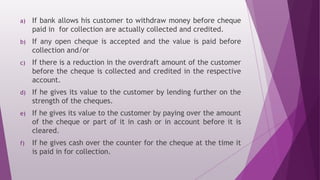

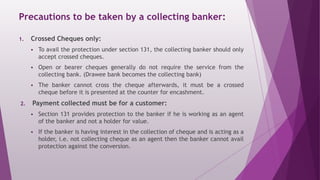

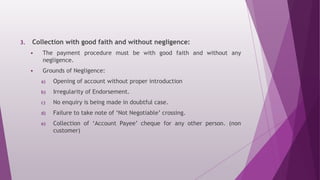

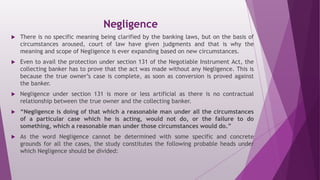

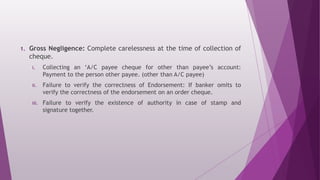

The document discusses the roles and responsibilities of a collecting banker when handling cheque collections. It outlines that a collecting banker can act either as a holder for value or as an agent of the customer. As a holder for value, the collecting banker enjoys rights similar to a holder in due course. As an agent, the banker must take precautions to avoid liability for conversion. The document also discusses the statutory protection provided to collecting bankers under Section 131 of the Negotiable Instruments Act if they collect payment in good faith and without negligence. It provides examples of negligence and outlines various duties and precautions collecting bankers must follow.