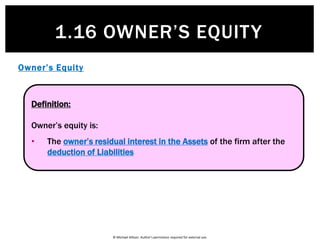

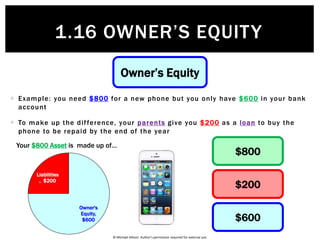

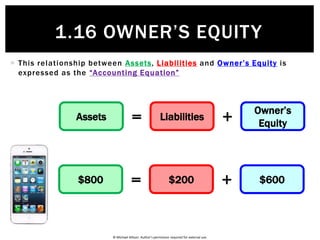

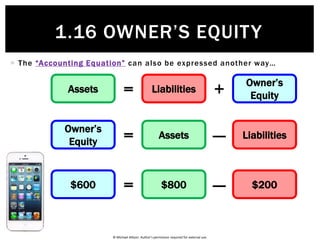

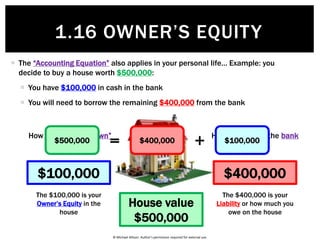

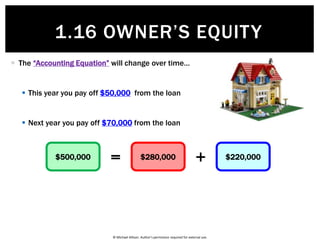

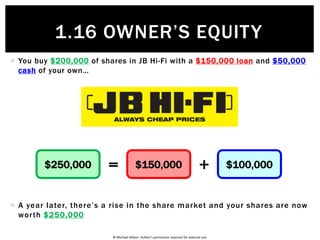

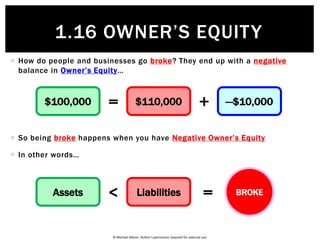

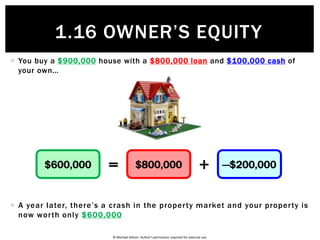

The document explains owner’s equity as the residual interest in a firm's assets after liabilities are deducted, illustrated through examples involving personal financial situations like buying a phone and a house. It highlights the accounting equation (Assets = Liabilities + Owner's Equity) and its application in various scenarios, including the impact of loans and market fluctuations on equity. The document also mentions that negative owner’s equity indicates financial distress.