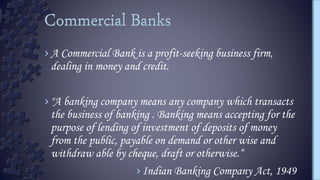

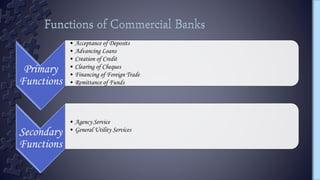

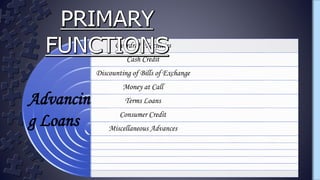

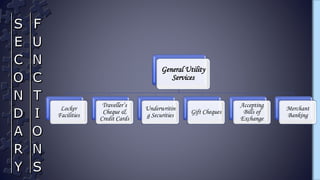

This document discusses the functions of commercial banks. It begins by defining a commercial bank as a profit-seeking business that deals in money and credit by accepting deposits from the public and lending money. It then lists the primary functions of commercial banks as accepting deposits, advancing loans, creating credit, clearing checks, financing foreign trade, and remitting funds. The document also discusses the secondary functions of commercial banks such as providing agency services and general utility services to customers. It provides examples of different types of deposits, loans, and services offered by commercial banks.