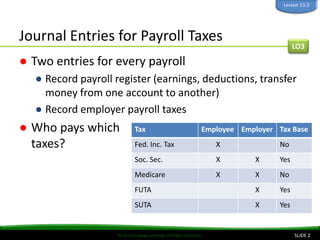

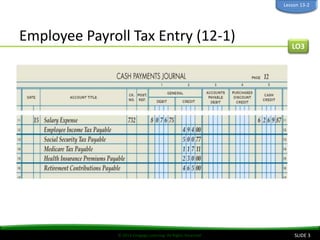

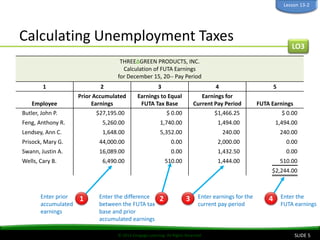

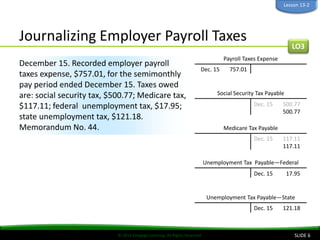

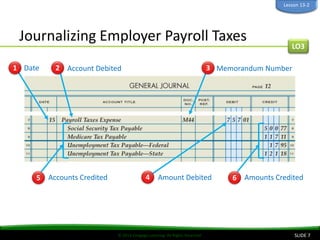

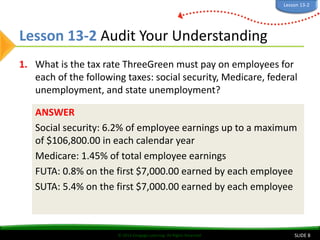

This document discusses employer payroll taxes. It explains that employers must pay social security and Medicare taxes on employee earnings, as well as federal and state unemployment taxes. It provides details on calculating unemployment taxes, including that the first $7,000 of employee earnings are subject to federal and state unemployment taxes. Journal entries are presented for recording the various payroll tax expenses owed by the employer.