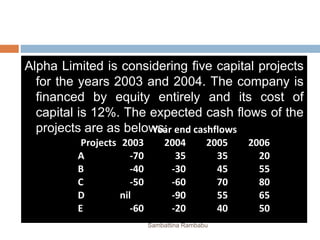

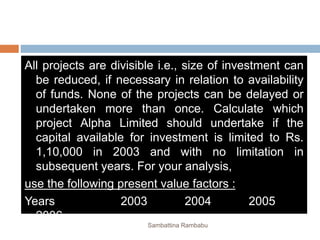

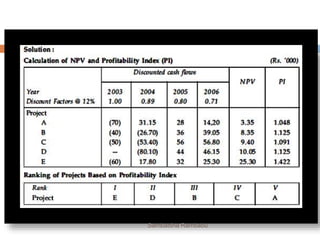

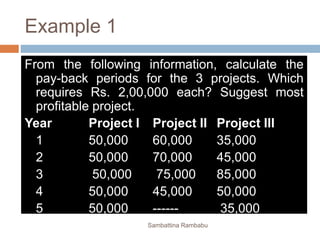

The document provides cash flow information for 5 projects (Projects A, B, C, D and E) being considered by Alpha Limited for the years 2003 to 2006. It mentions that the company's cost of capital is 12% and all projects are divisible with no limitations on funds in subsequent years after 2003 which has a capital limitation of Rs. 110,000. The assistant is asked to calculate which project Alpha Limited should undertake based on the cash flow information and present value factors provided for 2003 to 2006.

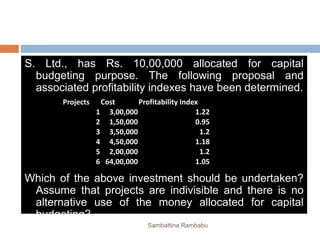

![Illustration 2 :

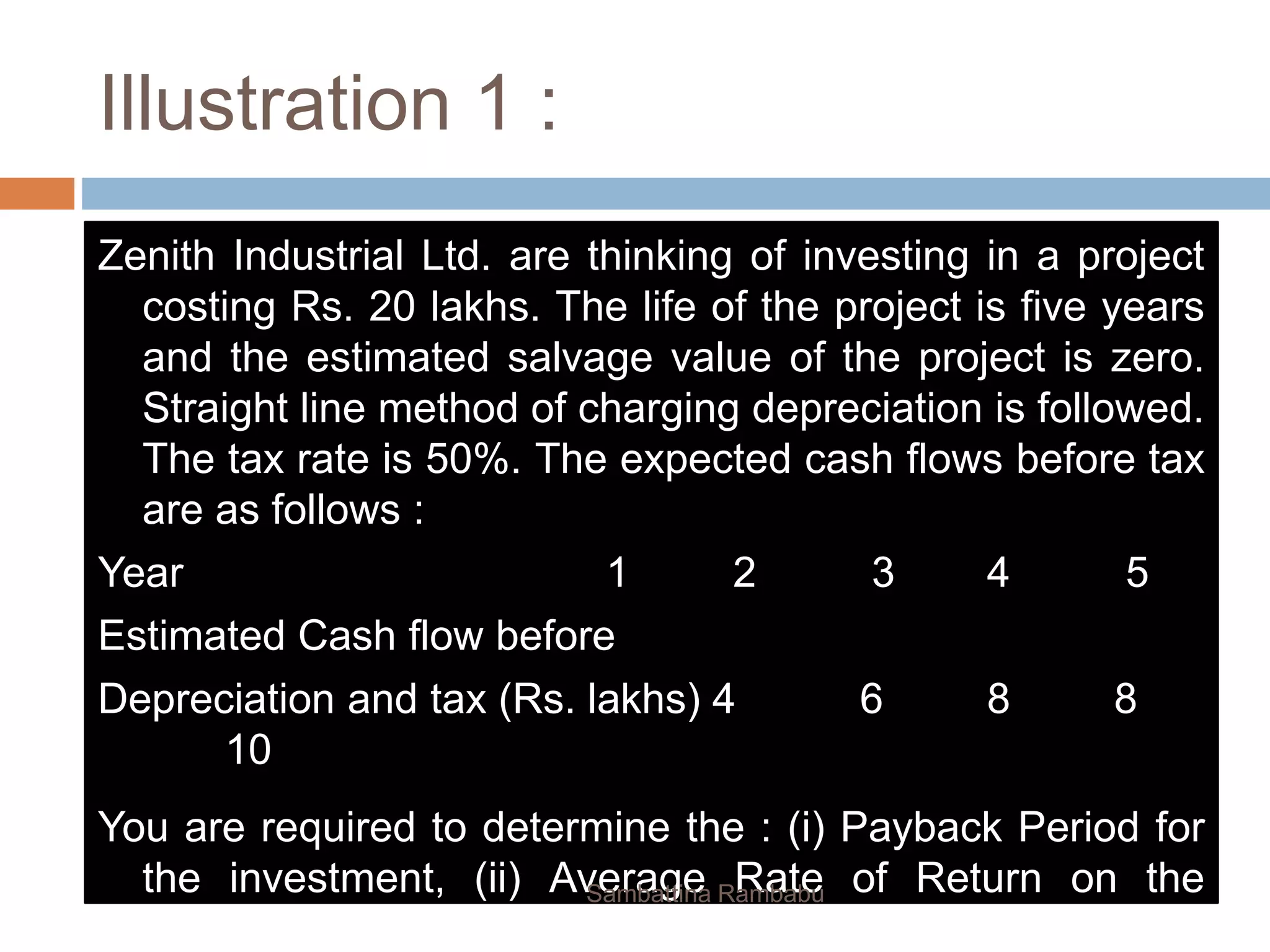

The relevant information for two alternative systems of internal transportation

are given below :

(Rs.)

Particulars System 1

System 2

Initial investment 60,00,000 40,00,000

Annual operating costs 10,00,000 900,000

Life 6 years 4 years

Salvage value at the end 20,00,000 15,00,000

Which system would you prefer if the cost of capital is 6%? Justify your

recommendation

with appropriate analysis.

[Present value of annuity at 6% for 6 years = 4.917 and for 4 years = 3.465.

Present value of

Rs. 1.00 at 6% at the end of 6the year 0.705 and that at the end of 4th year

0.792].

Sambattina Rambabu](https://image.slidesharecdn.com/capitalbudgetingpractice-170327110143/85/Capital-budgeting-practice-2-320.jpg)