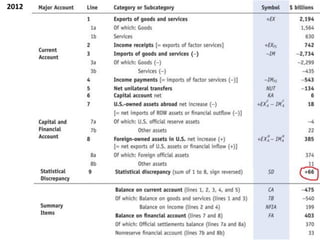

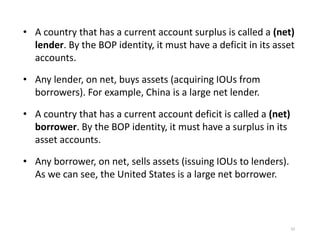

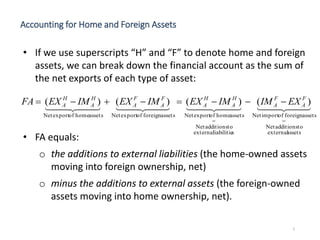

The document discusses the balance of payments identity and how it accounts for changes in a country's external wealth over time. It makes three key points:

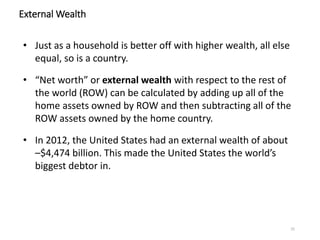

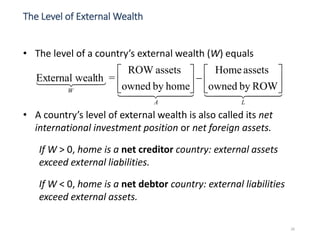

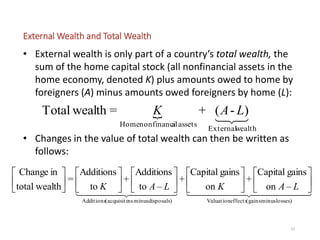

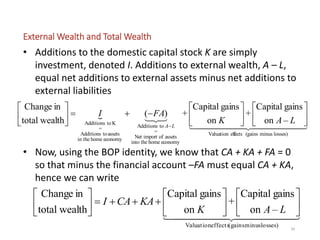

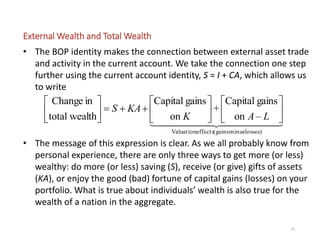

1. A country's external wealth is equal to the value of assets it owns abroad minus the value of foreign-owned assets in the country. It can increase through current account surpluses, capital account surpluses, or capital gains on assets.

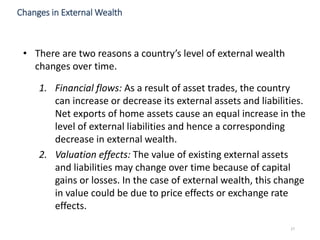

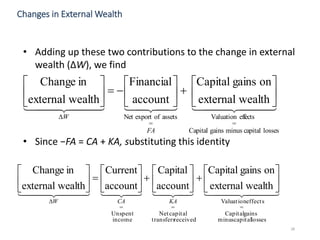

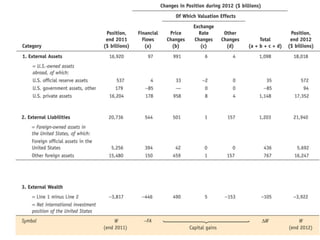

2. Changes in a country's external wealth come from financial flows that increase or decrease external assets/liabilities, and valuation effects from changes in asset prices.

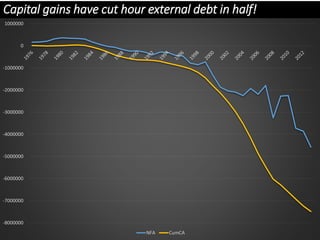

3. For the US, valuation effects from capital gains have significantly reduced its external debt over the past 30 years compared to what financial flows alone

![3

• Recall that gross national disposable income is

• In addition, the home economy can free up resources by

engaging in net sales (or purchases) of assets. We calculate

these extra resources using our previous definitions:

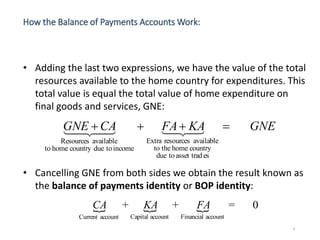

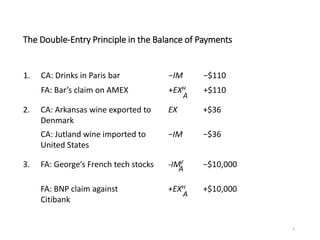

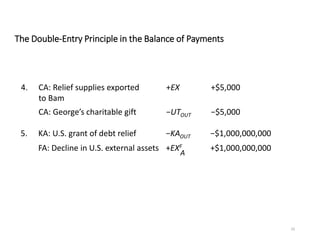

How the Balance of Payments Accounts Work:

incomefromcountryhometo

availableResources

CAGNENUTNFIATBGNEGNDIY

esasset tradtodue

countryhometheto

availableresourcesExtra

purchasesviaimportedassetsall

ofValue

giftsas

imported

assetsall

ofValue

imported

assetsall

ofValue

salesviaexportedassetsall

ofValue

giftsas

exported

assetsall

ofValue

exported

assetsall

ofValue

][][ KAFAKAKAIMEXKAIMKAEX OUTINAAINAOUTA ](https://image.slidesharecdn.com/balancingpaymentssavingsandexternalwealth-161205140702/85/Balancing-payments-savings-and-external-wealth-3-320.jpg)