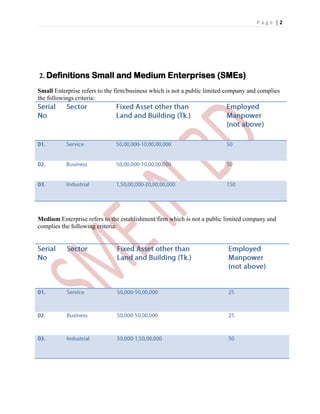

This document discusses SME financing in Bangladesh. It begins with an introduction to microcredit and SMEs, noting their importance for economic development and job creation. It then provides definitions for small and medium enterprises.

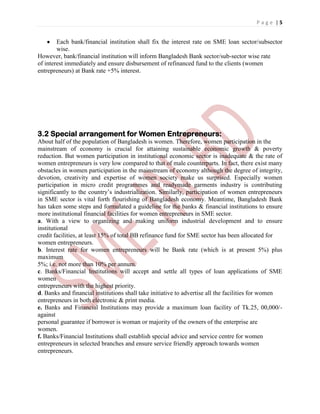

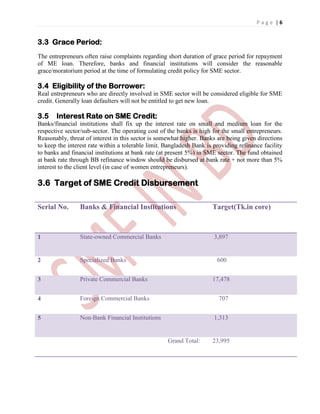

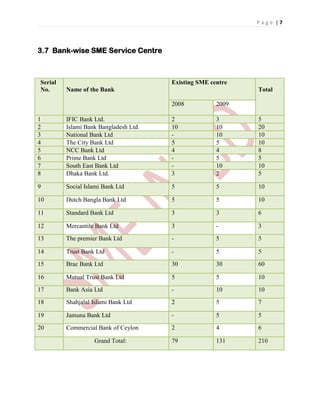

The bulk of the document discusses steps taken by Bangladesh Bank to promote SME financing, including refinance schemes, dedicated desks in banks, and targets for SME loan disbursement. Special arrangements are outlined for women entrepreneurs, including allocating 15% of refinance funds for women and interest rates not exceeding 10% for women borrowers.

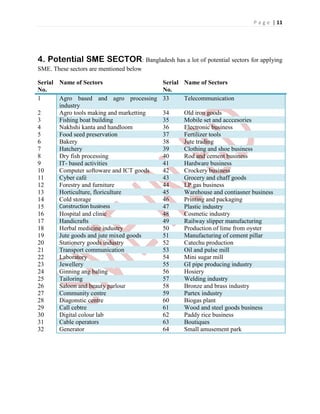

Potential sectors for SMEs in Bangladesh are also listed, including agro-based industries, fishing, IT, clothing, and retail.