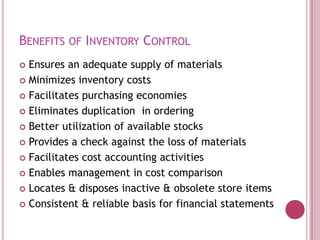

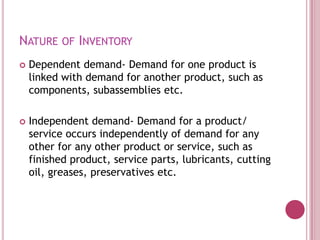

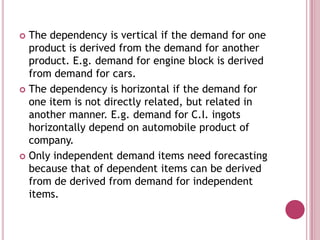

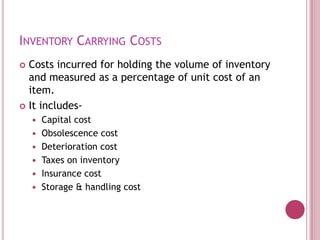

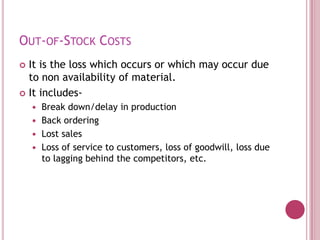

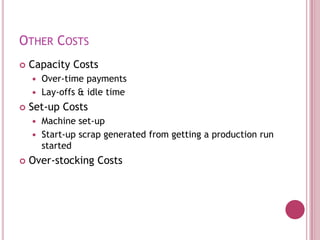

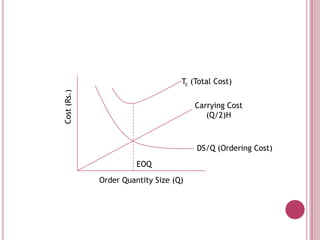

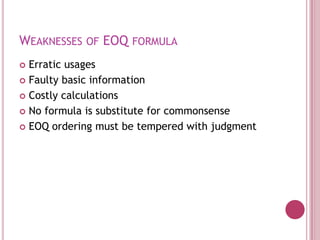

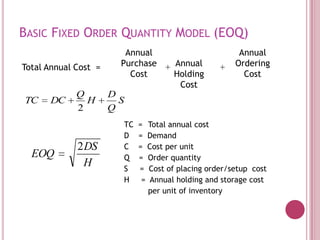

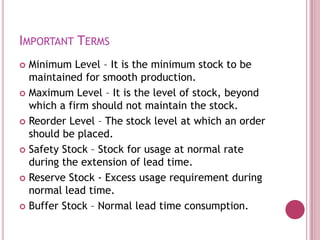

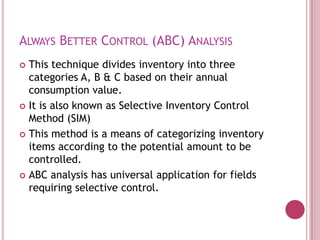

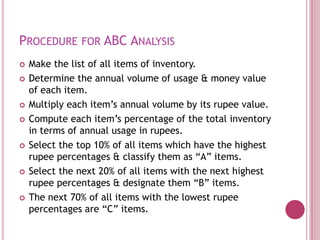

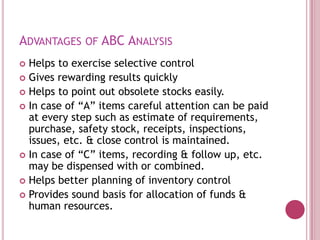

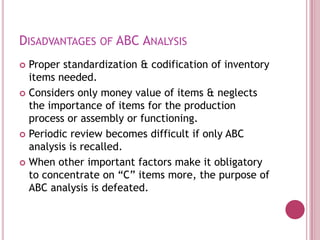

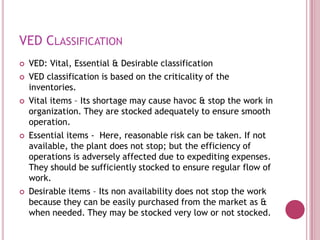

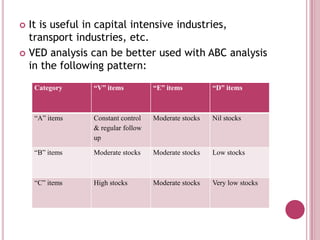

The document discusses inventory control and various inventory management concepts. It defines inventory control as regulating inventory levels according to predetermined norms to reduce costs. The objectives of inventory control are to meet demand and smooth production fluctuations. Factors like product type and volume affect inventory control. Economic order quantity and reorder point models aim to minimize total inventory costs by balancing ordering and carrying costs. ABC analysis classifies inventory into A, B, and C categories based on annual consumption to focus control efforts.