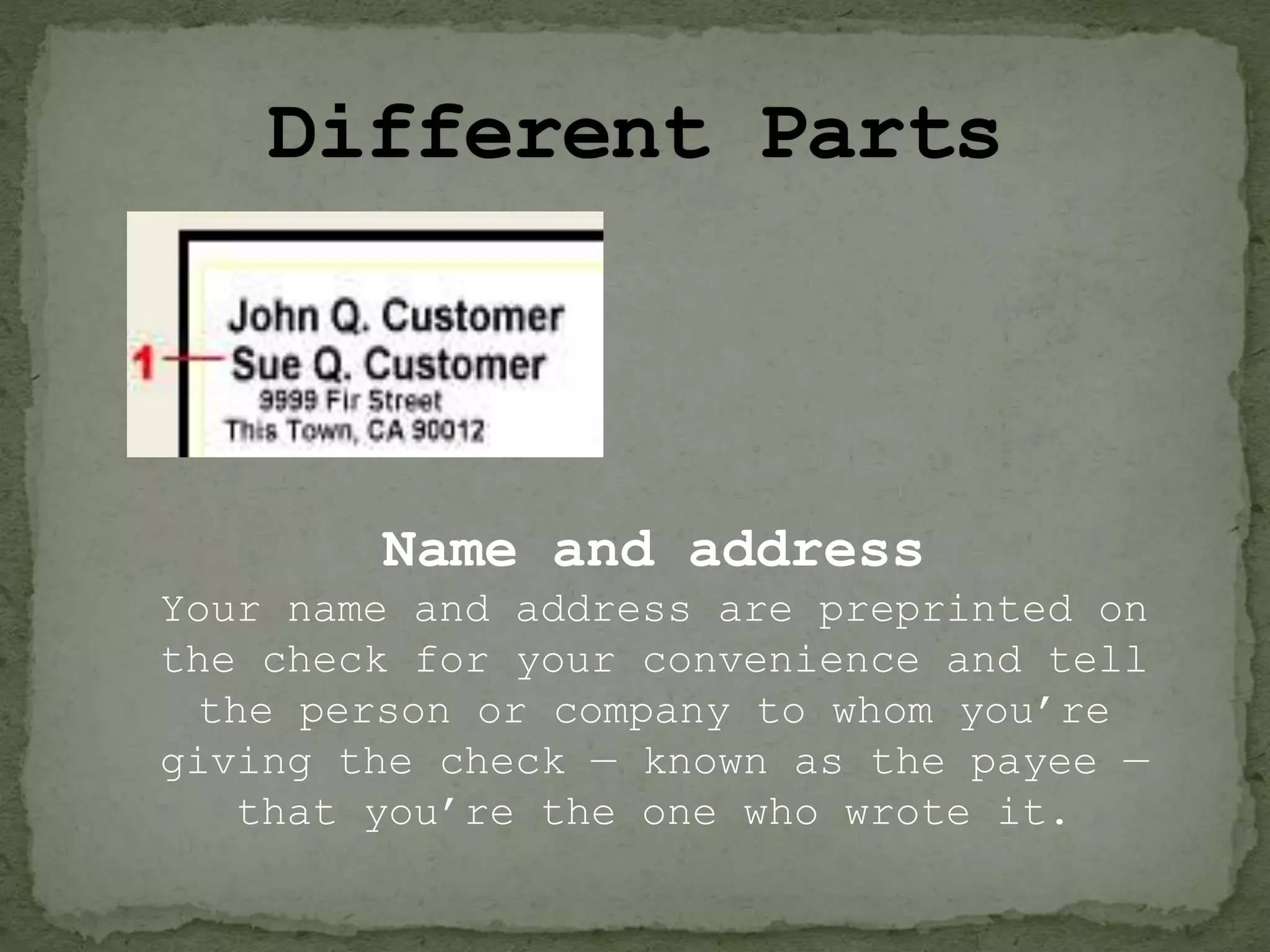

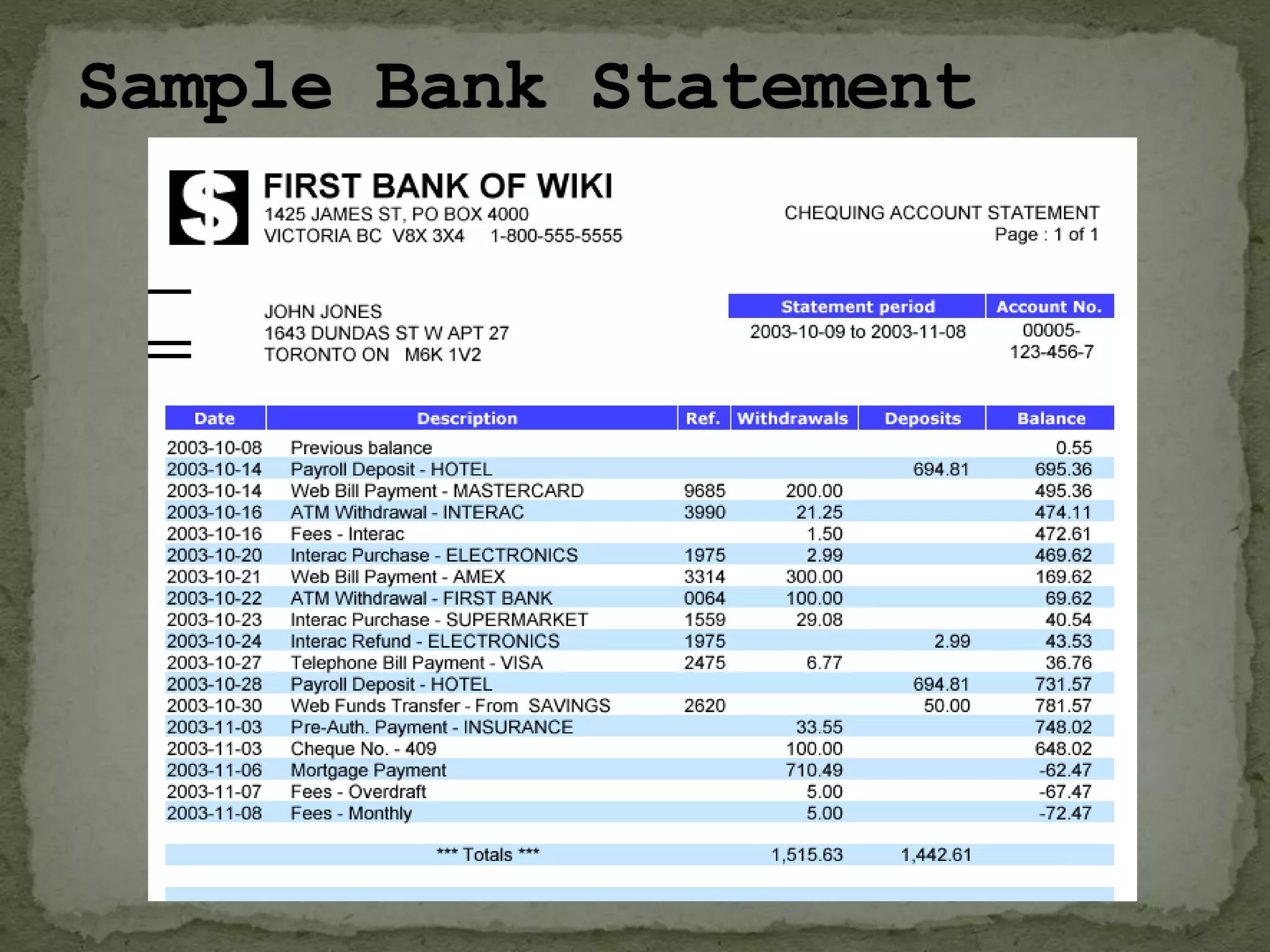

This document discusses Ella B. Dimaiwat's educational background in agri-ecotourism management from Central Bicol State University of Agriculture. It then provides information about different types of checks, including personal checks, business checks, cashier's checks, certified checks, and money orders. It defines the roles of the maker, drawee, and payee on a check. Finally, it discusses bank statements, how they can be received either through paper statements or electronic statements, and how keeping track of finances through bank statements can help with budgeting and identifying fraudulent transactions.