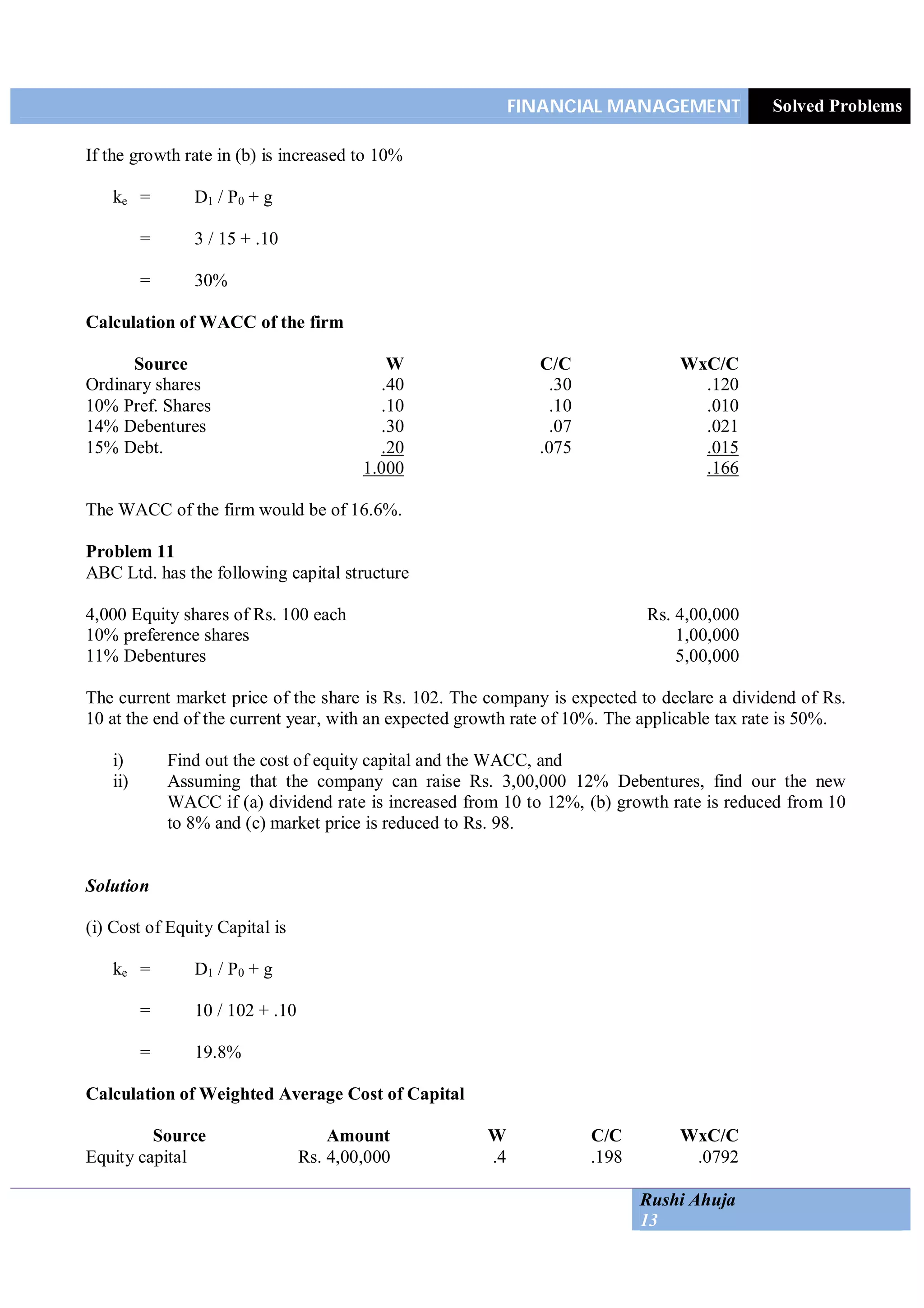

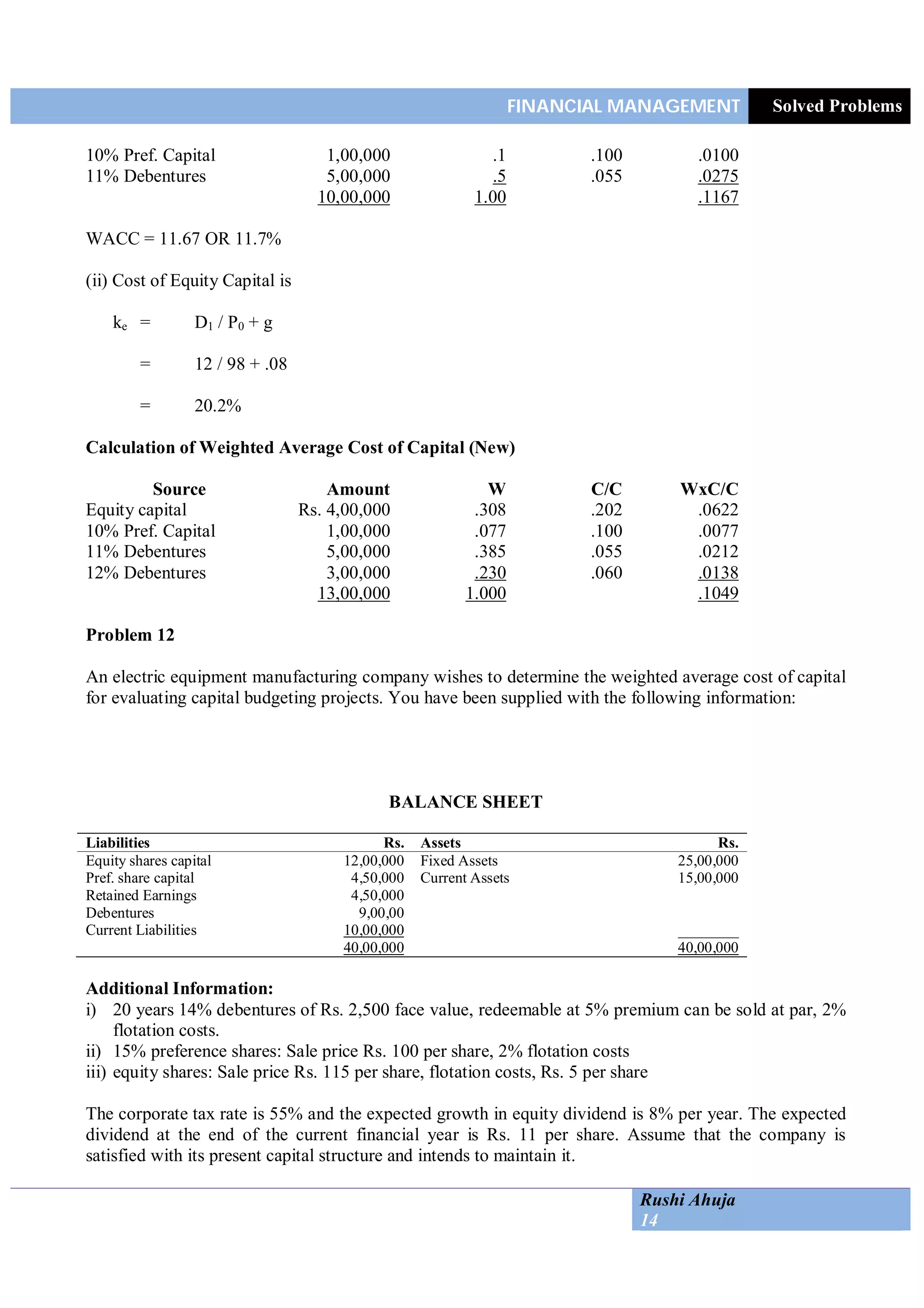

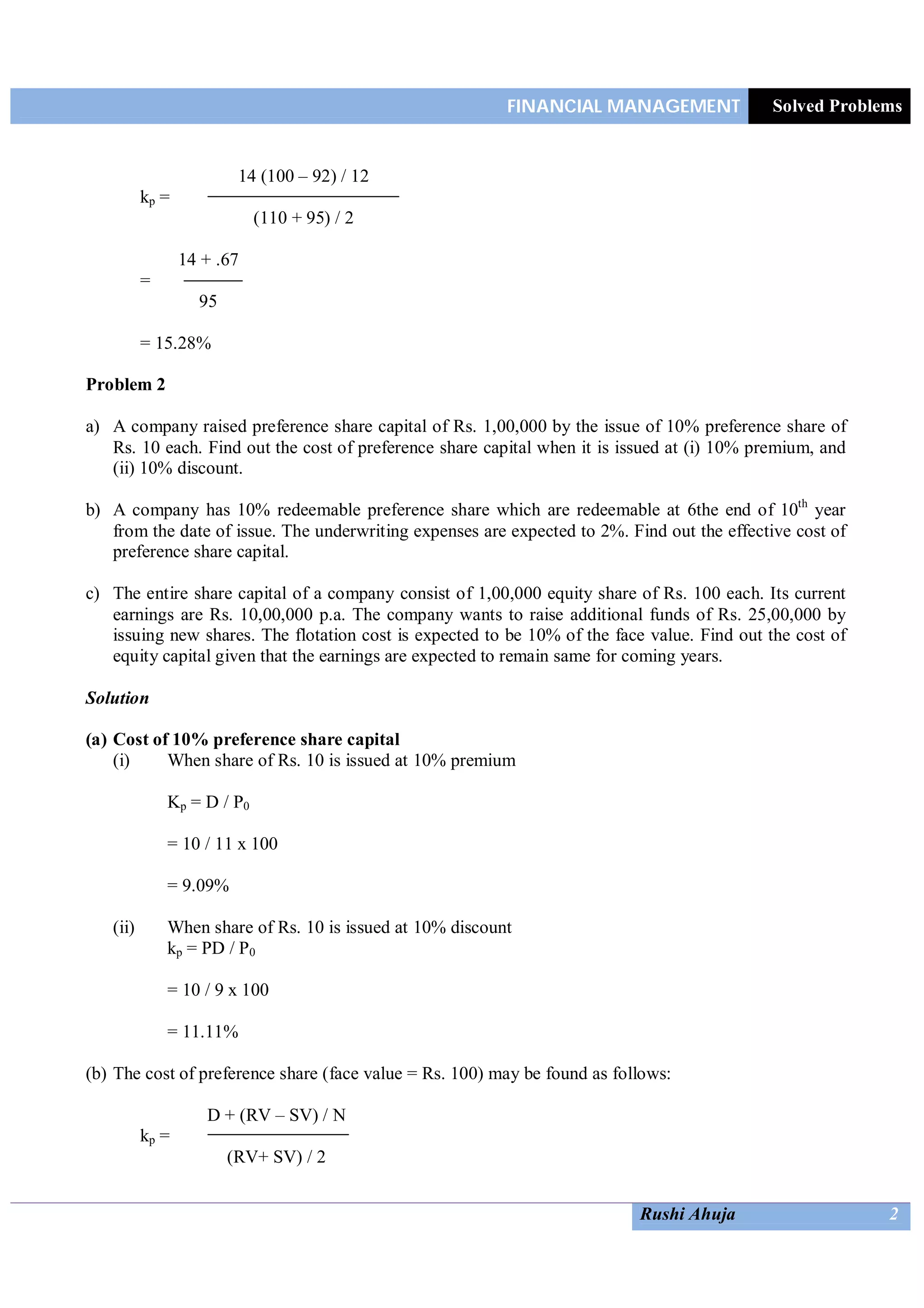

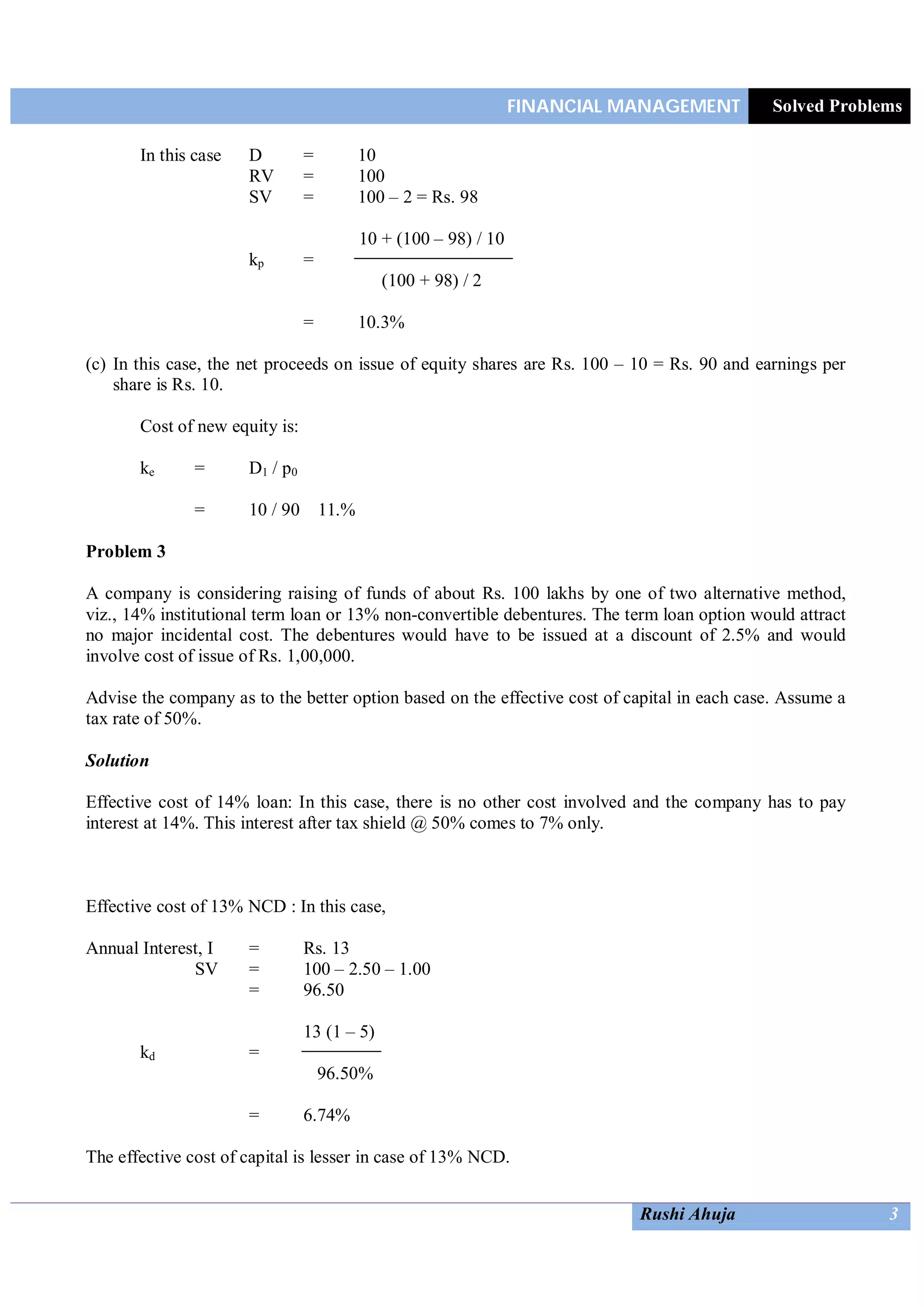

The document provides solved problems related to calculating cost of capital. It includes examples of calculating cost of debt, cost of preference shares, and weighted average cost of capital (WACC) for companies based on information about their capital structure, dividend rates, issue prices of securities, tax rates, and other financial details. The problems cover a range of scenarios and teach the methodology for determining the effective cost of different sources of capital and the overall WACC.

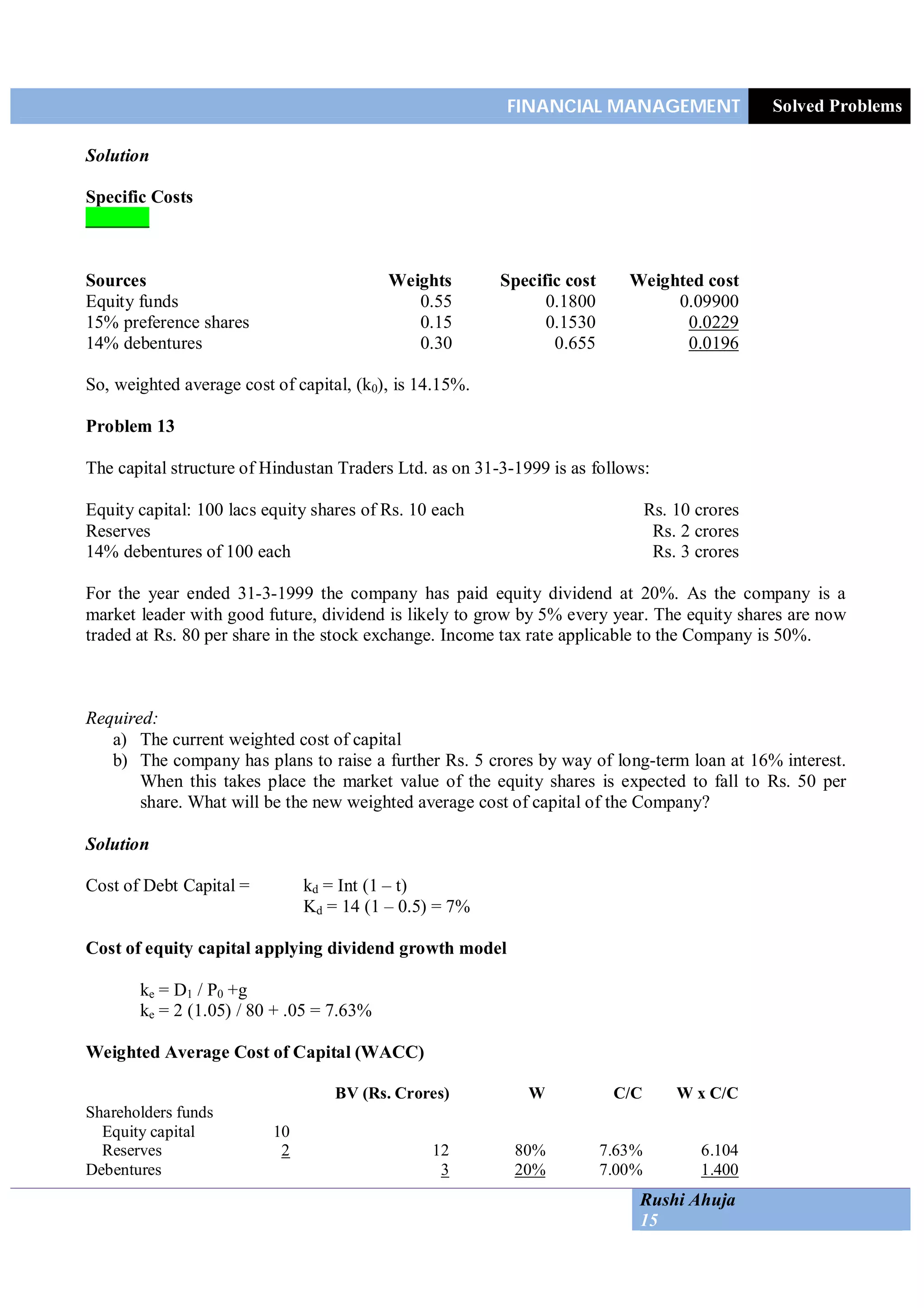

![FINANCIAL MANAGEMENT Solved Problems

Rushi Ahuja 1

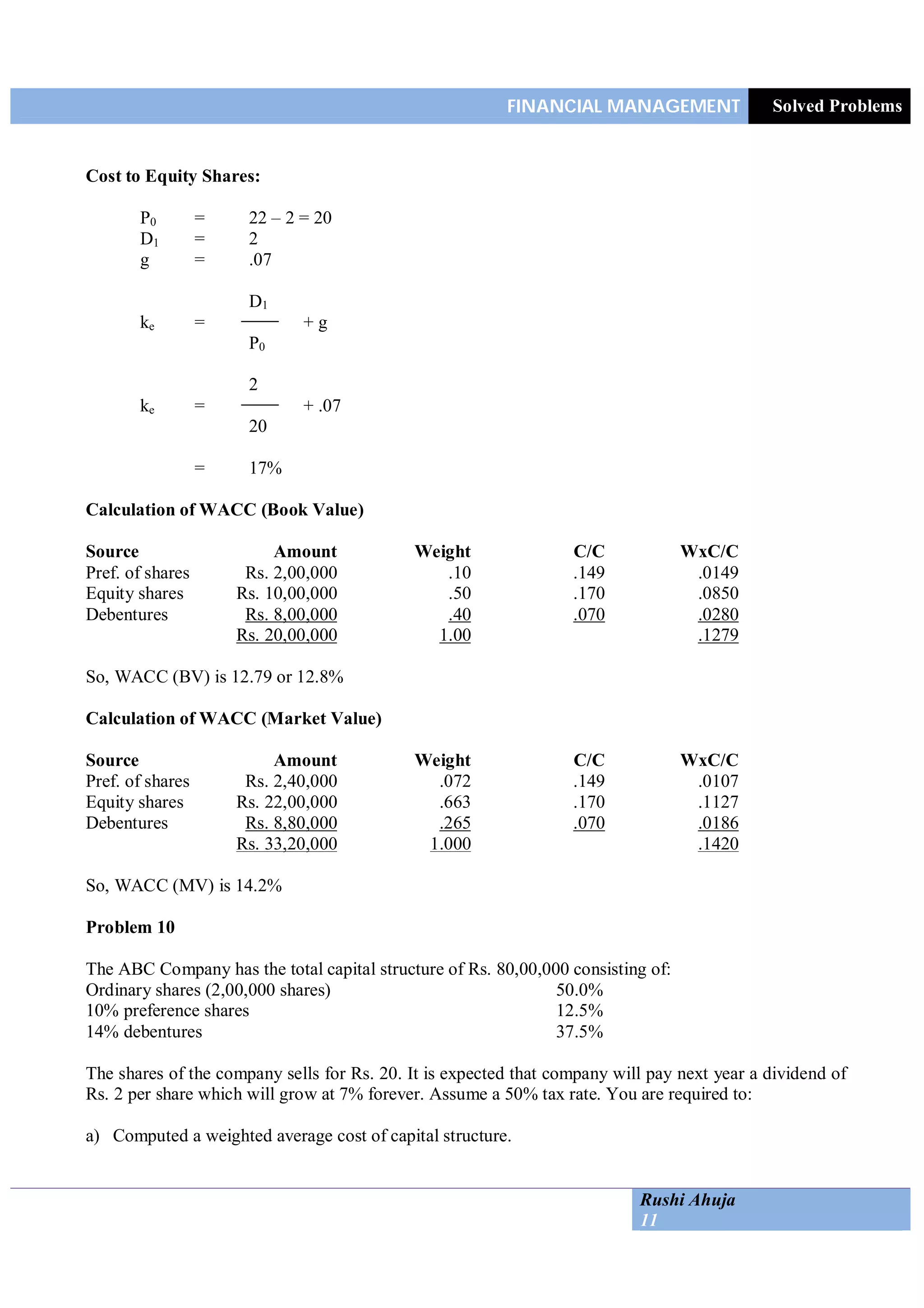

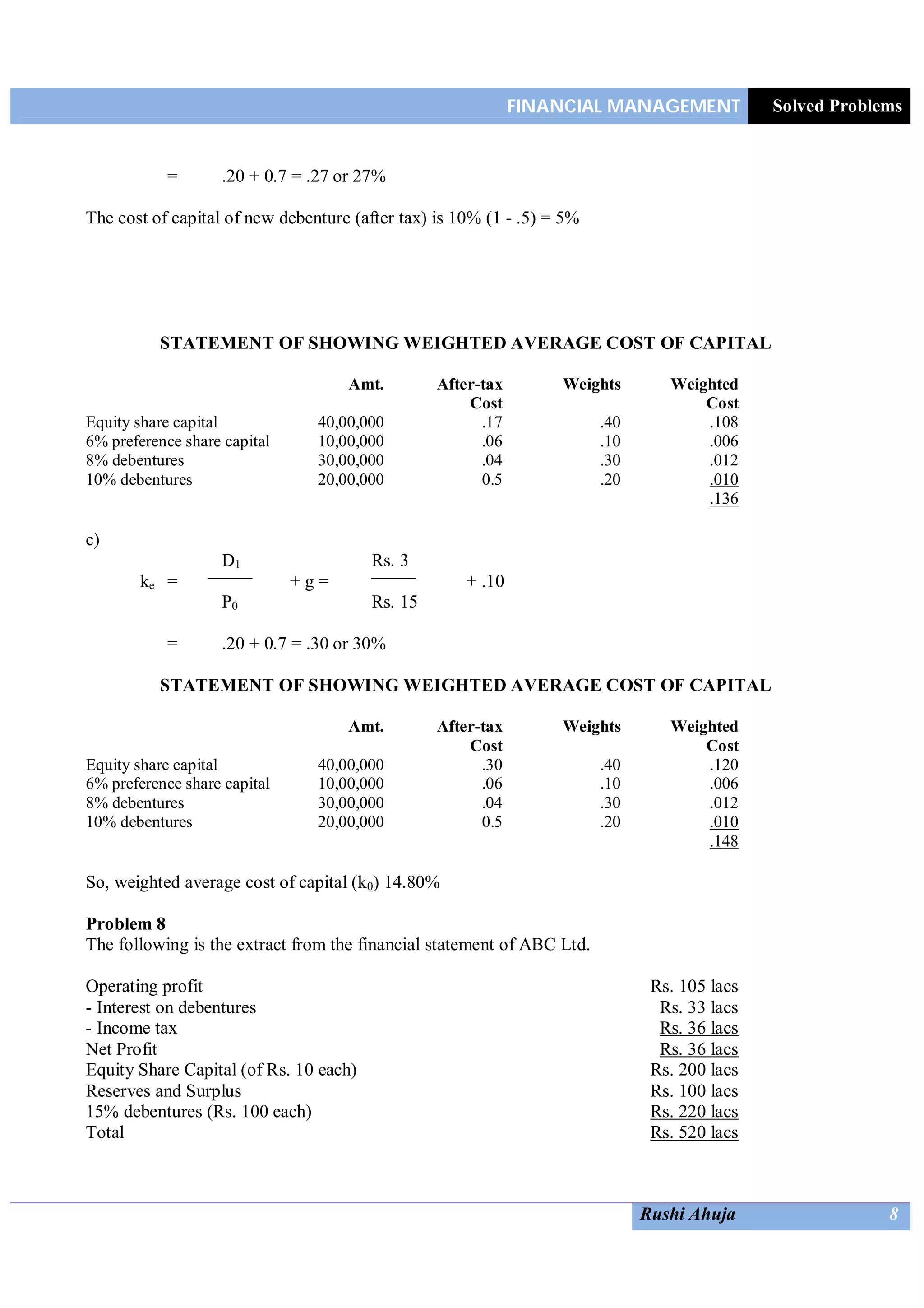

SOLVED PROBLEMS – COST OF CAPITAL

Problem 1

Calculate the cost of capital in the following cases:

i) X Ltd. issues 12% Debentures of face value Rs. 100 each and realizes Rs. 95 per Debenture.

The Debentures are redeemable after 10 years at a premium of 10%.

ii) Y. Ltd. issues 14% preference shares of face value Rs. 100 each Rs. 92 per share. The shares

are repayable after 12 years at par.

Note: Both companies are paying income tax at 50%.

Solution

(i) Cost of Debt

[Int + (RV – SV) / N] (1 – t)

kd

(RV + SV) / 2

Int = Annual interest to be paid i.e. Rs. 12

t = Company’s effective tax rate i.e. 50% or 0.50

RV = Redemption value per Debenture i.e. Rs. 110

N = Number of years to maturity = 10 years

SV = issue price per debenture minus floatation cost i.e. Rs. 95

[12 + (110 – 95) / 10] (1 – .5)

kd =

(110 + 95) / 2

[12 + 2.5](0.5) 7.25

= = = 7.43%

97.50 97.50

(ii) Cost of preference capital

D + (RV – SV) / N

kp

(RV + SV) / 2

Where,

D = Dividend on Preference share i.e. Rs. 14

SV = Issue Price per share minus floatation cost Rs. 92

N = No. of years for redemption i.e. 12 years

RV = Net price payable on redemption Rs. 100](https://image.slidesharecdn.com/99700905-cost-of-capital-solved-problems-150217090658-conversion-gate01/75/99700905-cost-of-capital-solved-problems-1-2048.jpg)

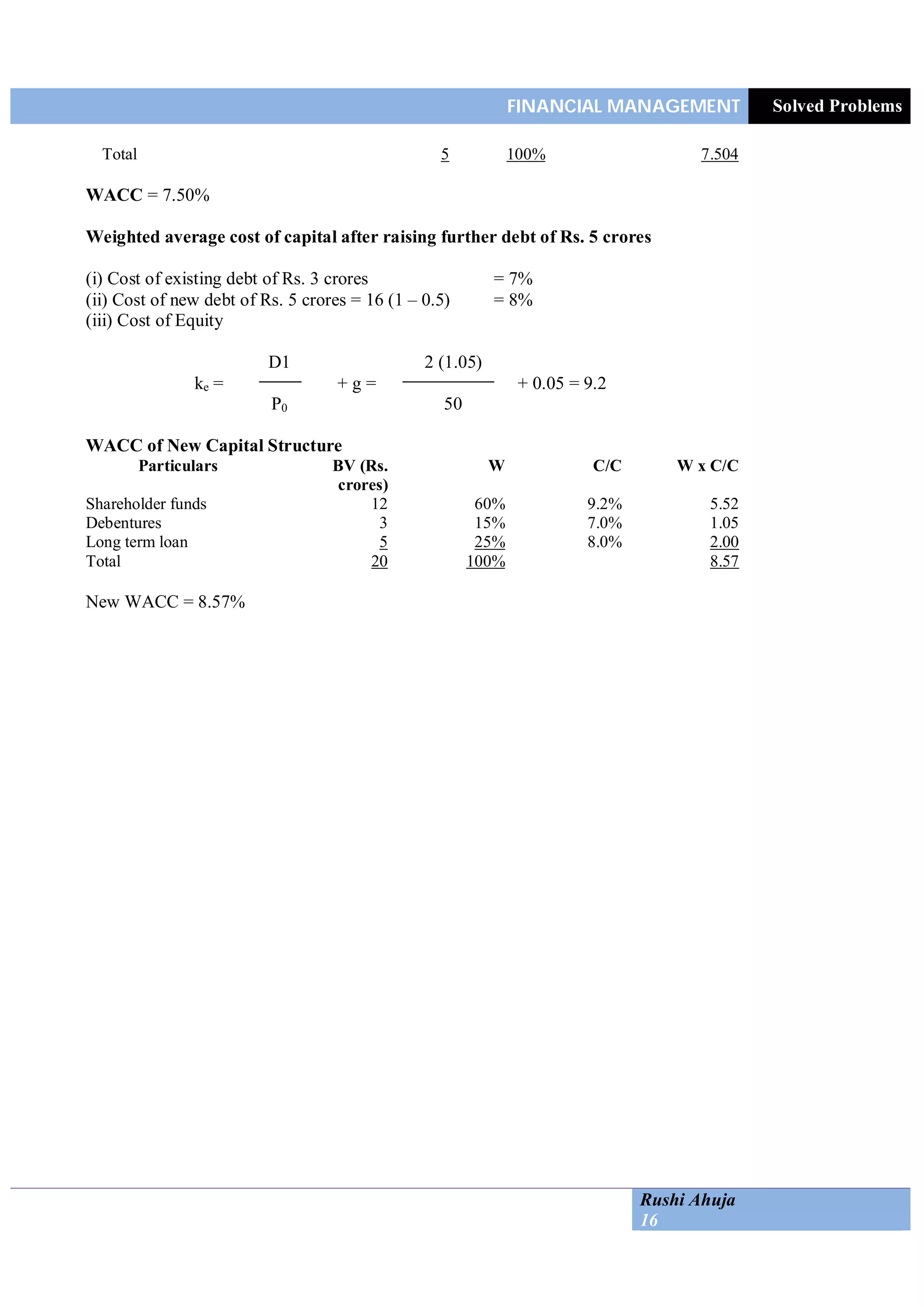

![FINANCIAL MANAGEMENT Solved Problems

Rushi Ahuja

10

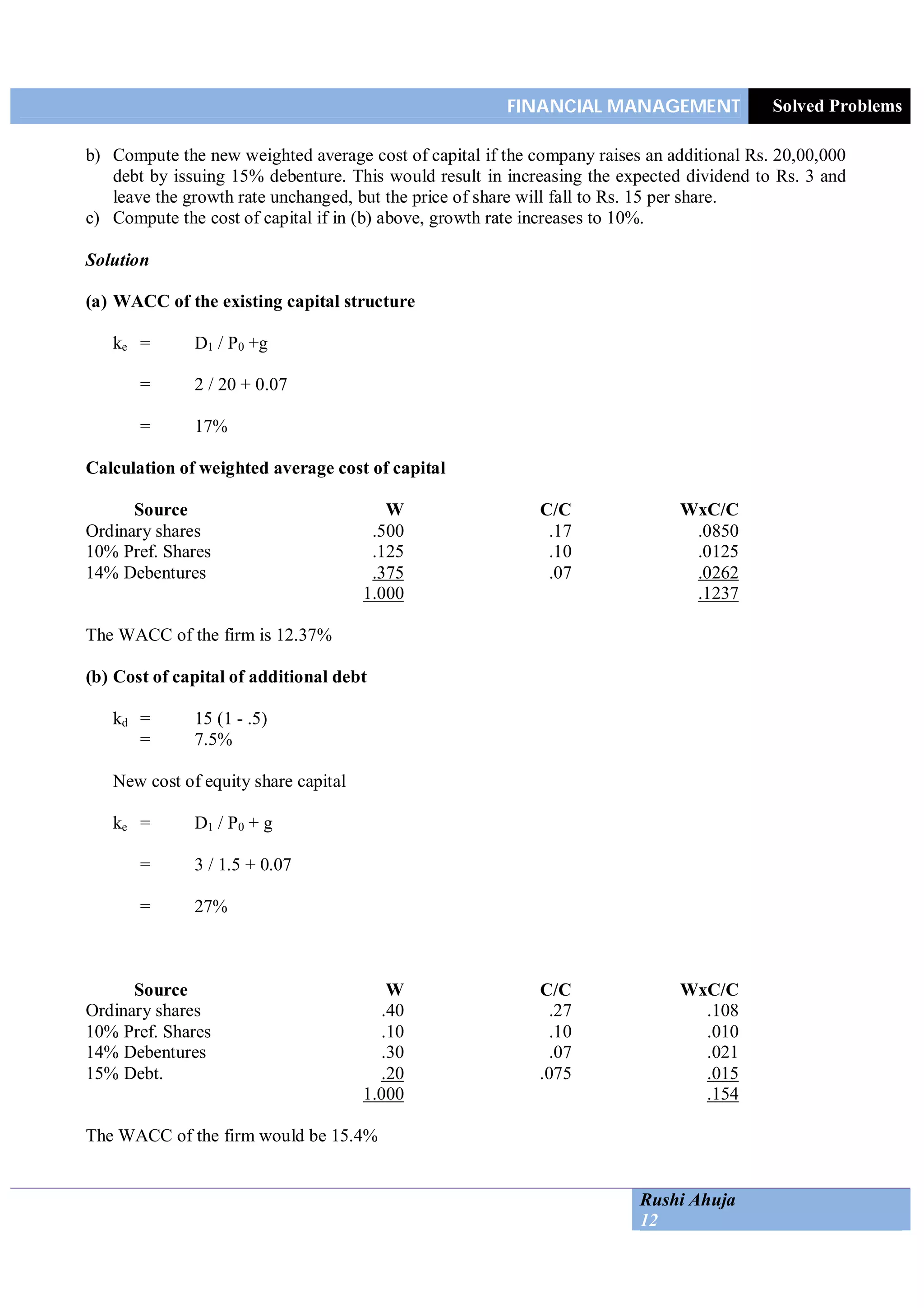

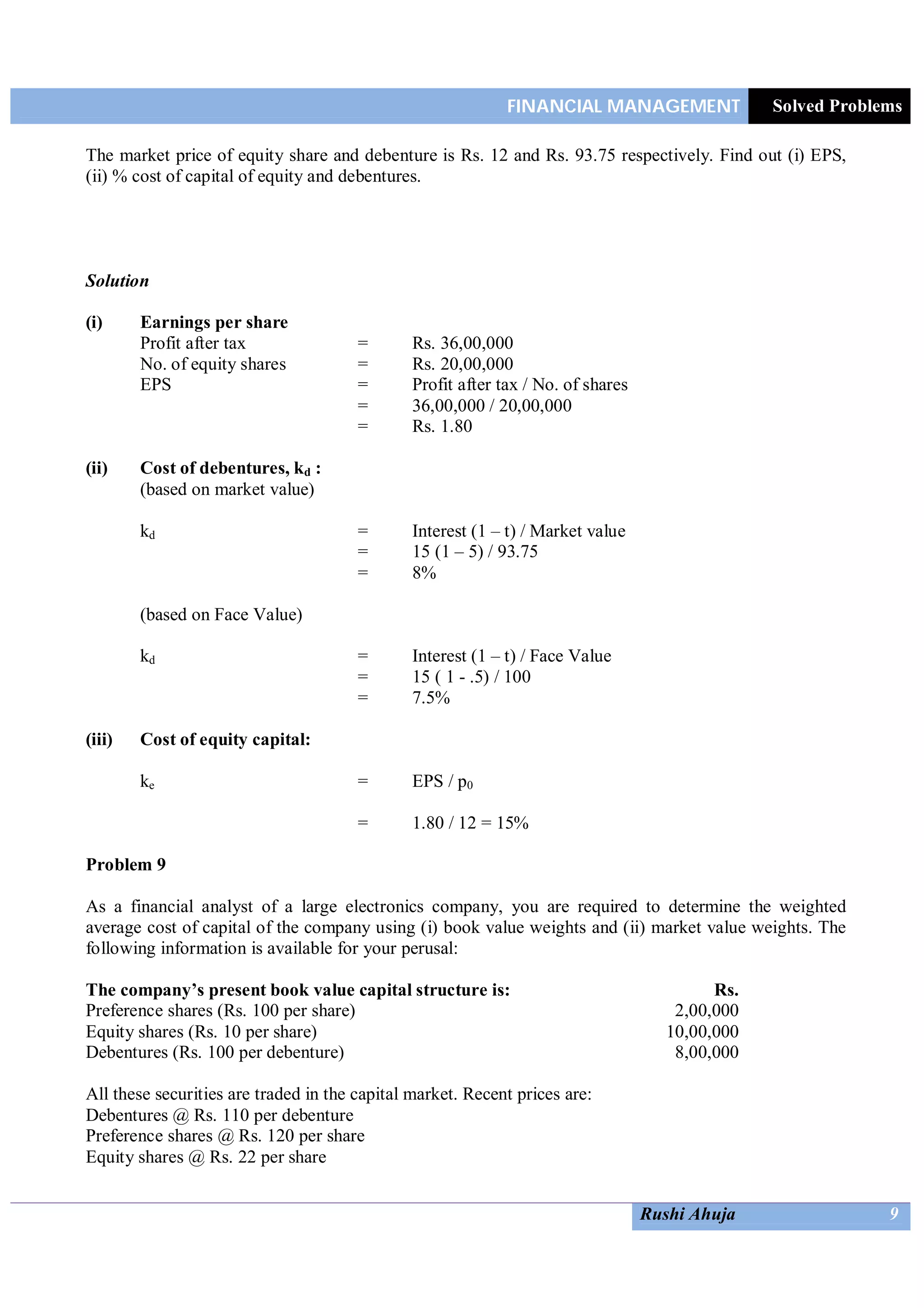

Anticipated external financing opportunities are:

i) Rs. 100 per debenture redeemable at par; 10 year-maturity, 13% coupon rate, 4% flotation costs, sale

price Rs. 100.

ii) Rs. 100 preference share redeemable at par; 10 year-maturity, 14% dividend rate, 5% flotation costs,

sale price Rs. 100.

iii) Equity shares: Rs. 2 per share flotation costs, sale price @ Rs. 22.

In addition, the dividend expected on the equity share at the end of the year is Rs. 2 and the earnings are

expected to increase by 7% p.a. The firm has a policy of paying all its earnings in the form of dividends.

The corporate tax rate is 50%.

Solution

In order to find out the WACC, the specific cost of capital of different sources may be calculated as

follows:

Cost to debenture:

Int, I = Rs. 13

SV = 100 – 4 = Rs. 99

RV = Rs. 100

t = .50

N = 10 year

[I + (RV – SV) / N] (1 – t)

kd =

(RV + SV) / 2

[13 + (100 – 96) / 10] (1 – .5)

=

(100 + 95) / 2

= 6.8%

Cost to Pref. Shares:

PD = Rs. 14

RV = 100

SV = 100 – 5 = Rs. 95

N = 10 years

D + (RV – SV) / N

kp =

(RV + SV) / 2

14 + (100 – 95) / N

=

(100 + 95) / 12

= 14.9%](https://image.slidesharecdn.com/99700905-cost-of-capital-solved-problems-150217090658-conversion-gate01/75/99700905-cost-of-capital-solved-problems-10-2048.jpg)