This document discusses key aspects of managing accounts receivable, including:

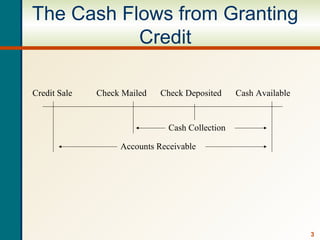

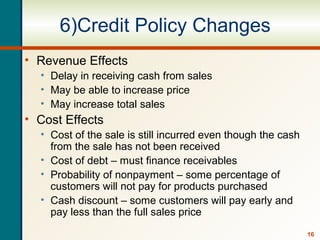

1) Credit management examines the tradeoff between increased sales from granting credit and costs like financing receivables and risk of nonpayment.

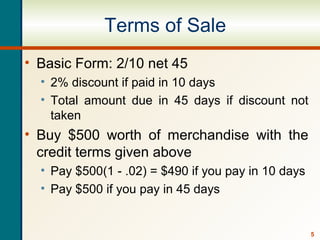

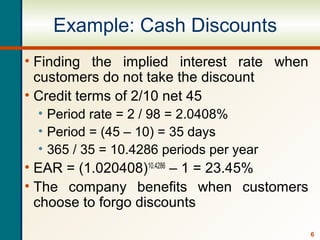

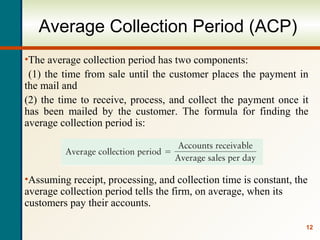

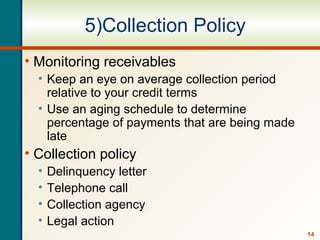

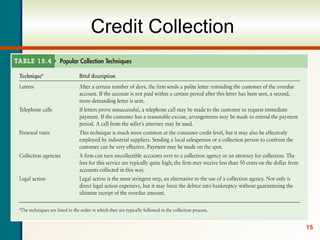

2) Components of credit policy include terms of sale, credit analysis to distinguish good vs bad customers, and collection policies.

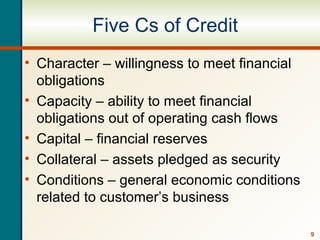

3) Credit analysis involves gathering customer financial information and payment history to assess creditworthiness using methods like the five C's of credit and credit scoring.