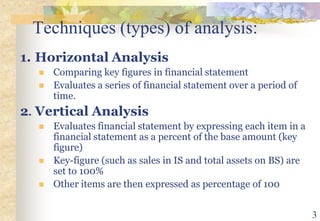

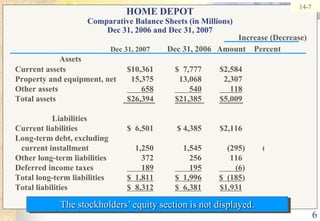

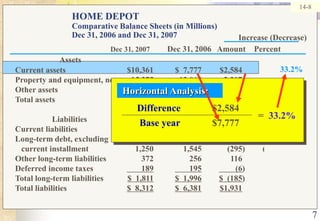

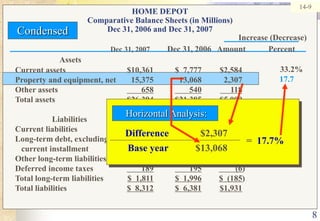

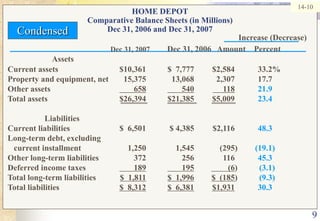

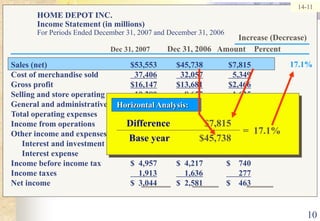

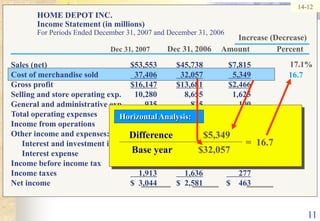

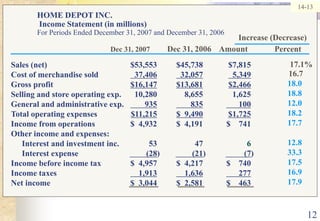

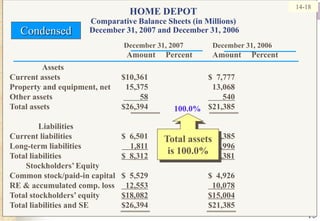

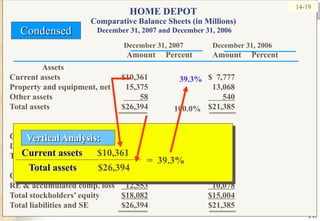

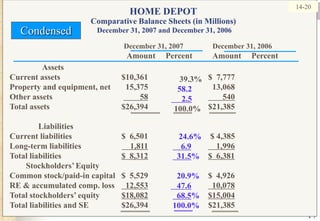

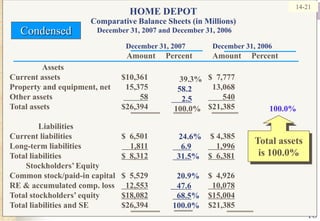

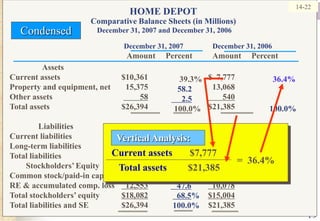

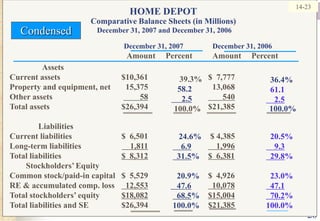

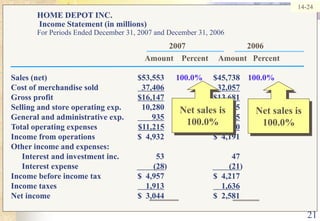

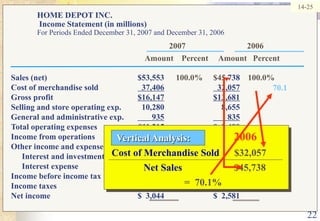

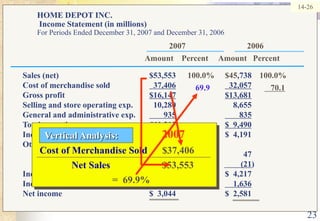

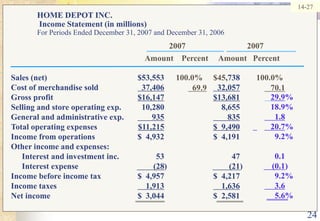

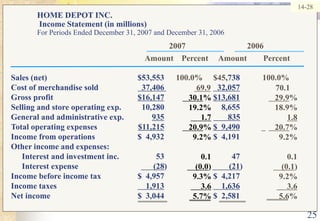

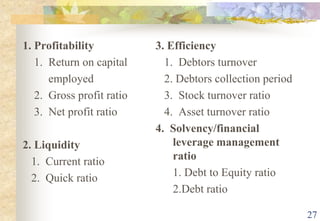

The document discusses techniques for analyzing financial statements, including horizontal analysis, vertical analysis, and ratio analysis. It provides examples of applying horizontal analysis to compare line items on Home Depot's balance sheet and income statement from 2006 to 2007. Vertical analysis is also demonstrated by expressing line items as a percentage of total assets or total sales. Key points shown include current assets increasing 33.2% and cost of merchandise sold increasing 16.7% based on the horizontal analysis examples.