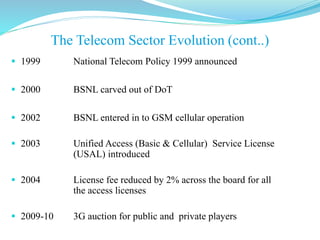

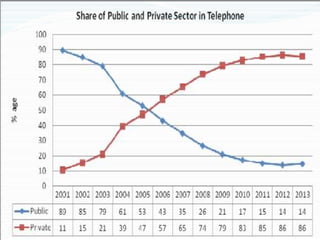

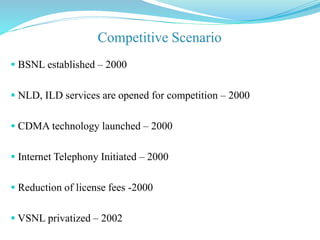

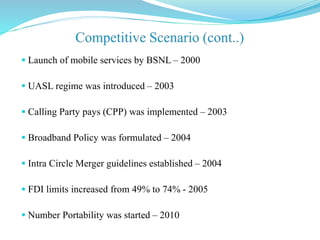

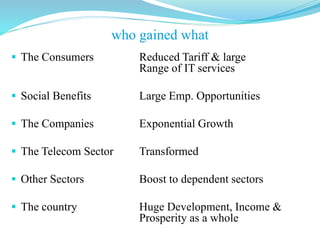

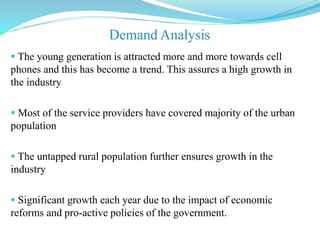

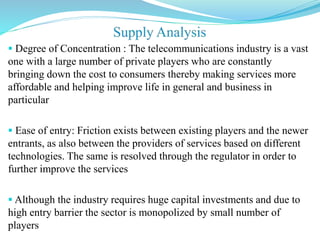

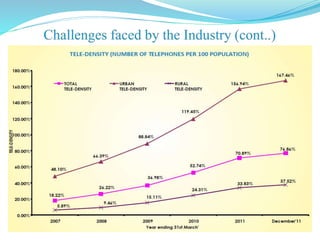

The Indian telecom sector has undergone significant changes since the 1970s. It started as a state-run monopoly but has since transitioned to a competitive private sector dominated market. Major reforms included allowing foreign investment, introducing private operators, and establishing an independent regulator. As a result, tele-density increased dramatically from 5% in 1999 to over 75% currently. However, intense price competition has led to declining revenues per user, posing financial challenges for operators in the saturated market. The oligopolistic industry is projected to consolidate further with only a few large players dominating in the coming years.