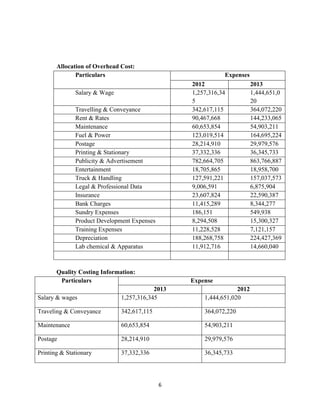

ACI Pharmaceuticals uses the traditional costing method for overhead allocation. This method uses multiple cost drivers for different product lines, including direct labor cost, machine hours, direct labor hours, direct material cost, and production volume. While easy to apply, this method does not always accurately allocate costs when there are multiple products. Using a single cost driver can also result in misleading allocations that do not reflect actual cost drivers. ACI tracks overhead costs by department and allocates costs using blanket or machine rates.