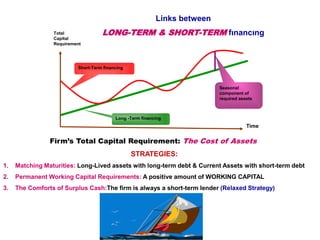

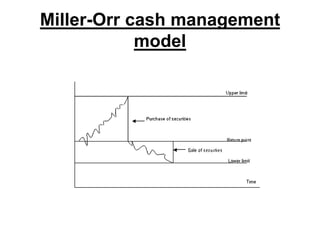

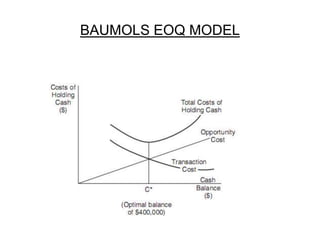

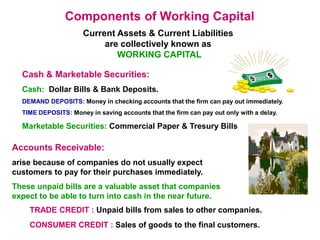

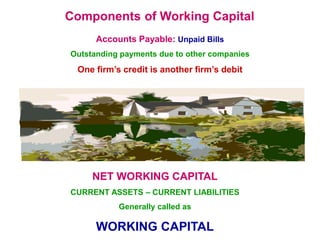

Working capital management involves managing a company's current assets (cash, inventory, receivables) and current liabilities (payables, debt). There are various components of working capital like accounts receivable, cash, inventory, and accounts payable. Managing working capital effectively involves balancing the carrying costs of holding current assets versus the shortage costs of not having enough. Firms aim to minimize total costs by finding the optimal level of current assets. Cash management is important to ensure sufficient cash flow and liquidity while minimizing idle cash balances.

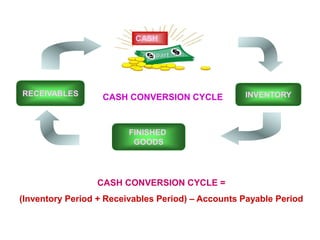

![CASH CONVERSION CYCLE =

(Inventory Period + Receivables Period) – Accounts Payable Period

CASH CONVERSION CYCLE :

Period between firm’s payment for materials and collection on its sales

Inventory Period = Average Inventory / [Cost of Goods Sold / 365]

Receivables Period = Average Accounts Receivables / [Sales / 365]

Payable Period = Average Payable / [Sales / 365]](https://image.slidesharecdn.com/fm2chapter23-240328193446-1b50d4b3/85/working-capital-management-FM2CHAPTER-2-3-ppt-5-320.jpg)