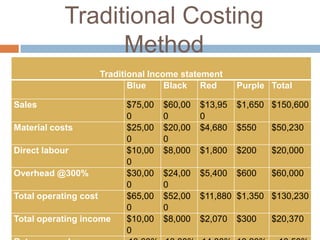

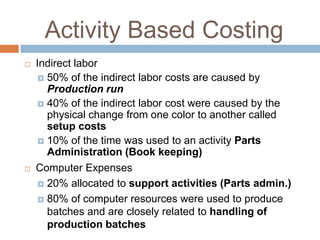

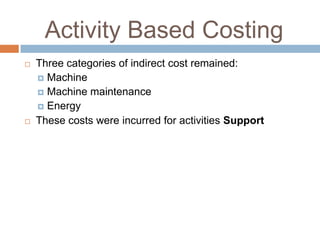

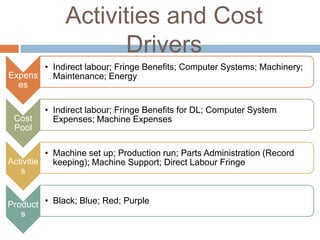

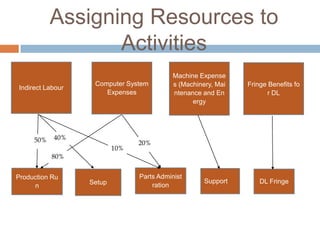

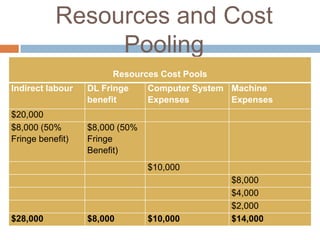

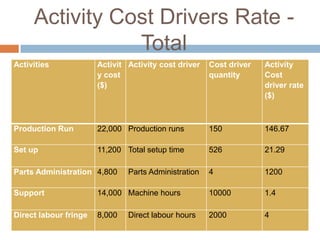

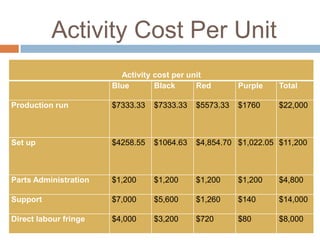

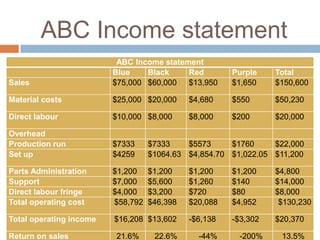

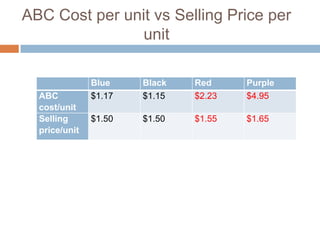

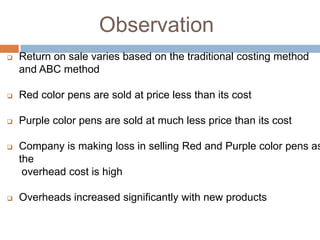

Classic Pen Company is analyzing its cost accounting system using activity-based costing to better understand profitability. Previously, all overhead costs were allocated based on direct labor, but ABC analysis identified drivers like setup time and production runs. This showed that red and purple pens have higher costs than indicated previously due to more setups. ABC cost per unit for red and purple exceeds their selling price, suggesting price increases are needed to improve profitability for those products.