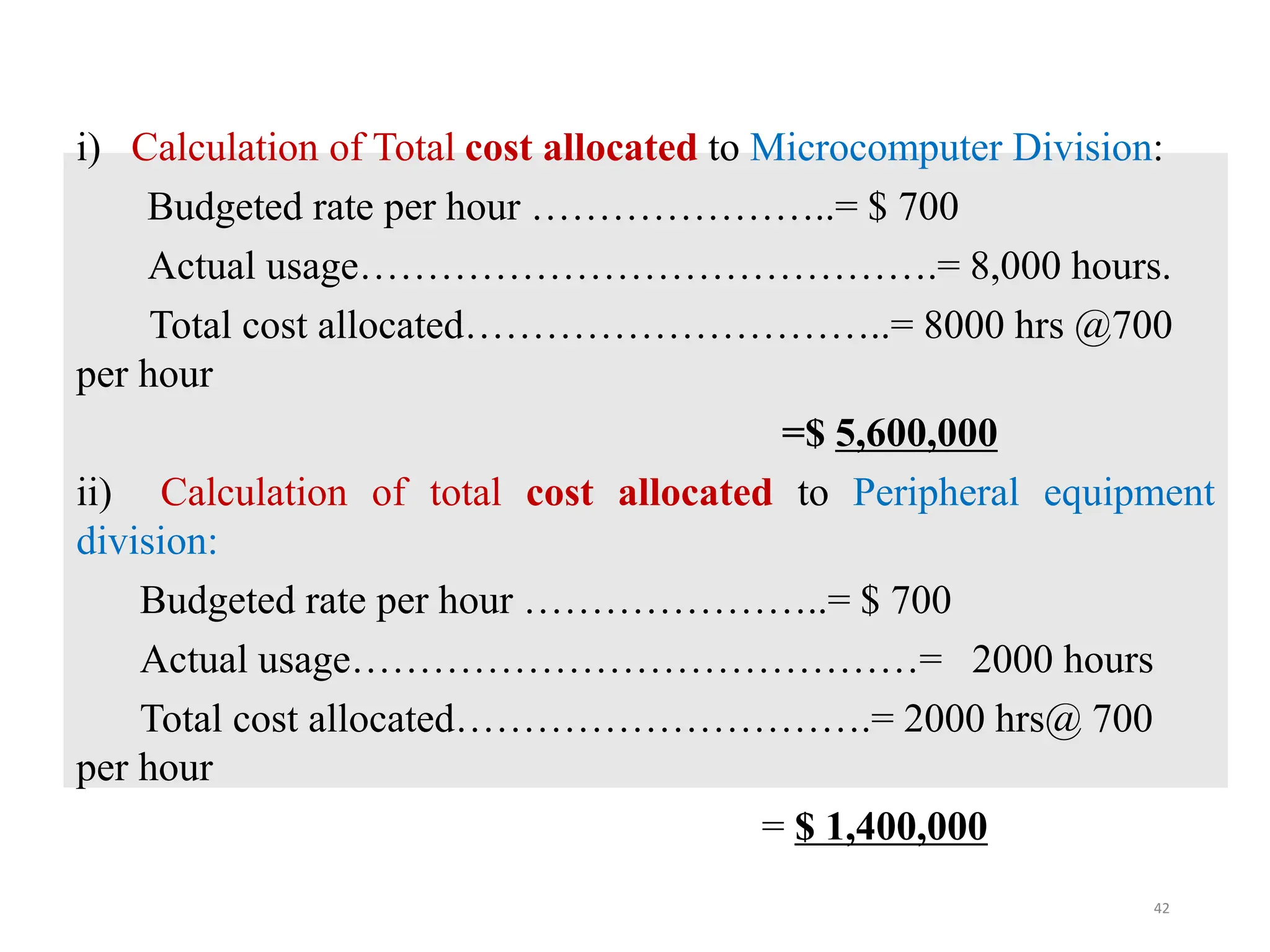

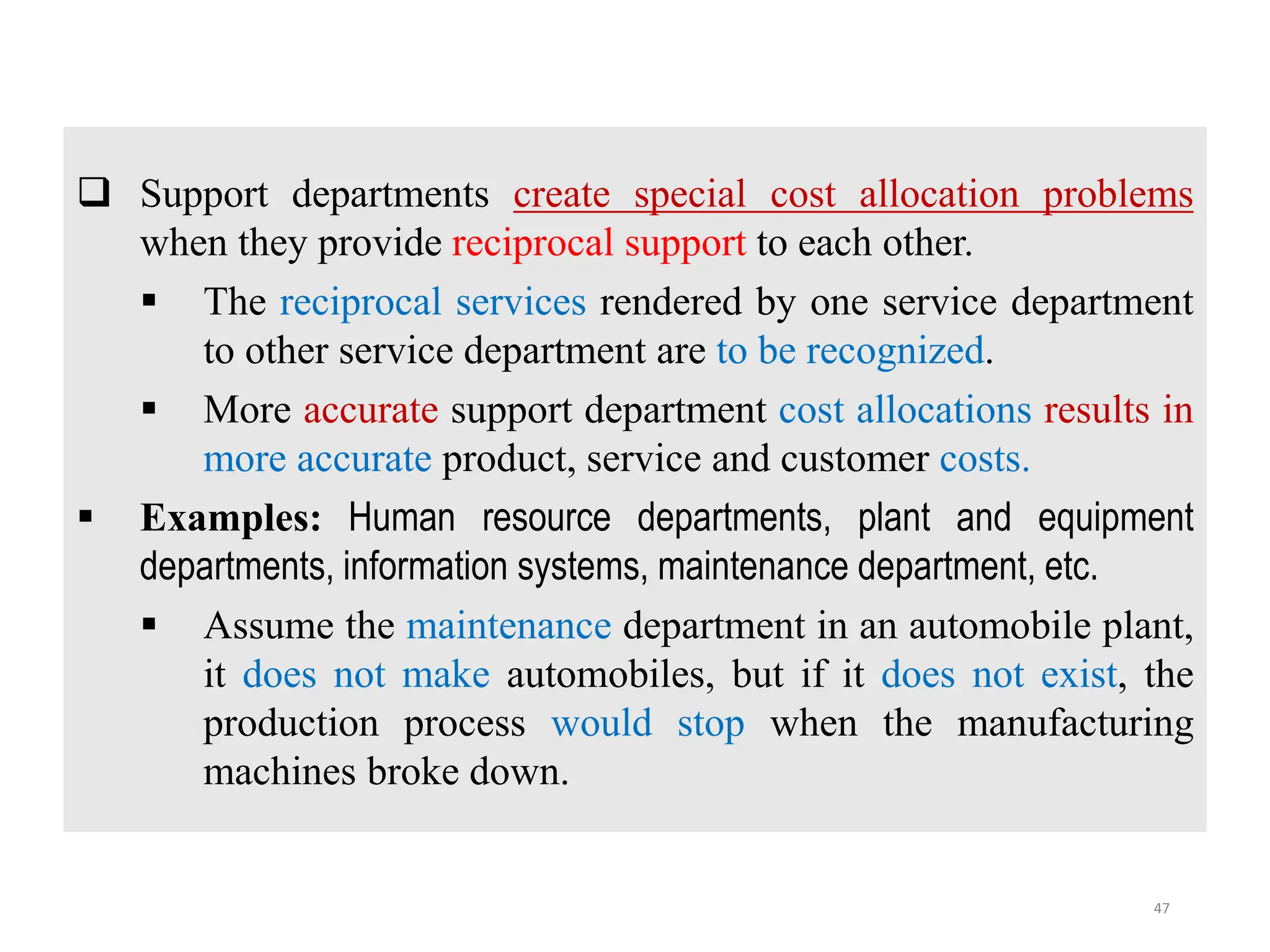

This document discusses cost allocation, which refers to assigning indirect costs to cost objects with the aim of ensuring all organizational costs are reflected in product pricing and financial reporting. Key concepts include direct and indirect costs, cost objects, cost pools, and the benefits of cost allocation for decision-making, fairness, and financial accuracy. It also outlines manufacturing overhead allocation processes and introduces traditional and activity-based costing methods for more accurate product cost assessment.

![C. $2,767,500 ×

10

10+80+10

= $276,750

B. $6, 576,750 ×

20

20+30+50

= $1,315,350

0.1[$1,452,150+0.2X ] = $6,576,750

A. X=$6, 300,000 +

3/31/2022 Mekonnen K. 63](https://image.slidesharecdn.com/ch-3costallocation-240731143909-983234fe/75/Chapter-3-Cost-Allocation-cost-accounting-pptx-63-2048.jpg)