The document summarizes different theories of trade cycles:

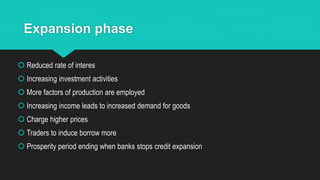

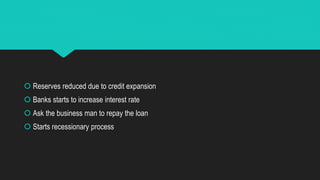

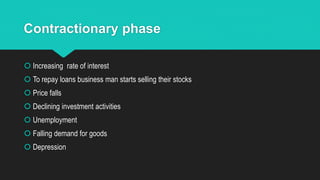

Hawtrey's monetary theory argues that trade cycles are caused by expansions and contractions in bank credit and interest rates over time. When interest rates are low, investment and economic activity increase, but banks eventually raise rates, causing recessions.

Hayek's overinvestment theory says disequilibrium between the natural interest rate and market rate can cause overinvestment during booms and underinvestment in recessions.

Keynes' theory is that fluctuations in marginal efficiency of capital and expected profitability drive booms and busts as optimism rises and falls. High investment initially boosts output and employment but eventually lowers profits, causing pessimism and contraction until confidence