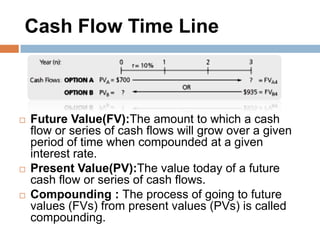

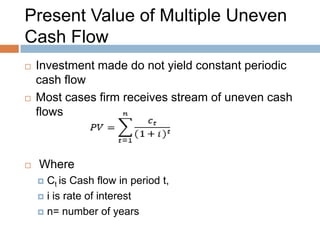

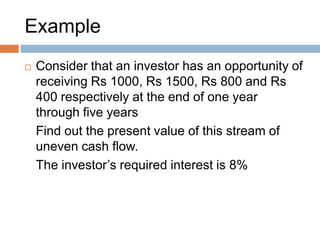

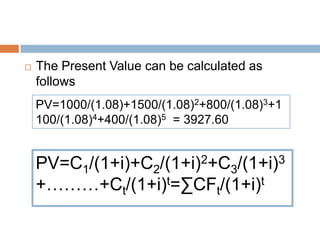

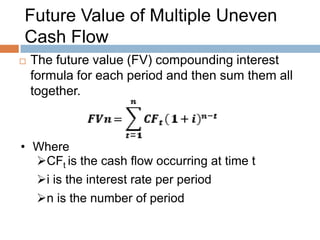

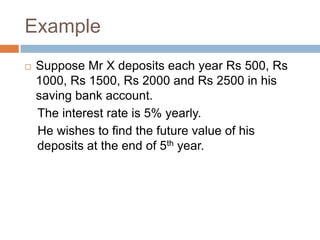

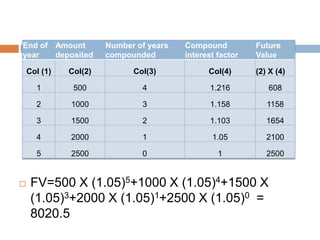

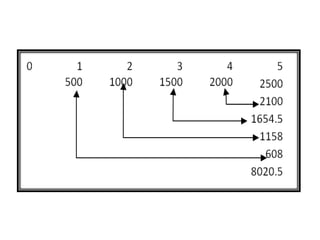

This document discusses calculating the present value and future value of multiple uneven cash flows. It provides the formulas for present value (PV) and future value (FV) of uneven cash flows. As an example, it calculates the PV of a cash flow of Rs. 1000, Rs. 1500, Rs. 800 and Rs. 400 over 4 years with an interest rate of 8%. It also provides an example to calculate the FV of deposits of Rs. 500, Rs. 1000, Rs. 1500, Rs. 2000, Rs. 2500 over 5 years with an interest rate of 5%.