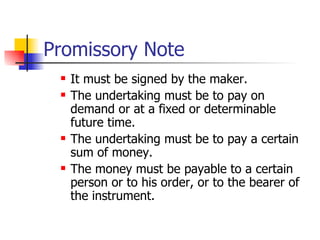

A bill of exchange must be in writing, contain an unconditional order to pay a certain sum of money to a certain person or bearer, and be signed by the maker. There are three necessary parties to a bill of exchange: the drawer, drawee, and payee. To be a holder in due course, one must physically possess the instrument, receive it for consideration, and acquire it without knowledge of defects in title. A holder in due course can recover amounts from all previous parties and is protected against certain defenses. Similarly, a promissory note must meet certain requirements under law to be valid.