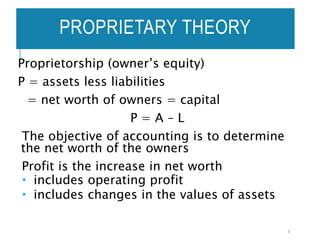

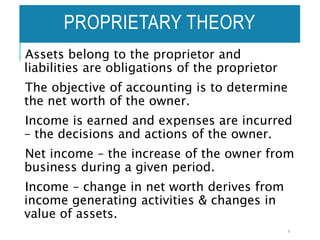

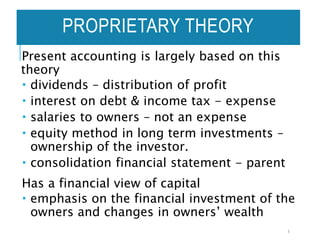

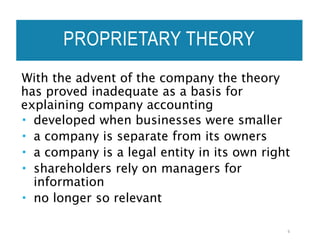

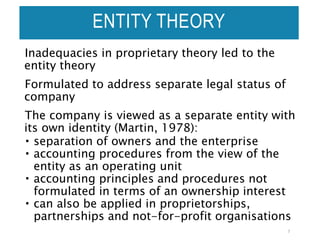

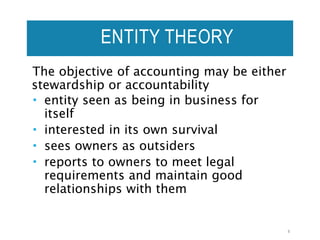

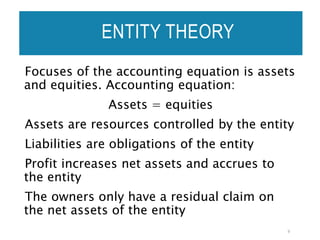

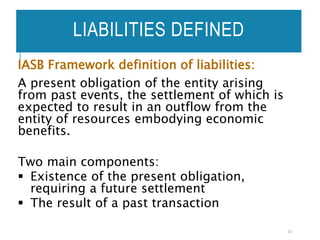

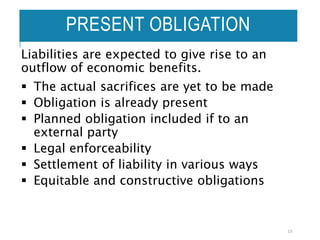

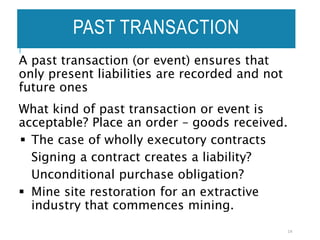

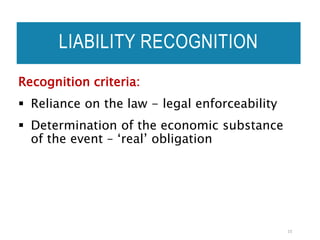

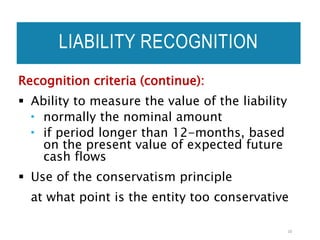

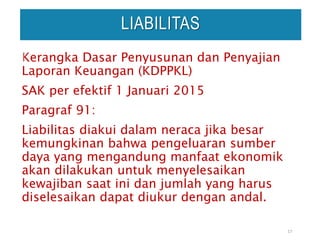

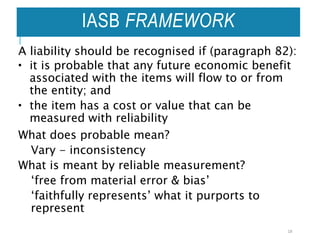

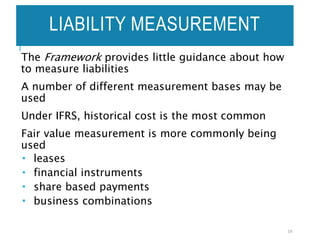

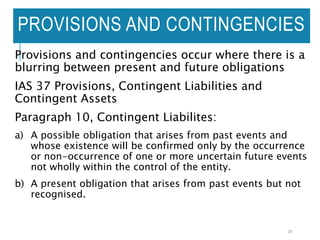

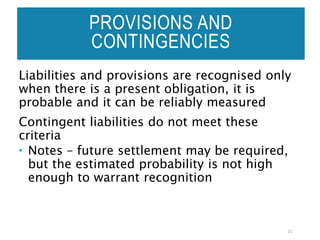

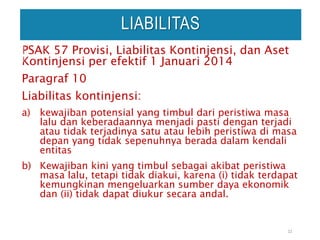

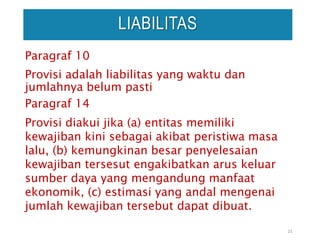

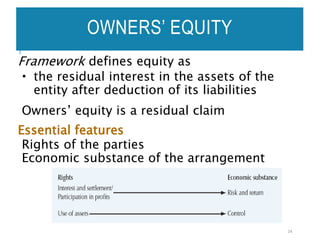

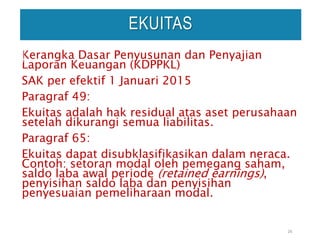

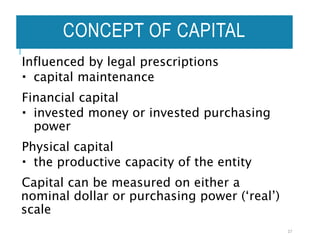

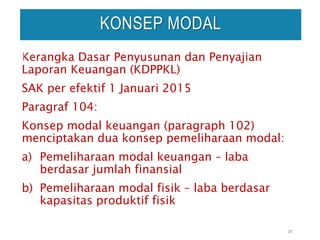

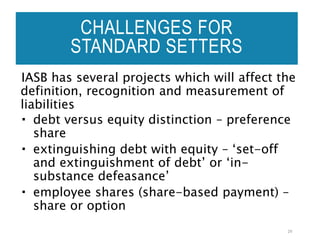

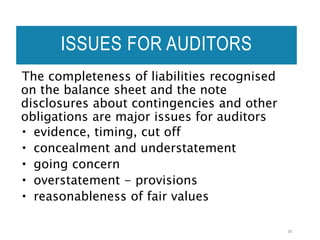

This document discusses theories of accounting for liabilities and owners' equity. It covers the proprietary theory, which focuses on the owners' interests, and the entity theory, which views the firm as a separate entity. The document also defines liabilities and owners' equity, and addresses recognition, measurement, and classification issues. It discusses challenges for standard setters and auditing issues related to ensuring complete liability reporting.