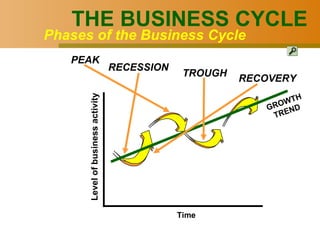

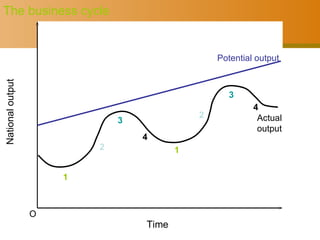

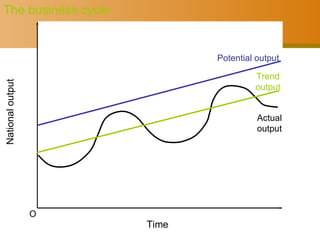

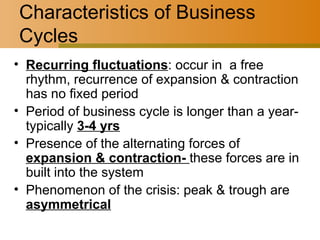

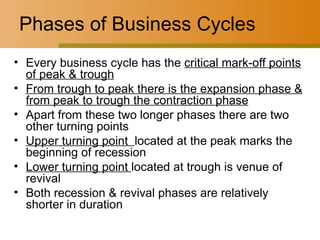

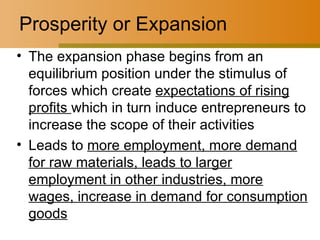

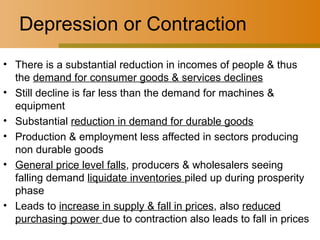

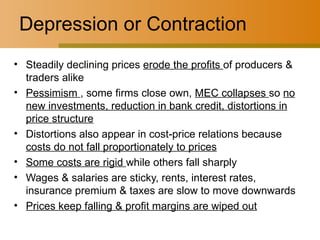

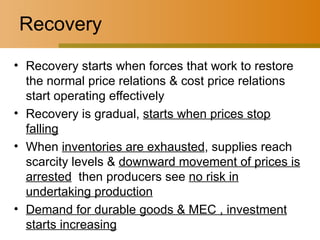

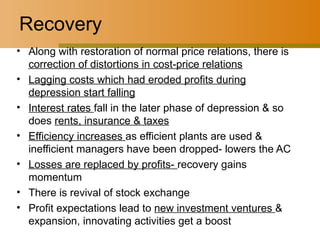

The business cycle consists of recurring periods of economic expansion and contraction. A typical cycle includes four phases: recovery, expansion, recession, and contraction. During expansion, economic activity increases as output and employment rise. However, expansion cannot continue indefinitely, and the forces that cause expansion eventually lead to recession as costs rise and profit margins shrink. Recession transitions into contraction, where there is a notable decline in production, employment, income and prices. Eventually, contraction gives way to recovery as prices stabilize, inventories are depleted, and investment and demand begin increasing again.