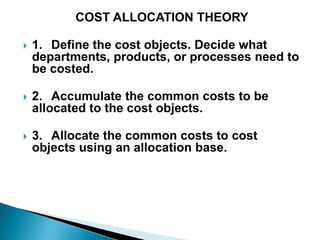

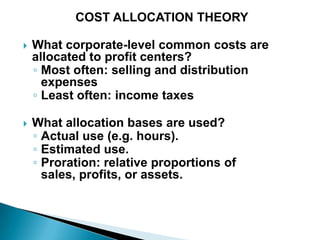

This document discusses cost allocation theory. It defines key terms like cost objects, common costs, and allocation bases. It explains that common costs are assigned to cost objects using an allocation base, like hours or sales dollars. The goals of cost allocation include providing information for decision making, external reporting, and controlling manager behavior. The best allocation bases closely match the related costs. Insulating and noninsulating allocation schemes both aim to motivate cost reduction.