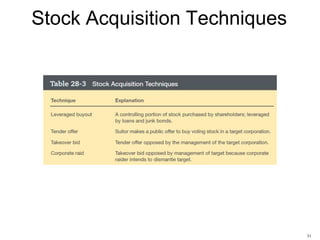

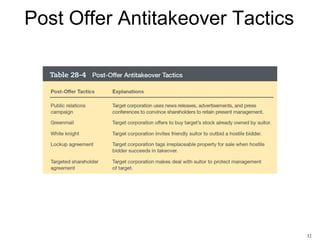

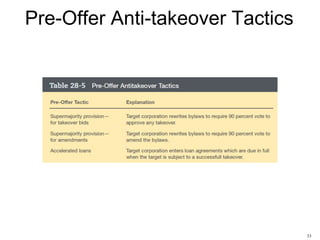

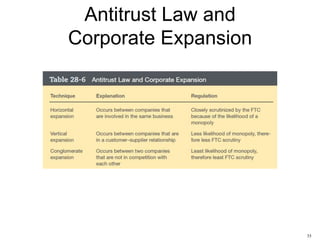

This document provides an overview of government regulation of corporate business in the United States. It covers the development of federal and state power to regulate business, securities laws like the Securities Act of 1933 and Securities Exchange Act of 1934, antitrust laws like the Sherman Antitrust Act, and the role of agencies such as the SEC and FTC. It also discusses corporate expansion tactics, their treatment under securities and antitrust laws, and circumstances for involuntary or voluntary corporate dissolution.