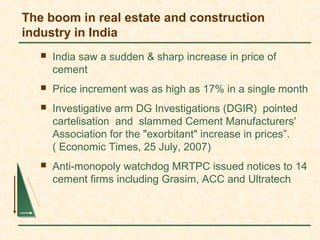

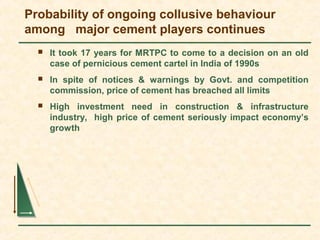

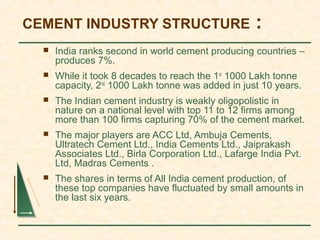

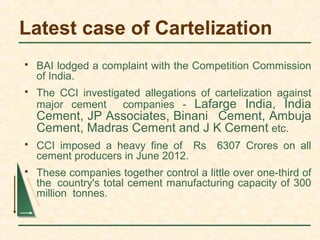

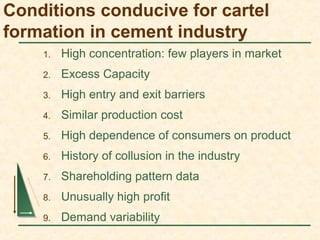

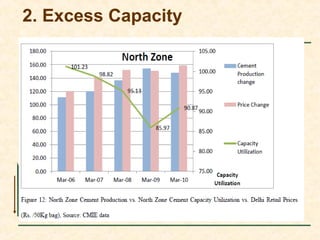

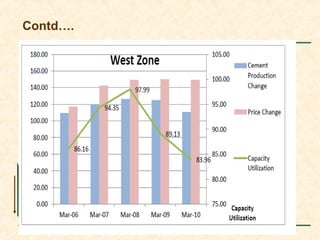

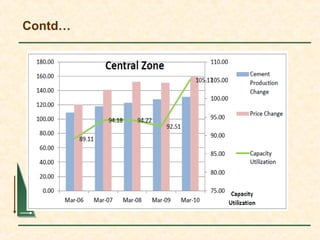

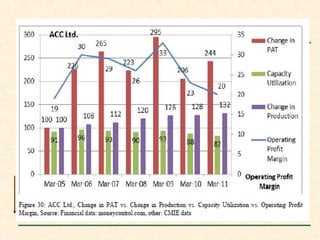

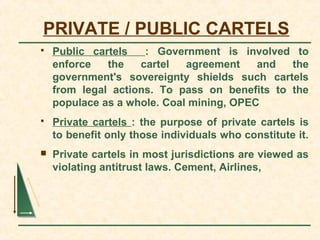

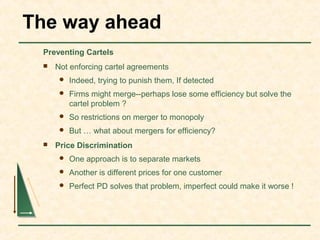

The document discusses cartelization in the Indian cement industry. It notes that India saw a sudden and sharp increase in cement prices in 2007, with some prices rising 17% in a single month. The anti-monopoly watchdog issued notices to 14 major cement firms for suspected collusive behavior. While cartels are illegal, the probability of ongoing collusive behavior among major cement players in India continues. It took a long time to rule on past cases of cartelization in the 1990s. High cement prices seriously impact the growth of industries like construction that have high investment needs.

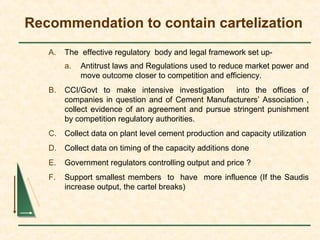

![A glimpse of general historical trend in number

of Domestic Cartels

Year Germany Austria Czech

.

Switz

erlan

d

Franc

e

Britai

n

Japan

1865 4

1887 70

1890/1 117

1900/2 300 50

1905/6 385 100 40

[93]

1911/2 550-660 120

1921 446 8

1929/30 2100 40-50,

70-80

100+ 9

0

+

80+ 30+

*Source: Fischer and Wagenführ (1929); Wagenführ (1931); Hadley (1970)](https://image.slidesharecdn.com/group1-cartel-140719095435-phpapp01/85/CARTEL-MICRO-ECONOMICS-40-320.jpg)