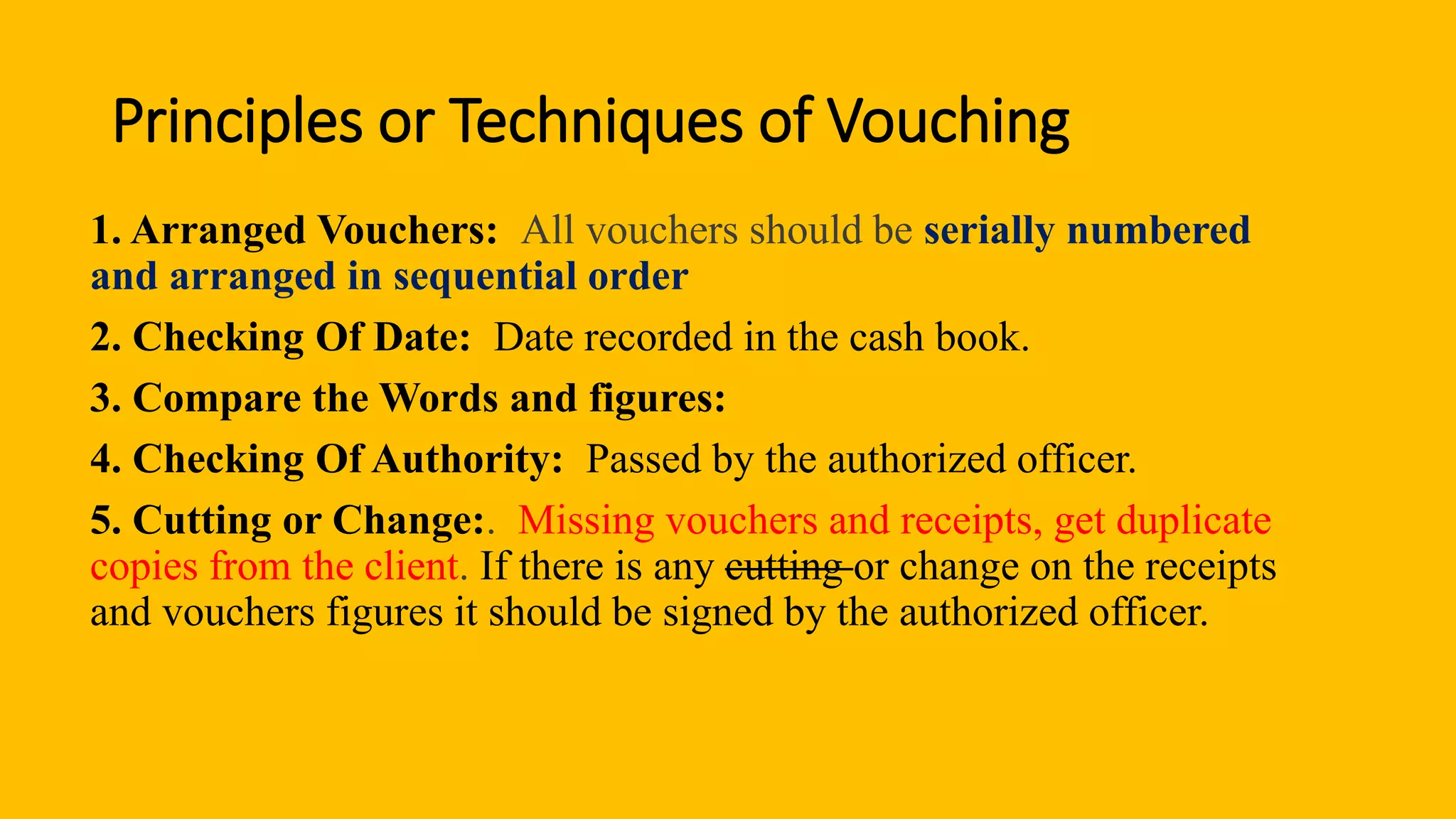

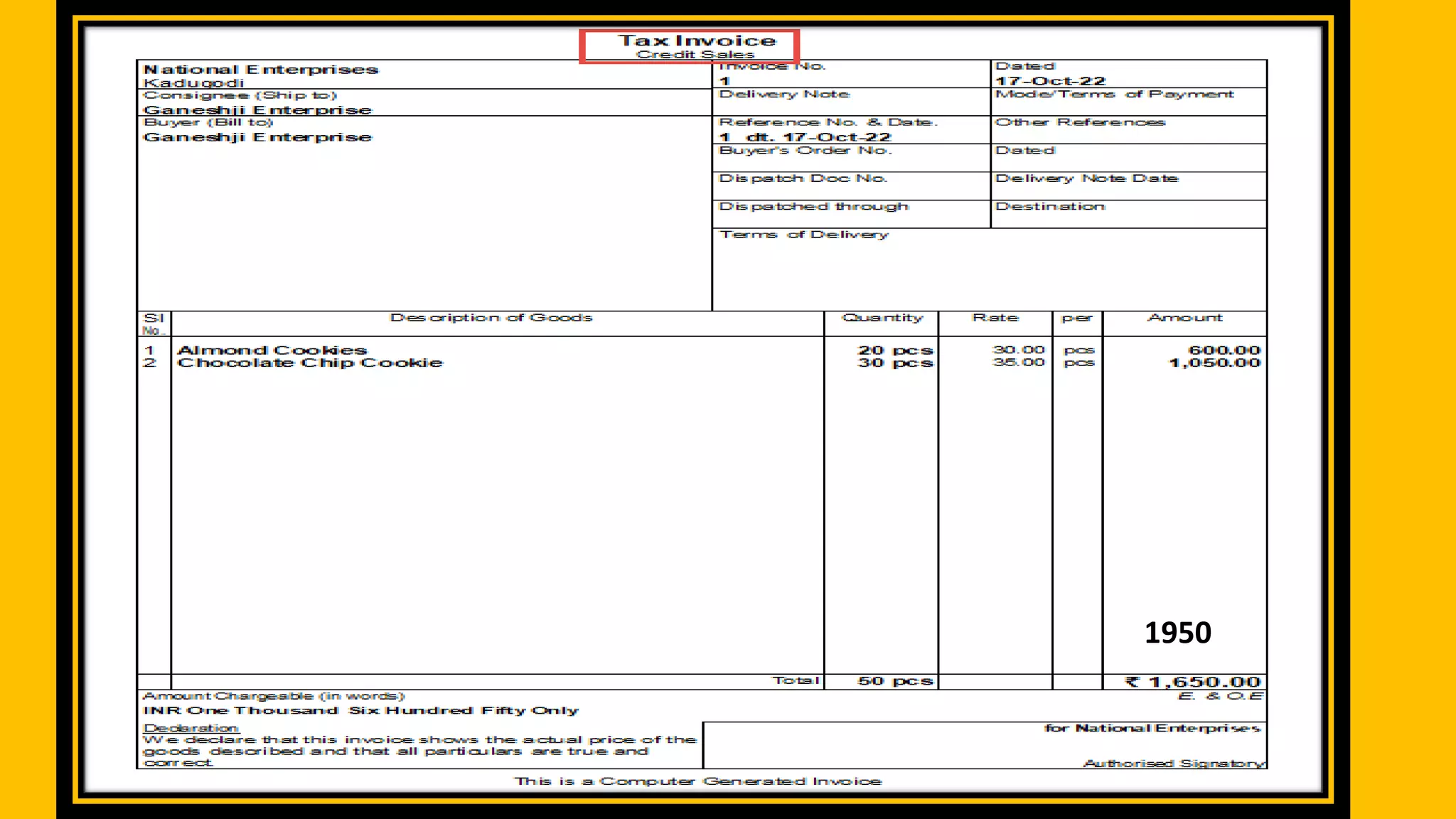

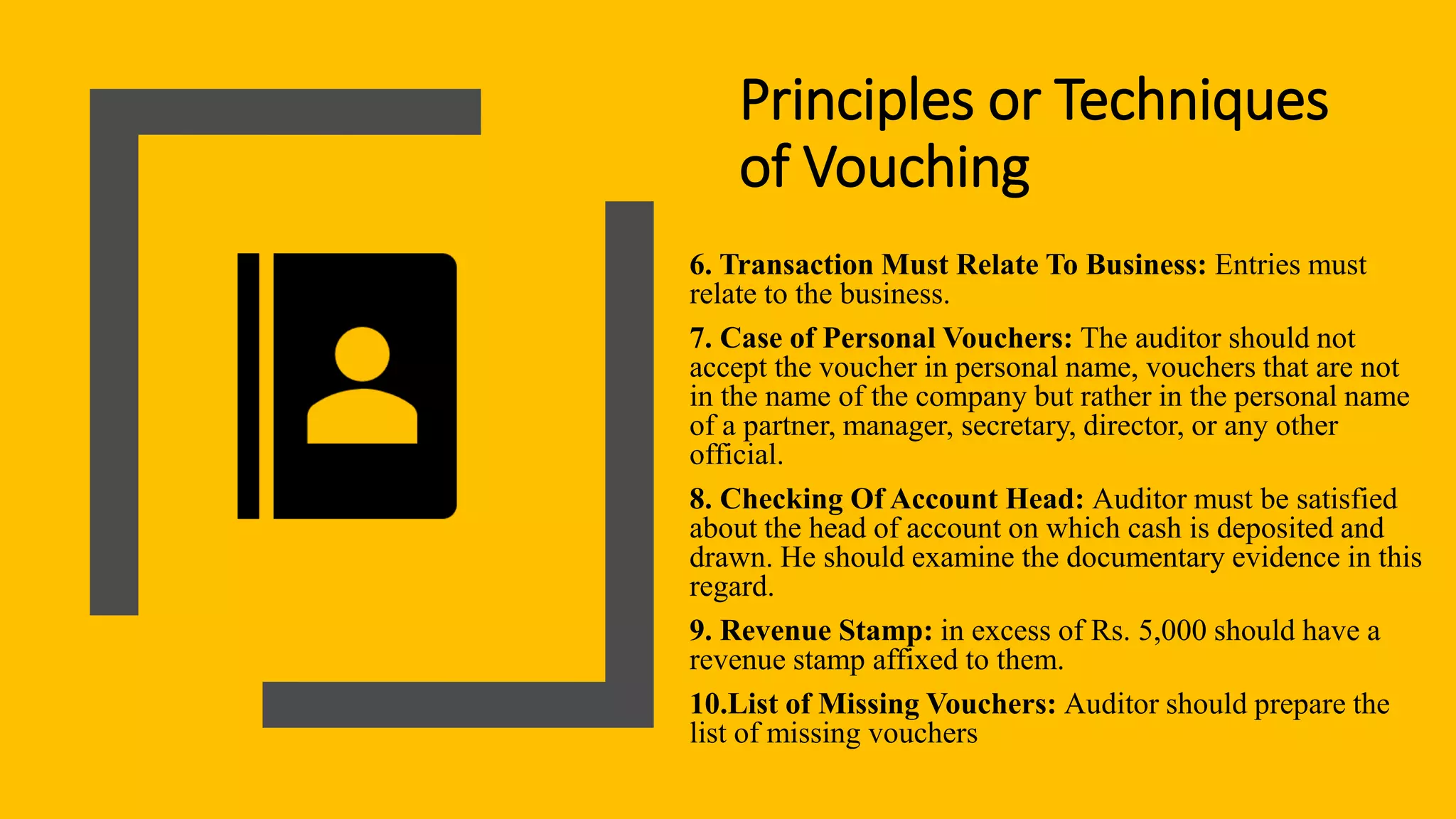

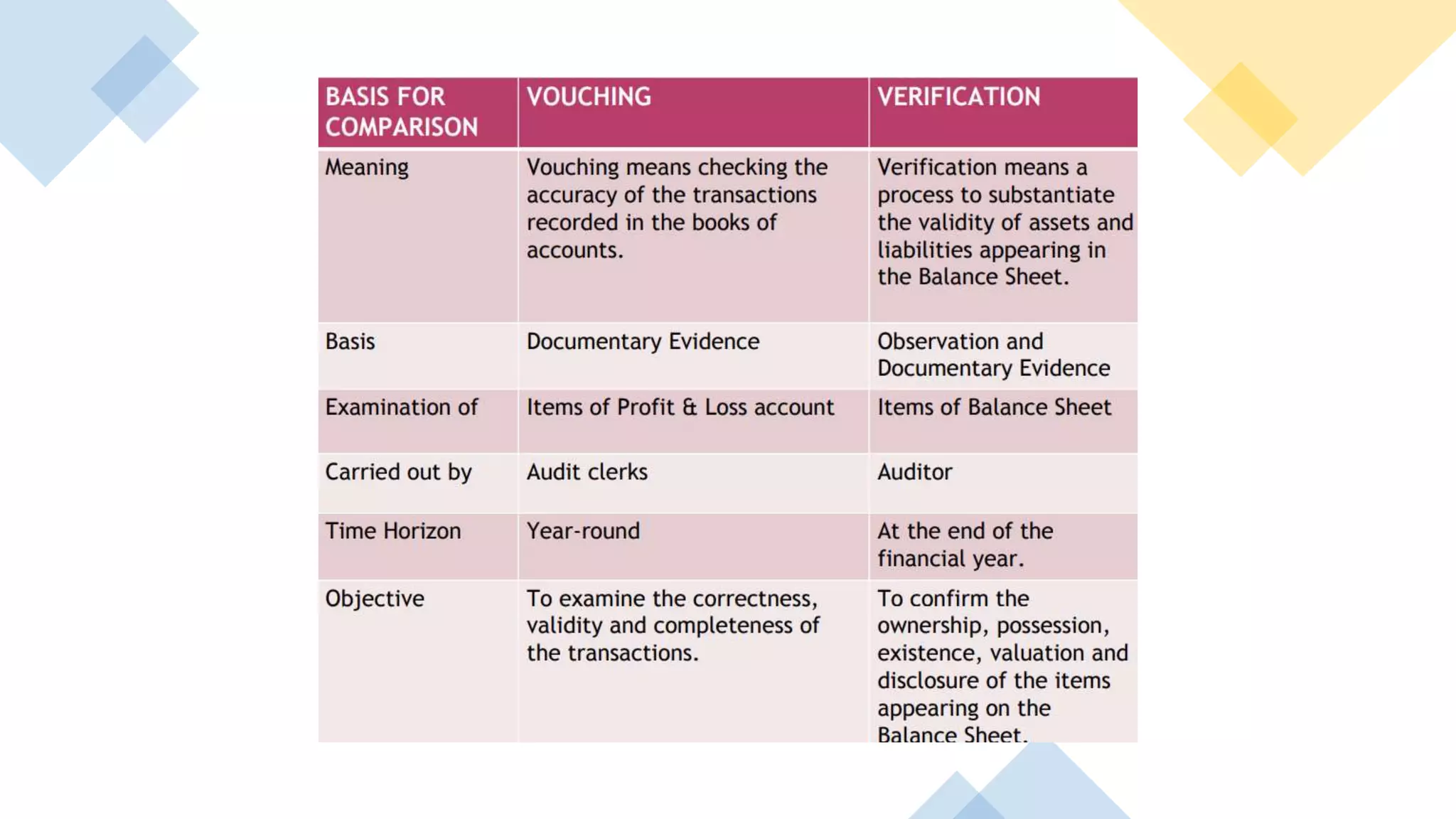

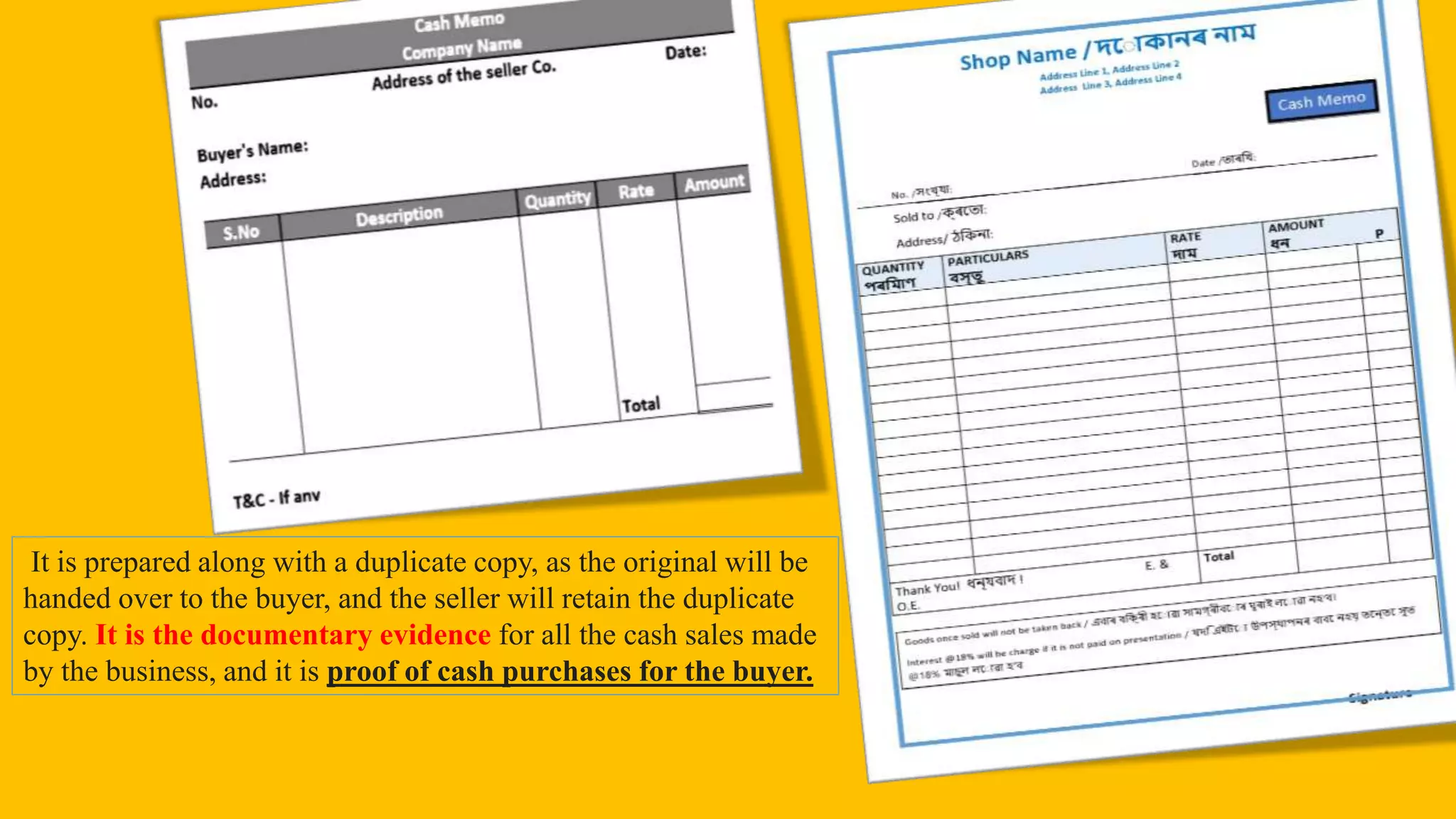

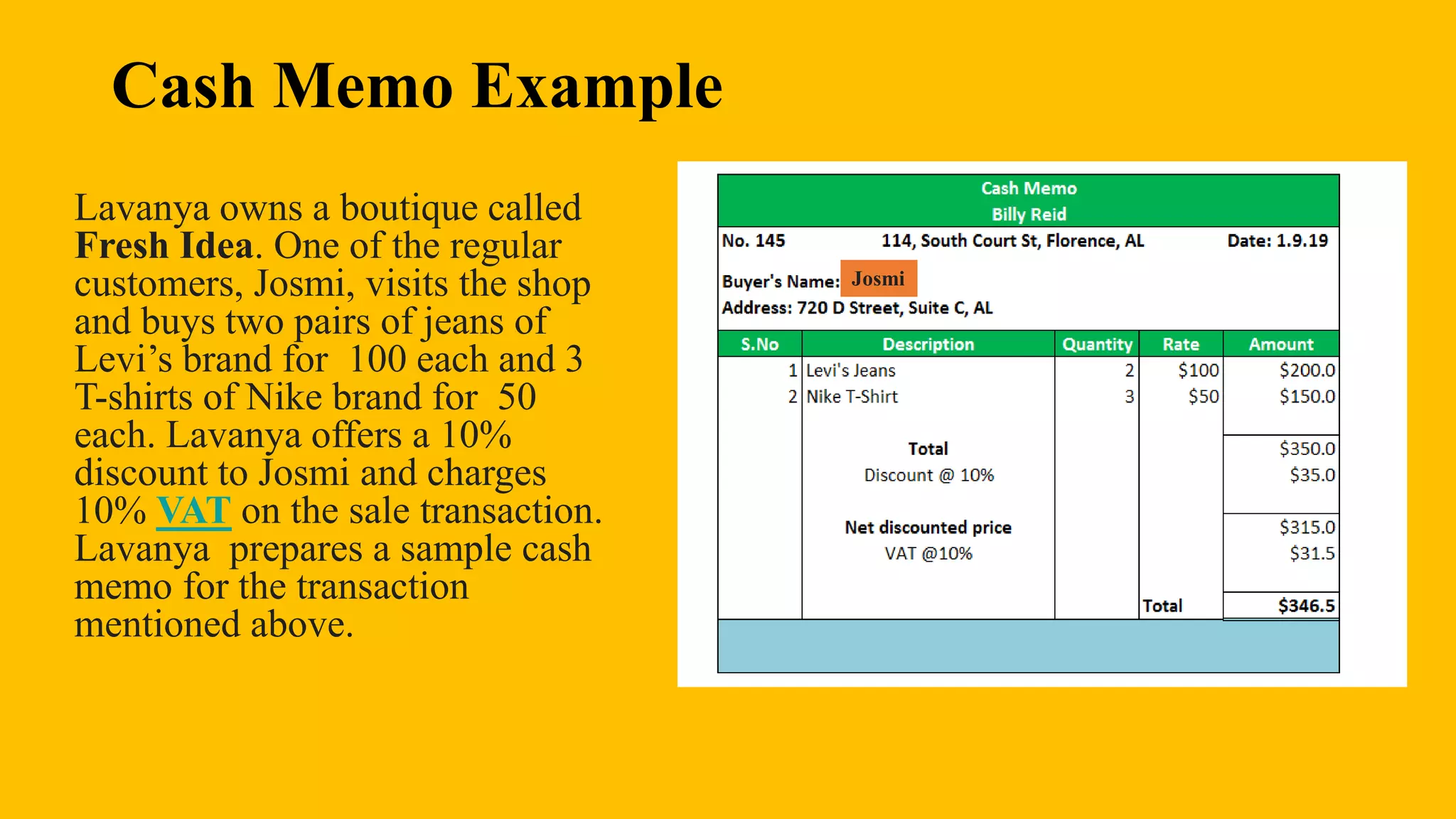

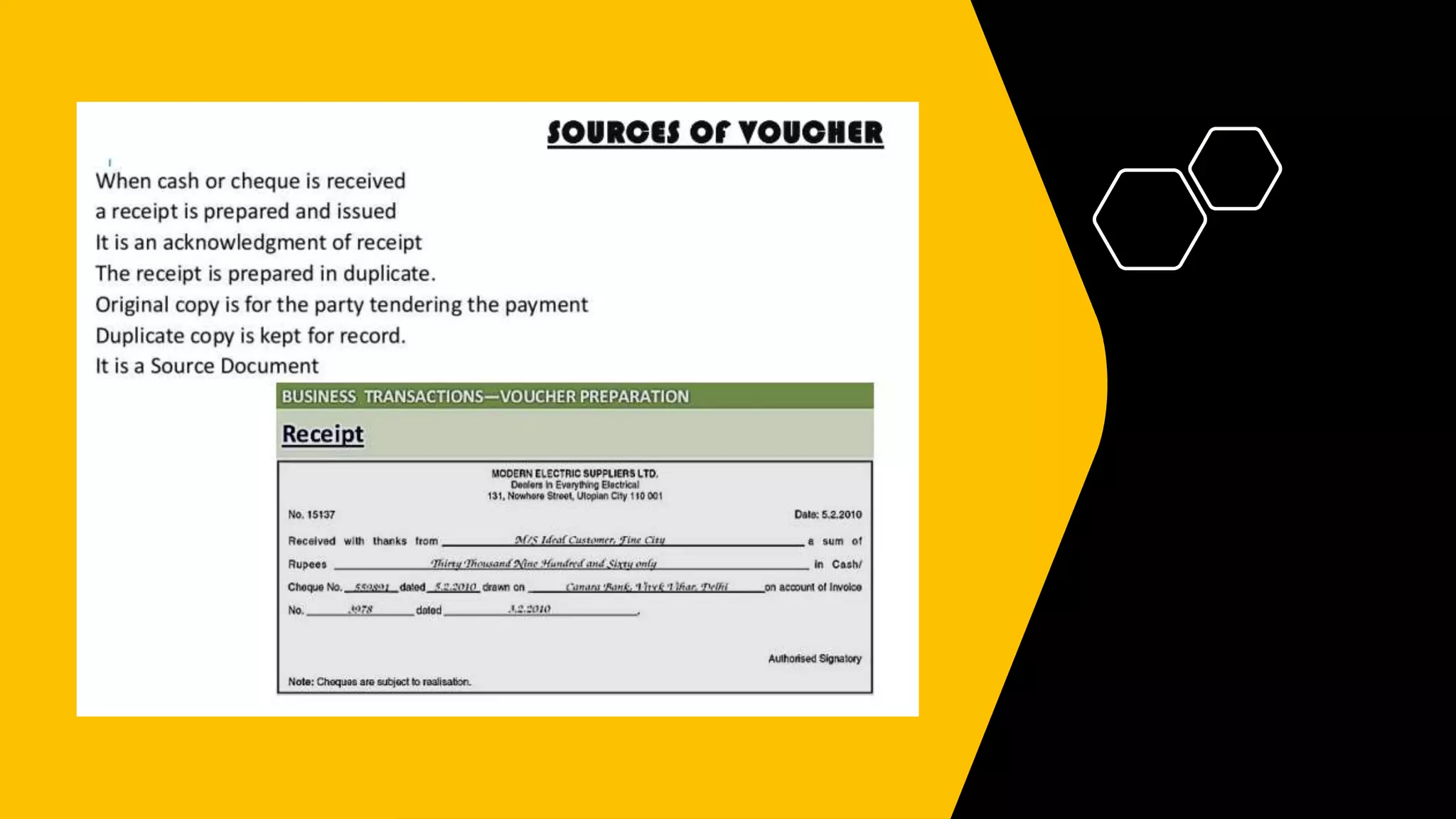

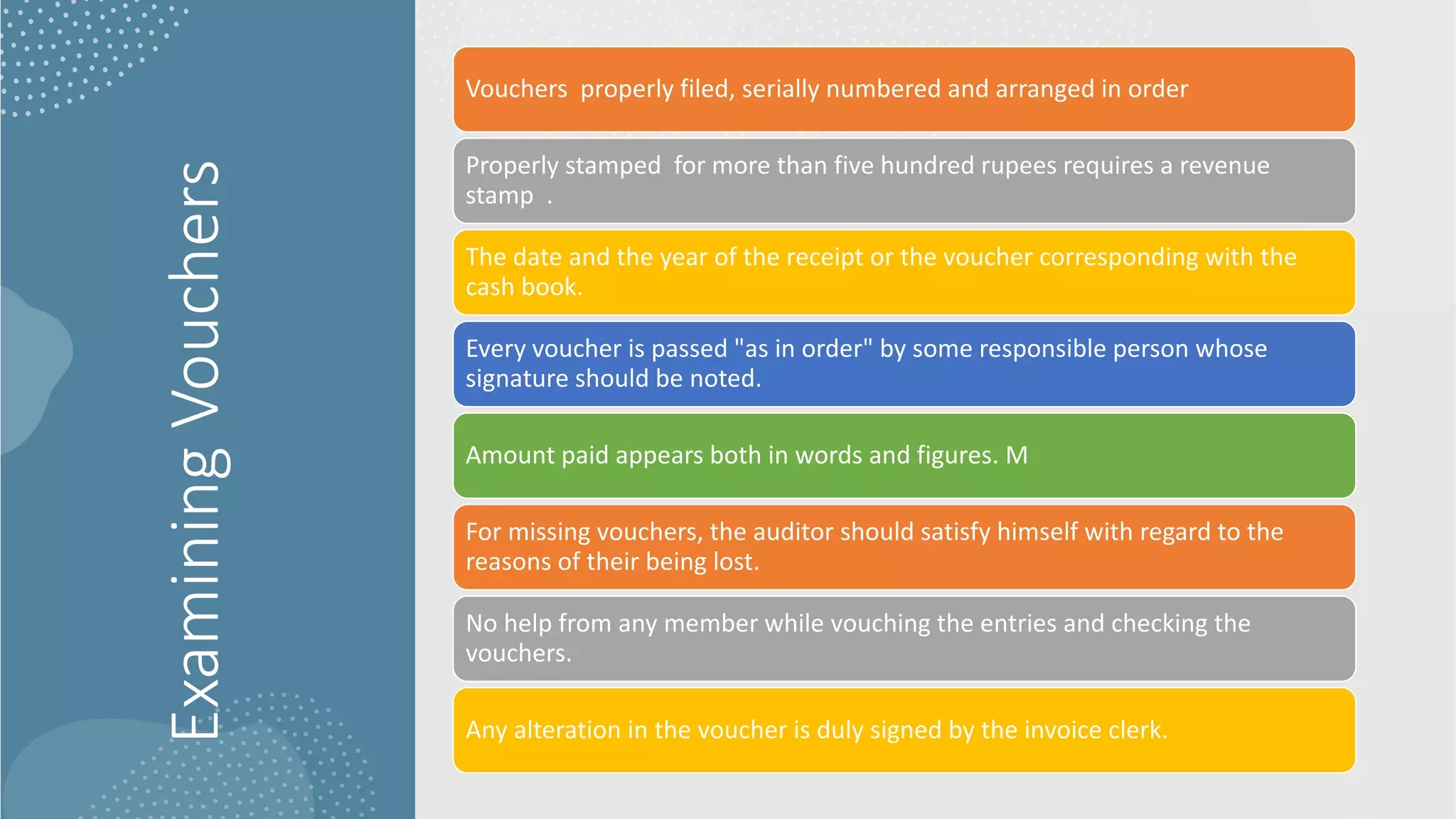

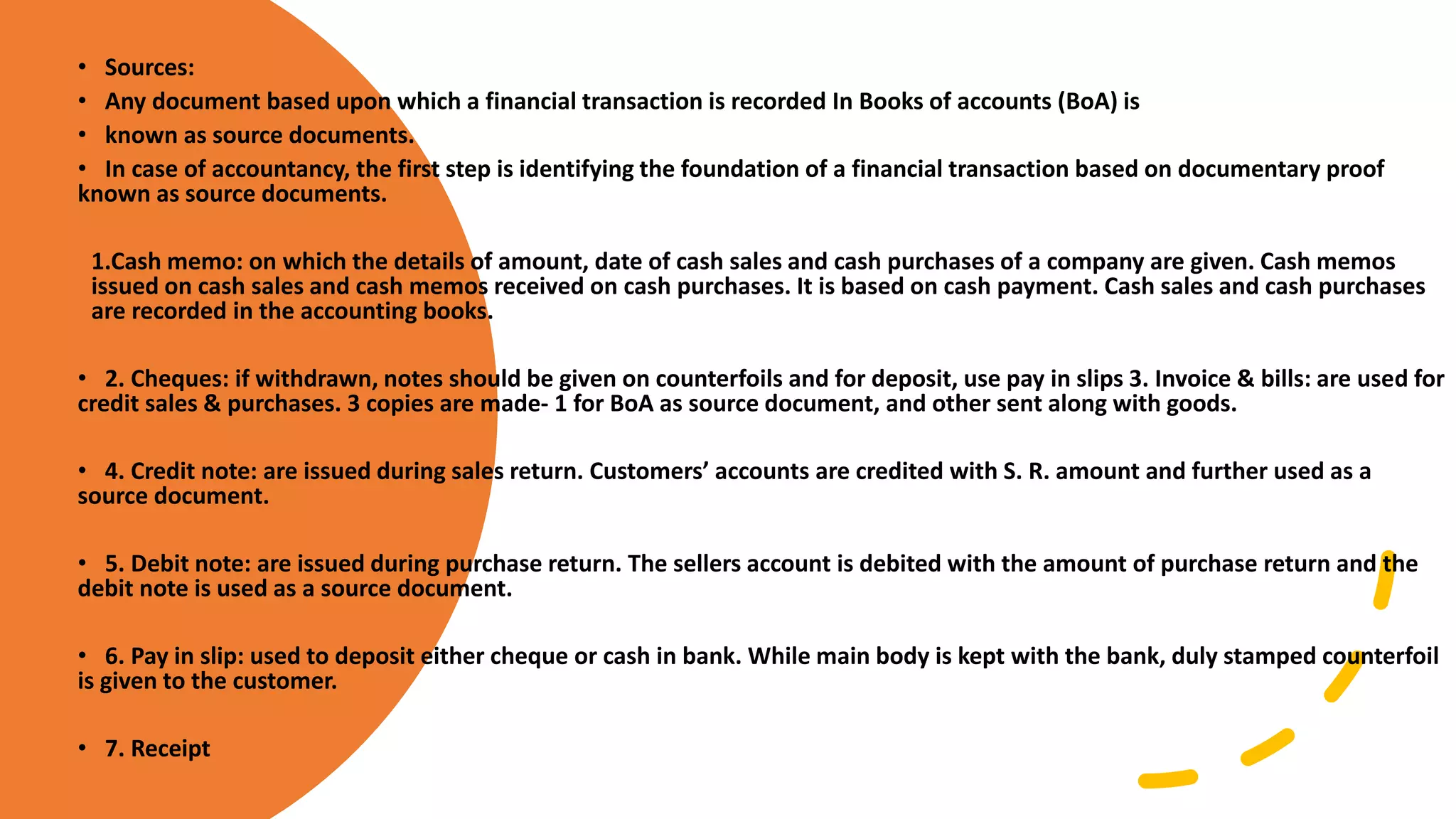

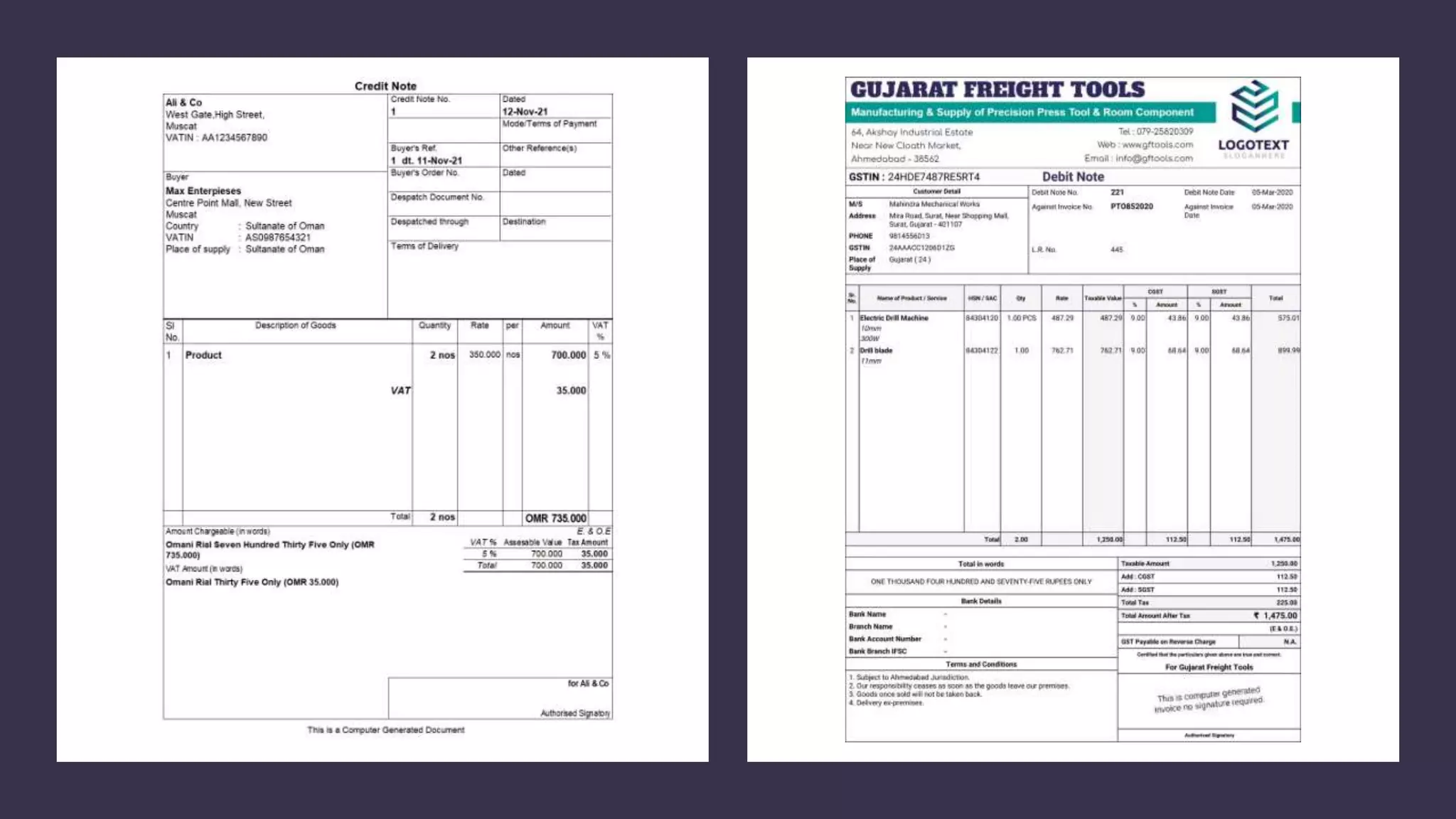

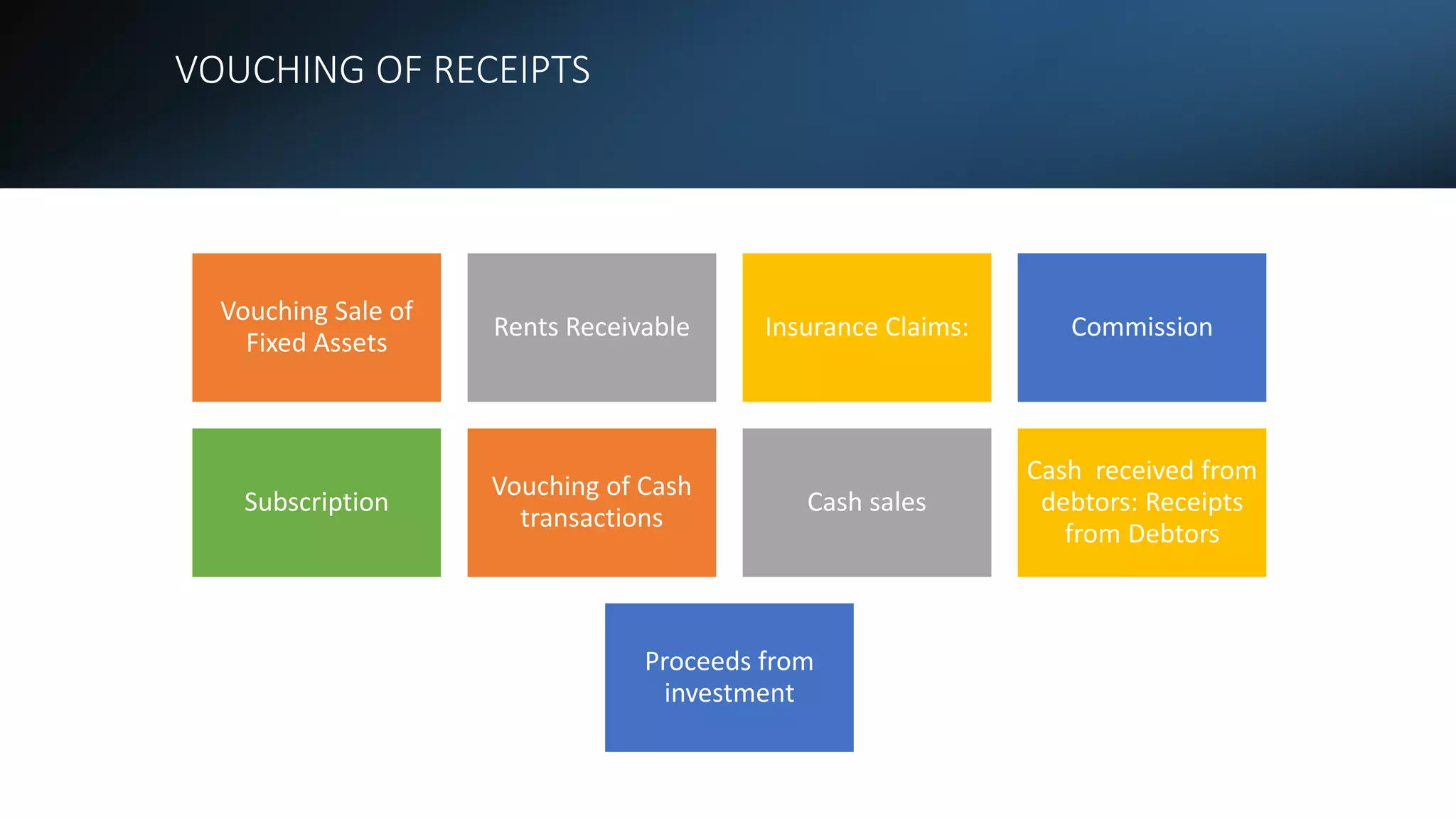

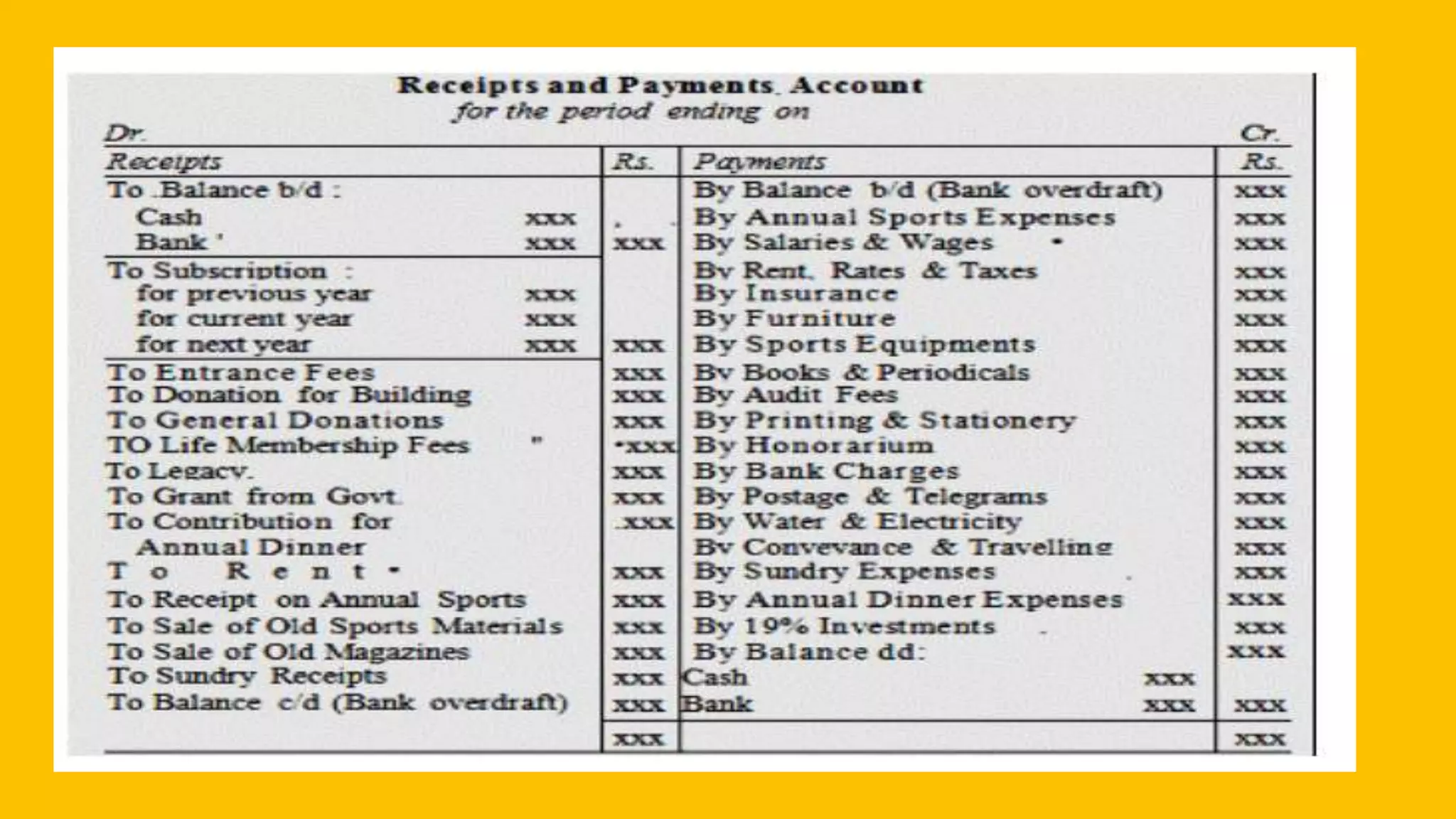

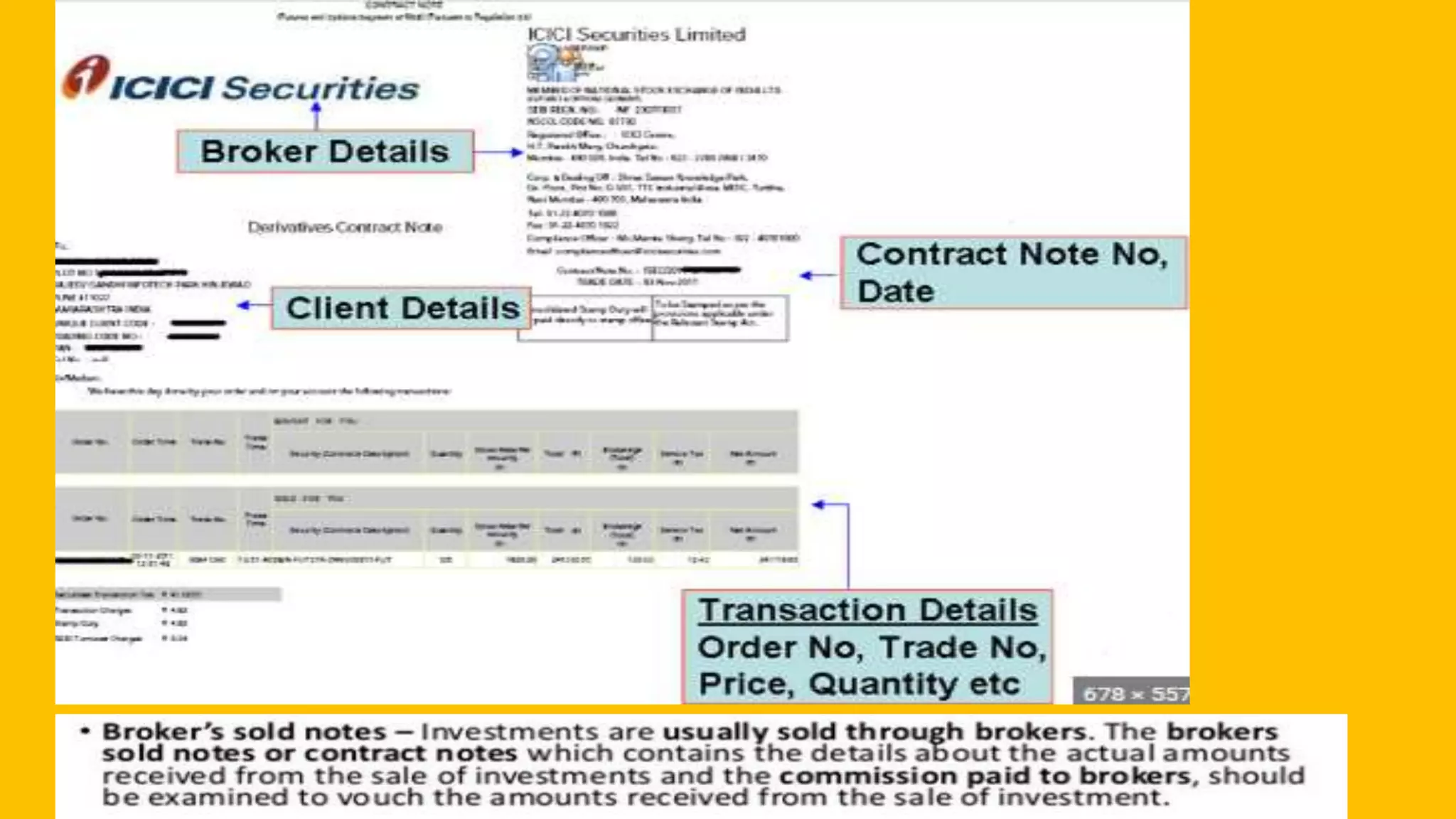

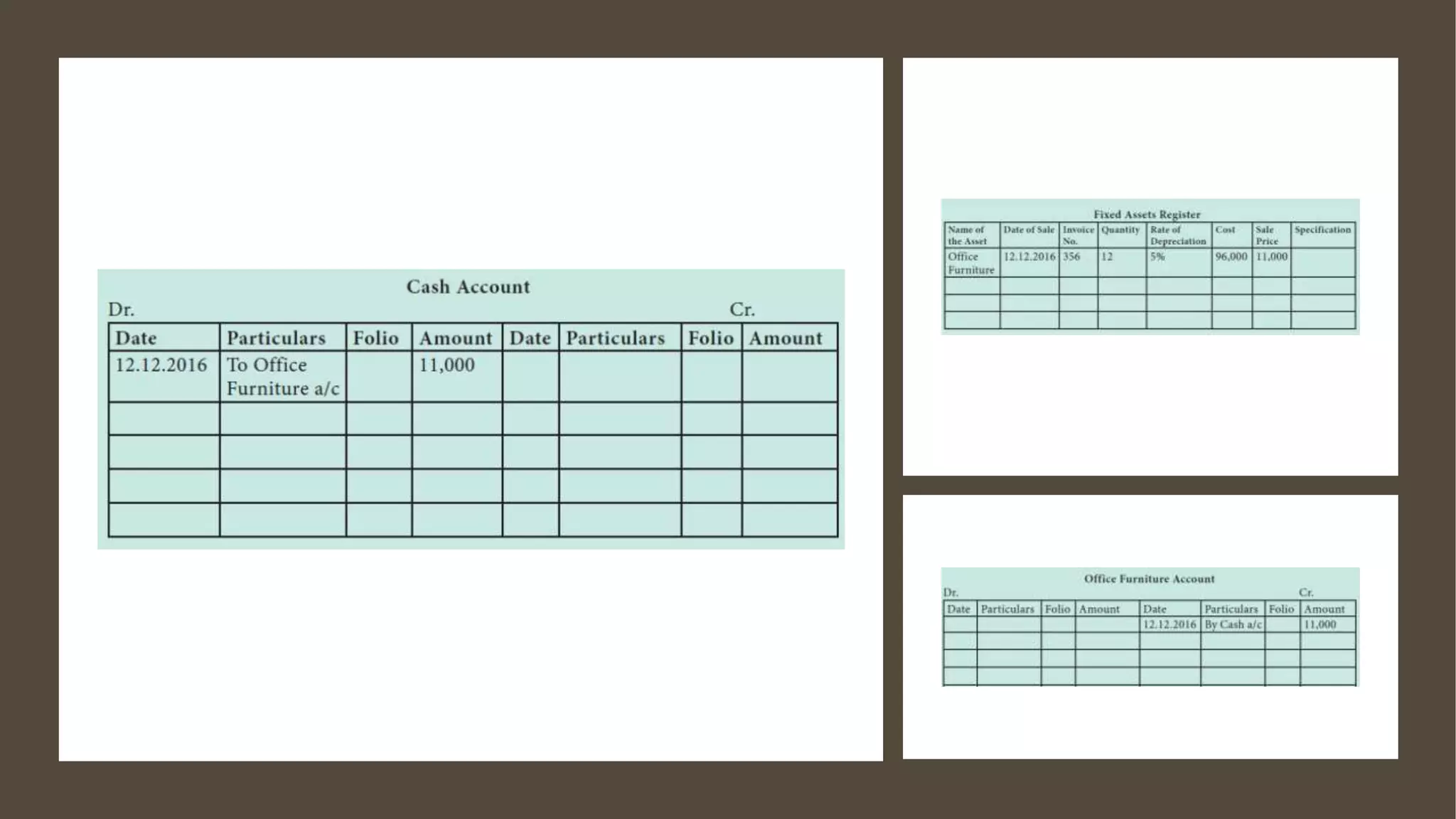

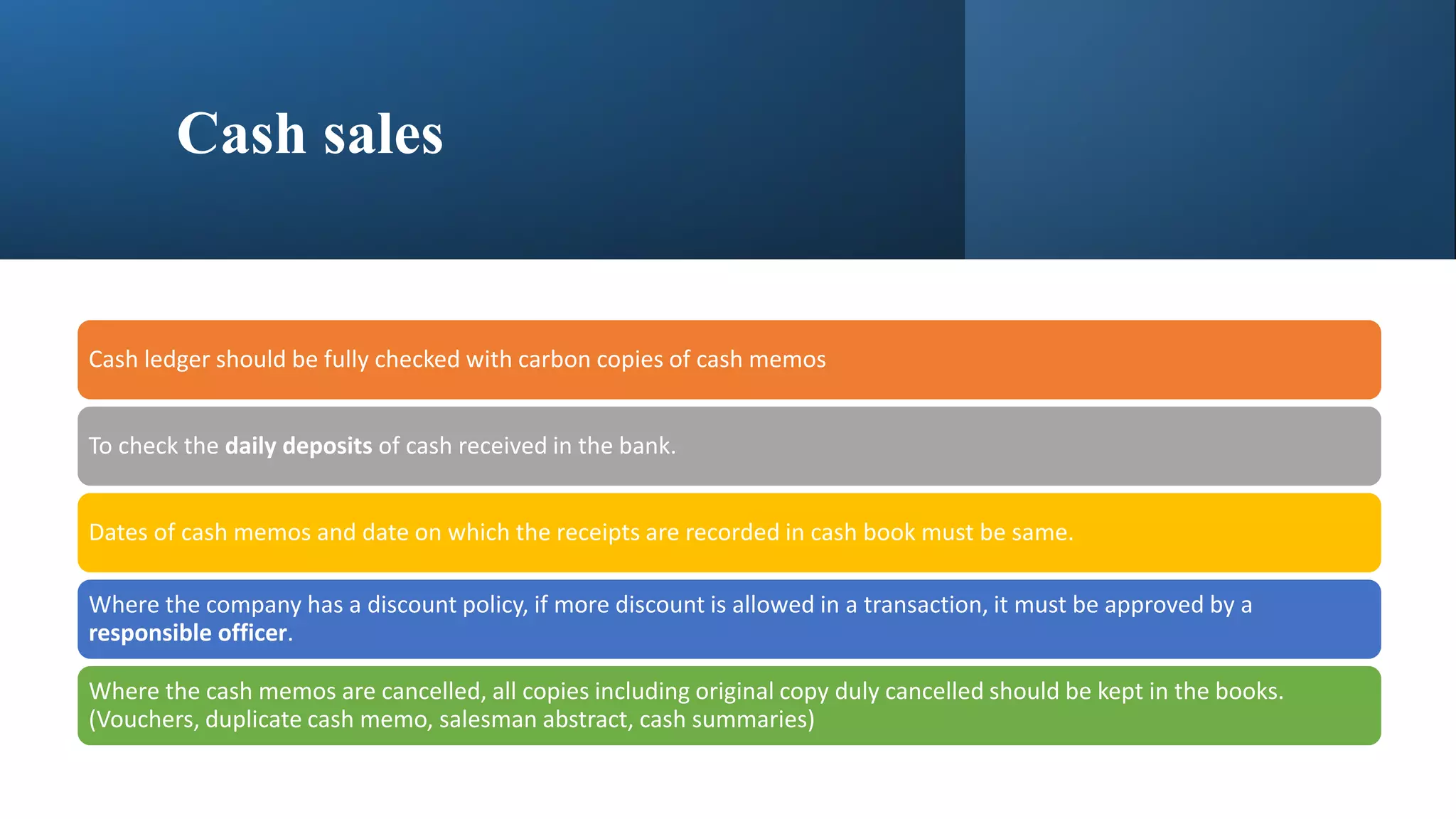

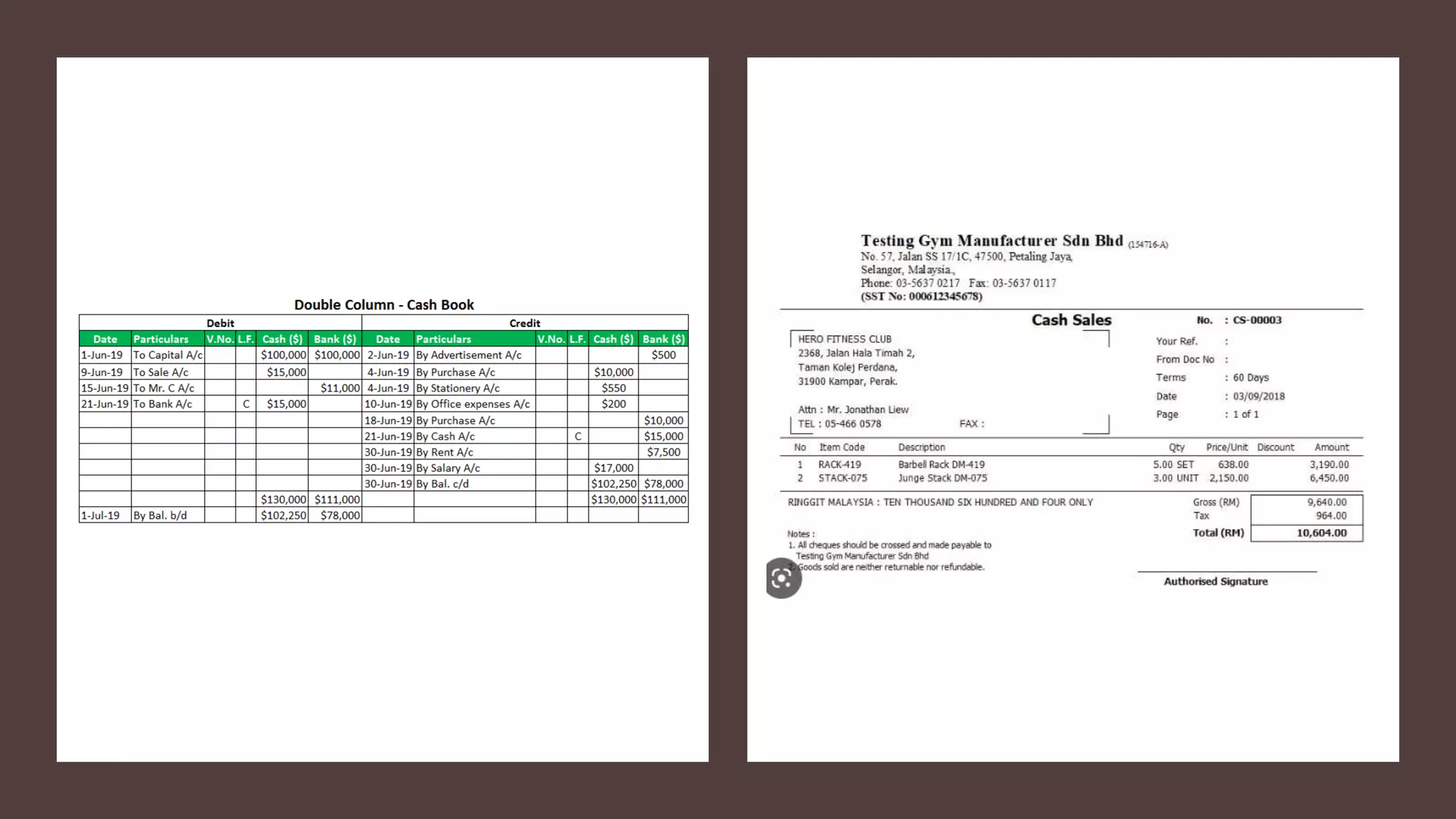

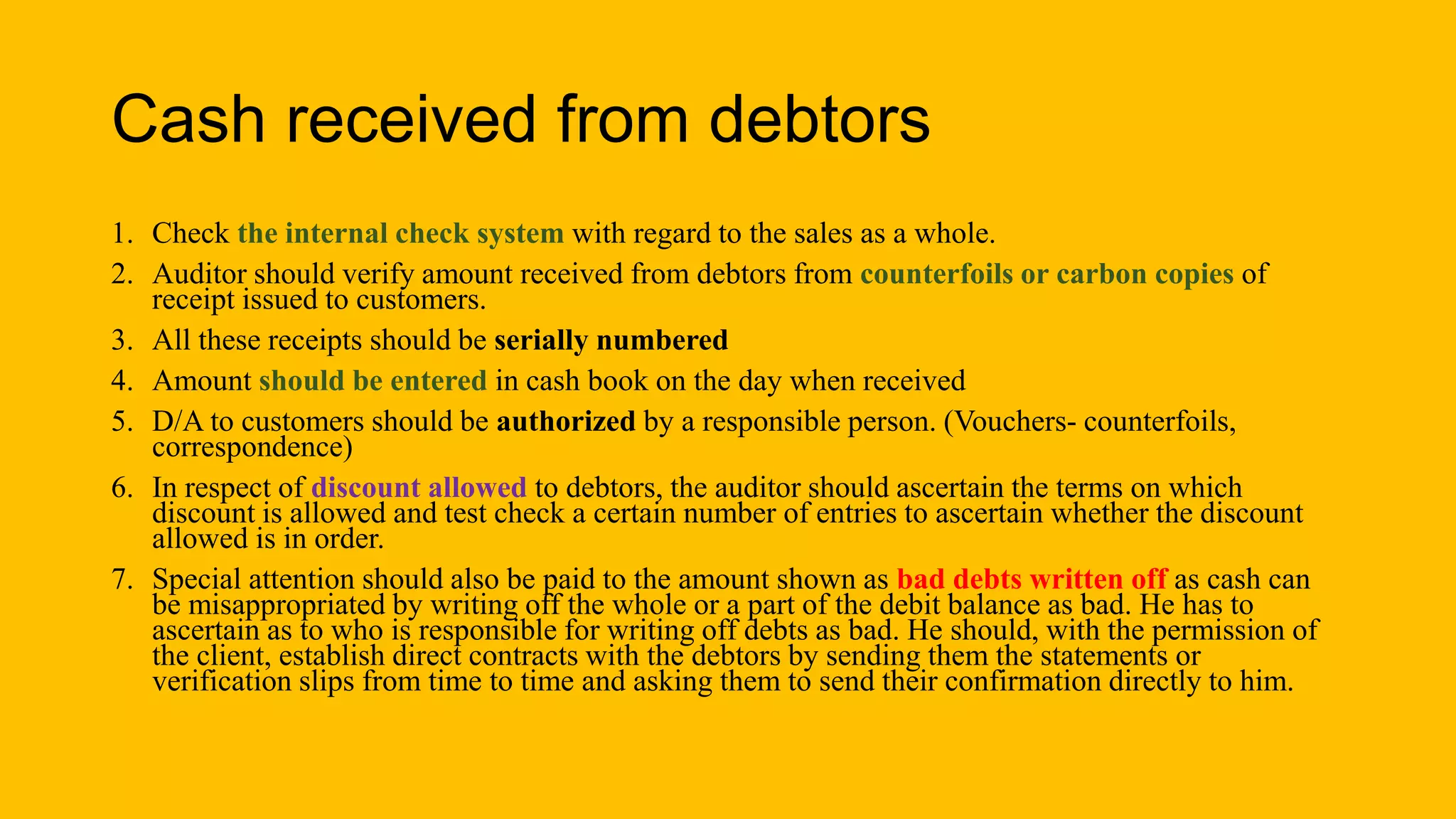

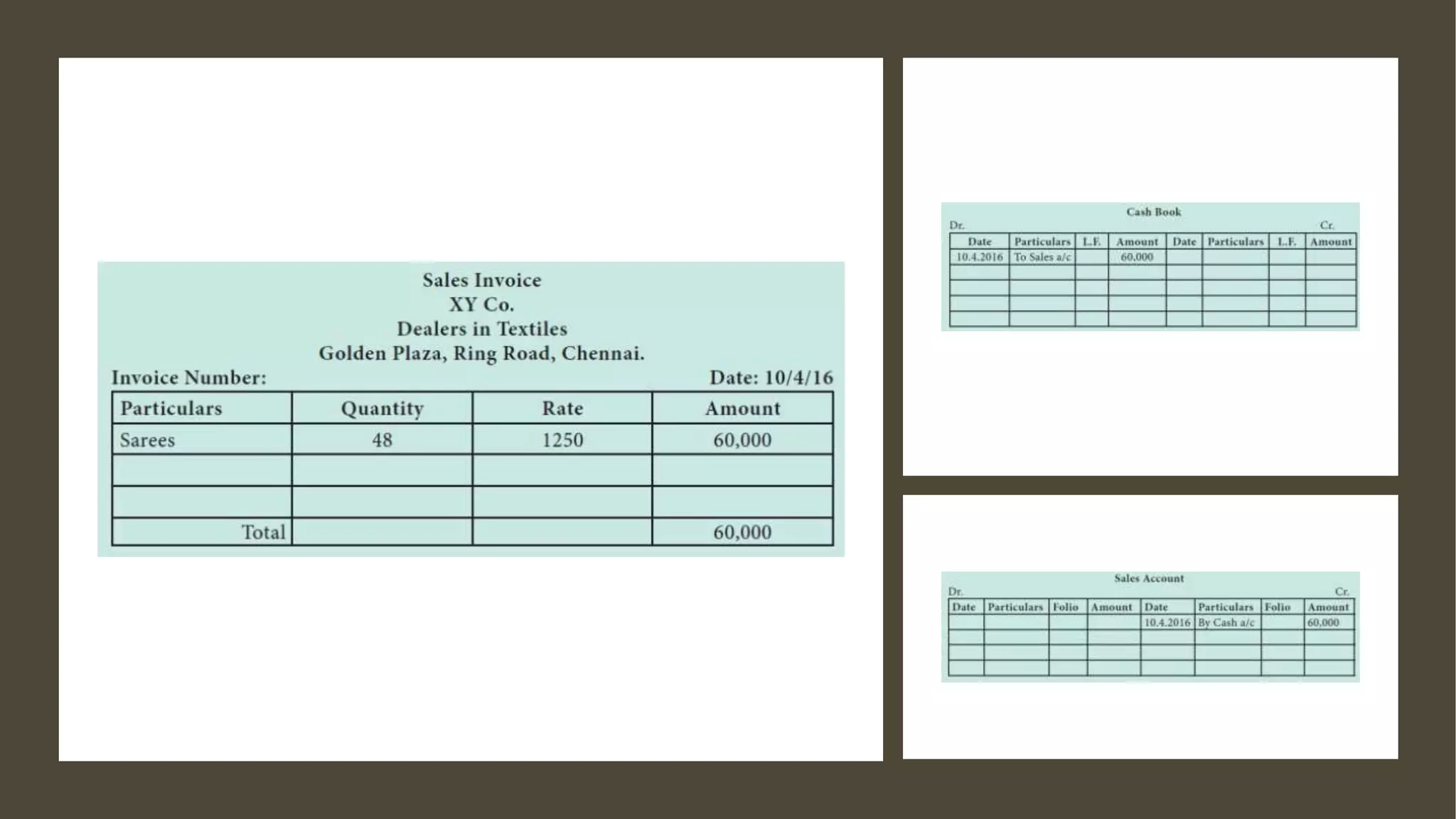

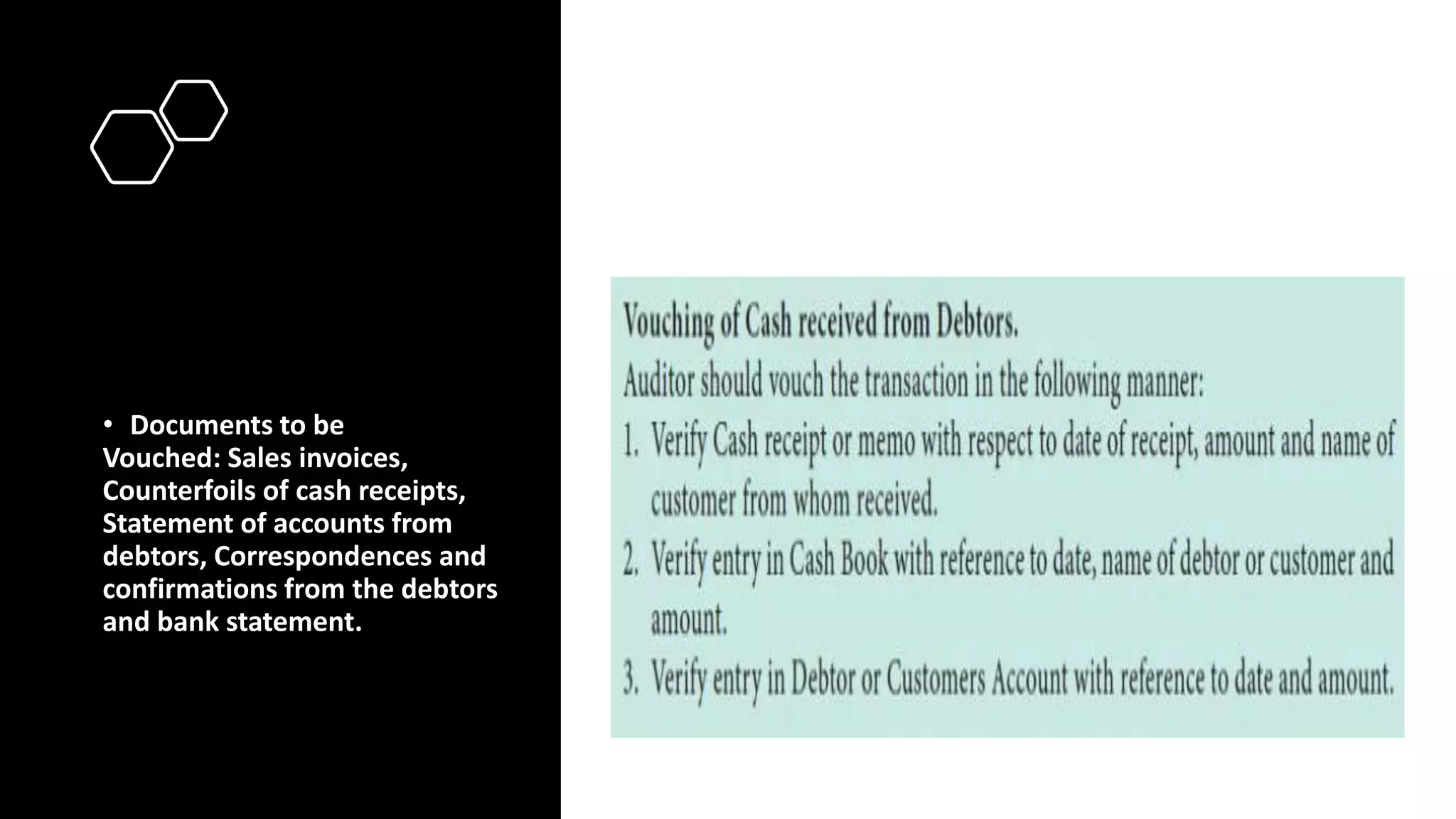

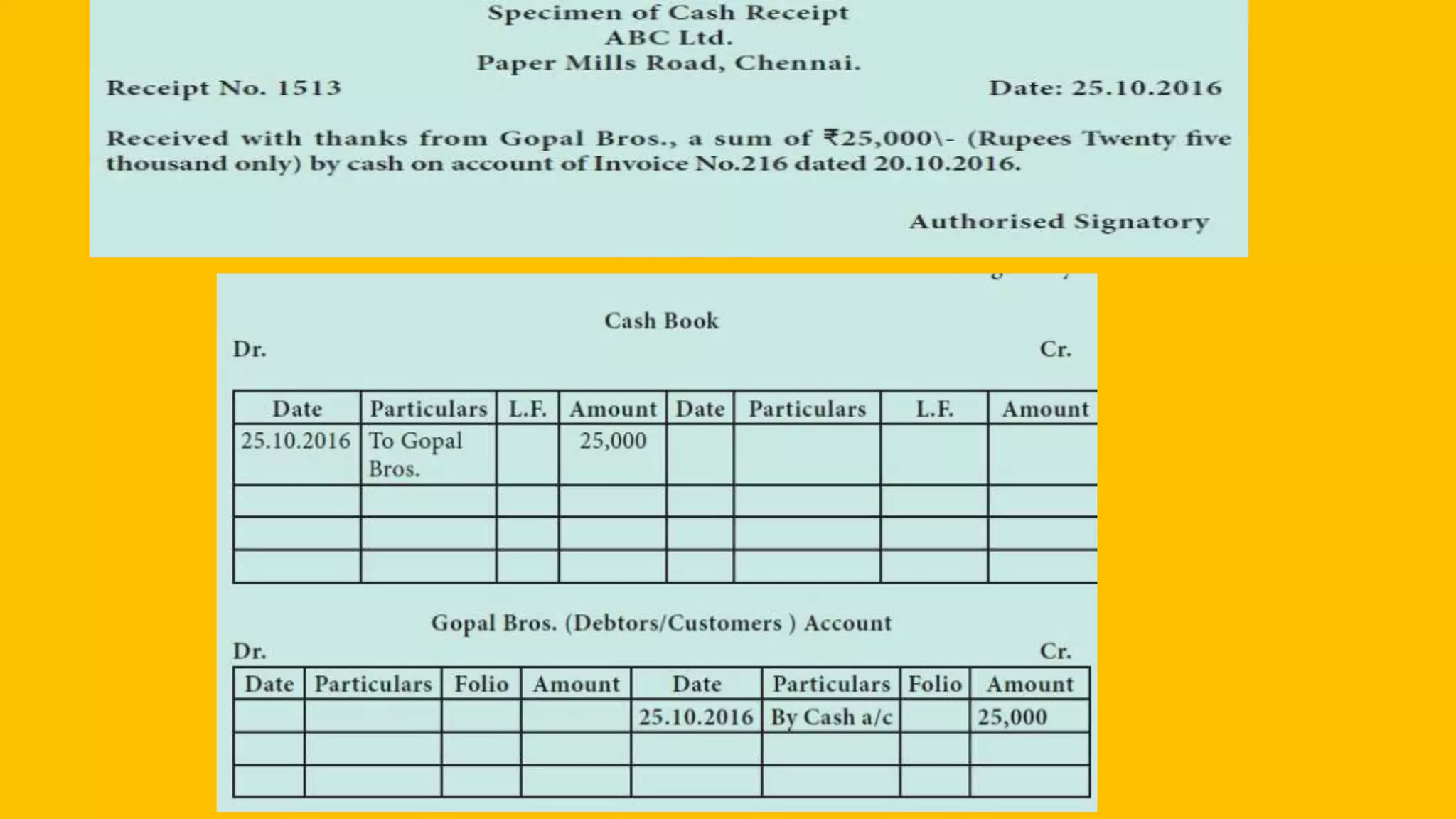

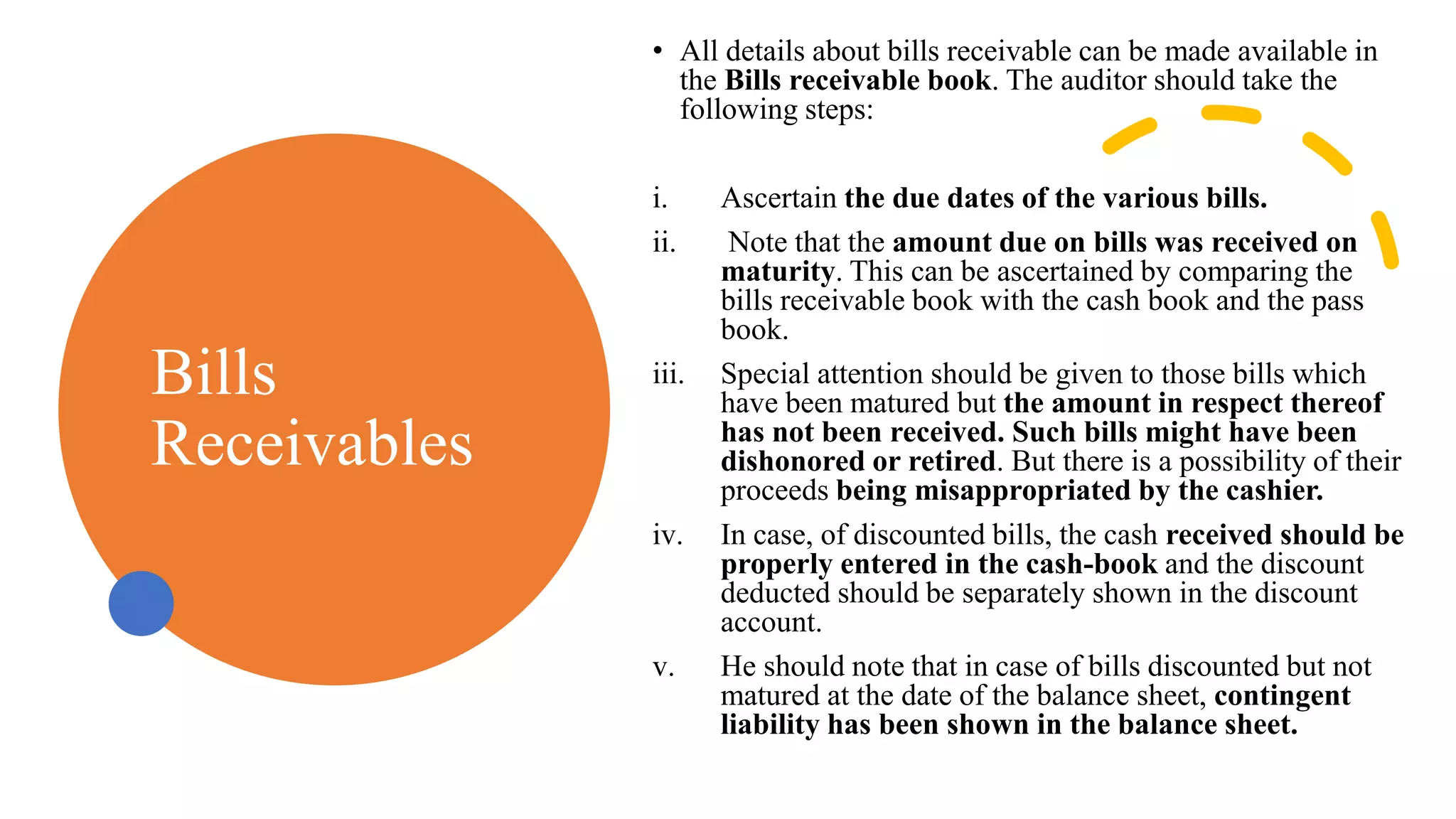

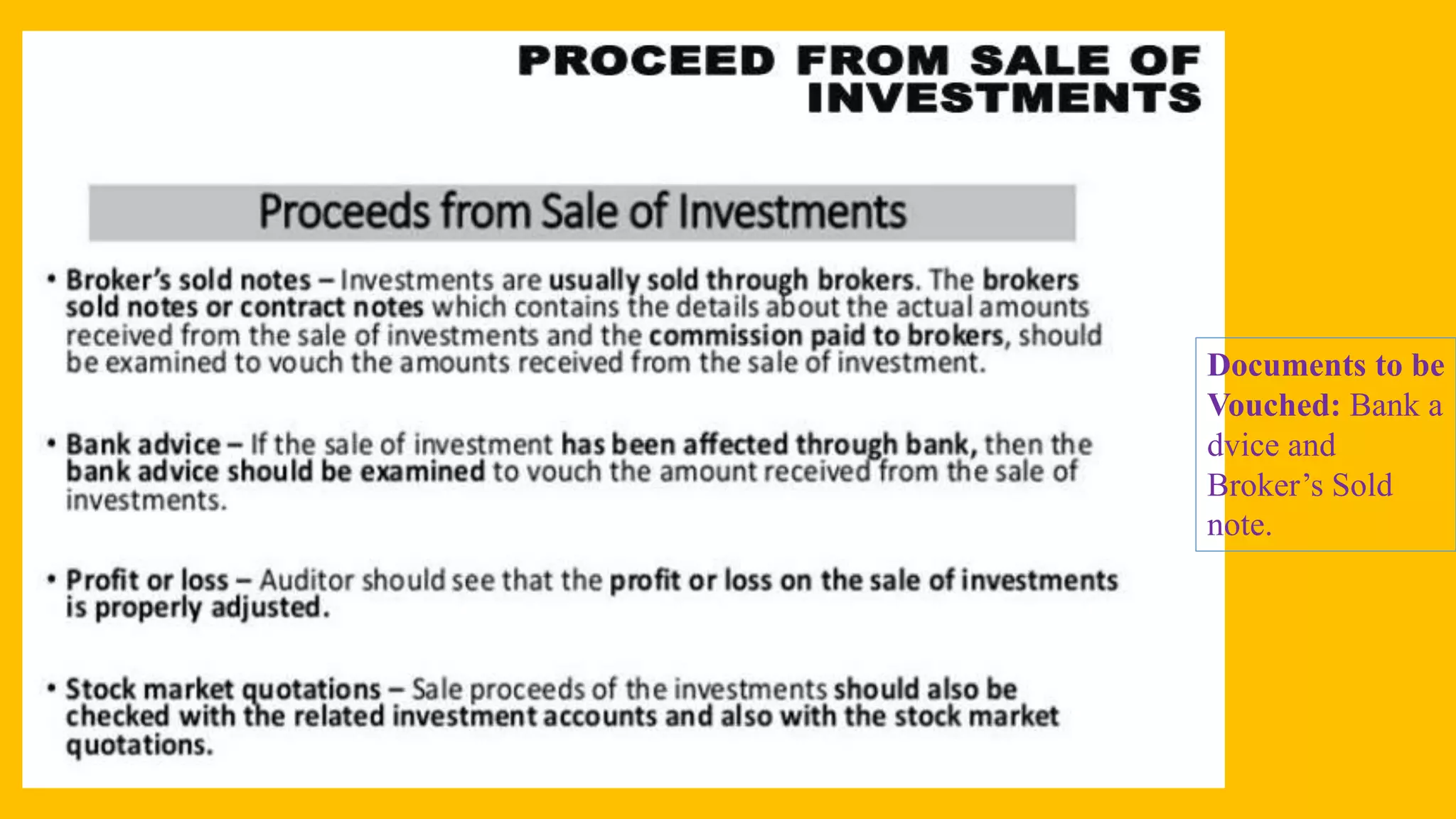

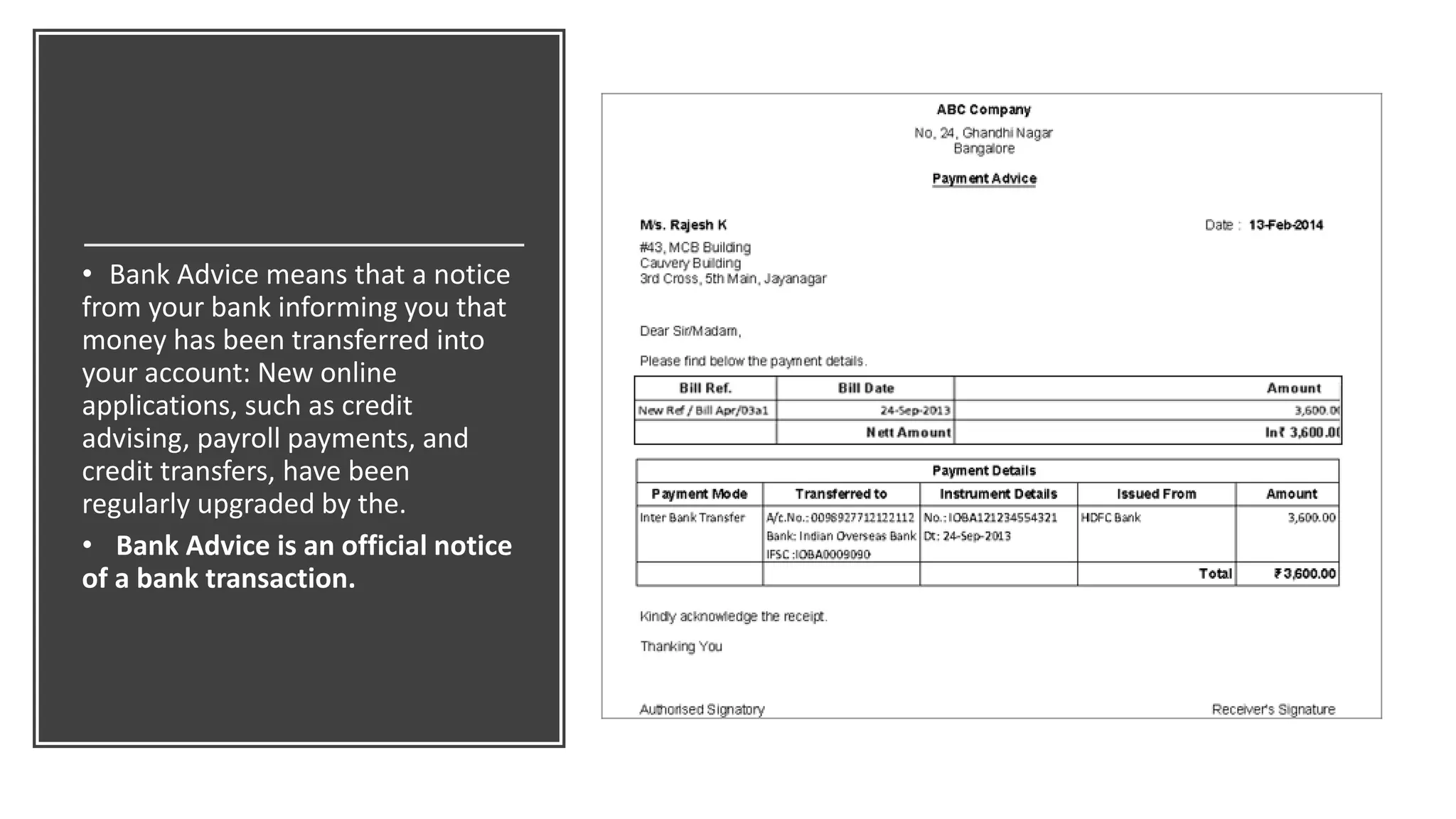

The document outlines the principles and importance of vouching in auditing, which involves examining documentary evidence to verify the authenticity of transactions. It discusses various types of vouchers, methods for checking their accuracy, and the role of auditors in vouching cash transactions, including cash sales and receipts from debtors. Additionally, it covers deferred revenue expenditure, emphasizing the importance of understanding expenses that yield benefits over multiple accounting periods.