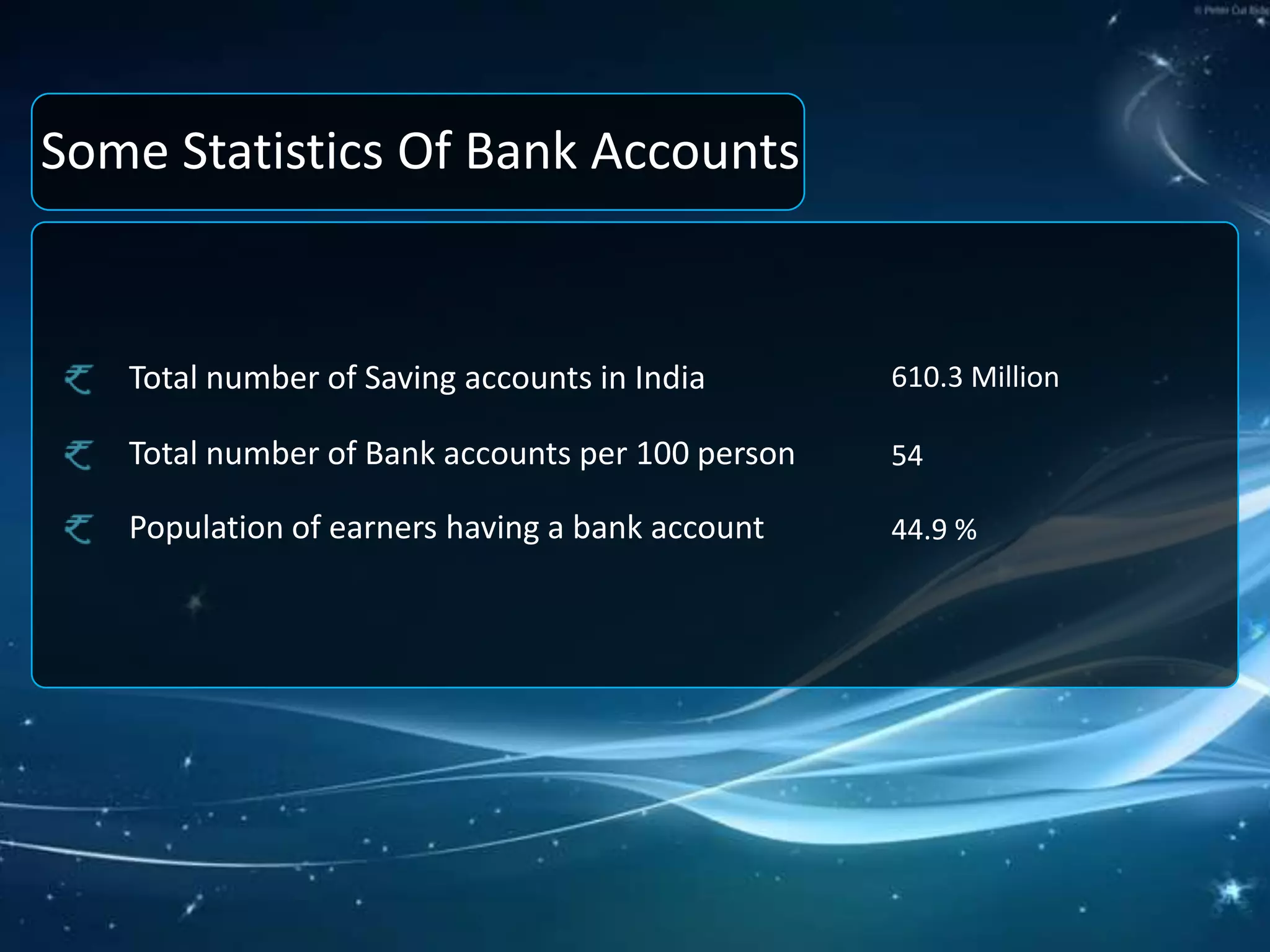

This document provides a summary of key financial terms presented by Group 3. It defines different types of bank accounts including savings accounts, current accounts, DMAT accounts, no frill accounts, and loan accounts. Savings accounts earn interest and have restrictions on transactions, while current accounts are for businesses and allow unlimited transactions but no interest. DMAT accounts are for share trading, and no frill accounts have no additional services but can be opened with zero balance. Loan accounts track amounts borrowed from a bank. Statistics on bank account ownership in India are also presented.