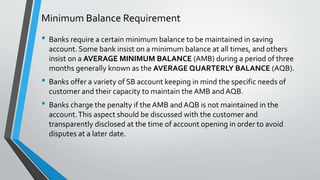

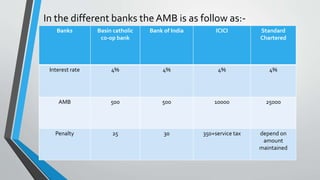

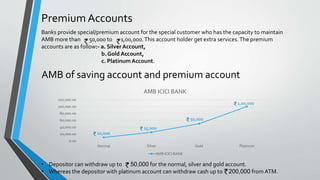

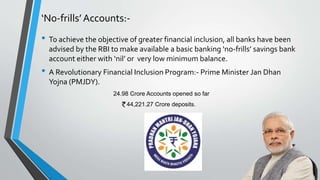

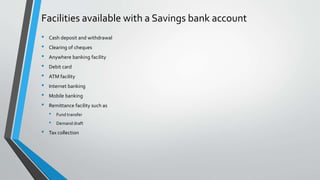

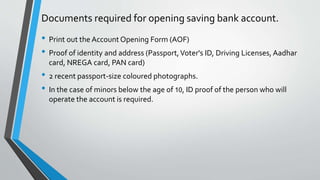

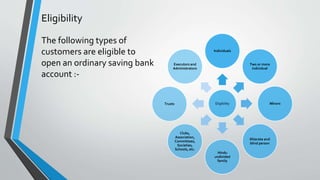

Savings bank accounts can be opened by individuals and certain organizations for saving purposes rather than business activities. Eligible account holders include individuals, HUFs, minors, trusts and associations. Accounts can be single, joint, or held jointly with survivorship rights. Interest rates are set by individual banks within RBI guidelines. Minimum balance requirements and penalties for non-maintenance are specified. Premium accounts offer higher withdrawal limits and services for maintaining higher balances. Documentation required includes proof of identity and address.

![Types of Account Holders:-

• Single/Individual :-A single person can open a account with his or her own name.

• Joint Holders:-A joint account is an account in the name of two or more person.

• Either (or) Survivor:- the most common form of joint account, only two individual can operate the

account i.e. primary and secondary account holder.

• Anyone (or) Survivor:- this is similar to “either or survivor” option.The only difference is, more than two

individual can operate the account.

• Former (or) Survivor:- in this account only primary account holder can access an operate the account till

the time he/she is alive.The secondary account holder can operate the account only after the death of

primary account holder.

• Latter (or) Survivor:- in this account secondary account holder can access an operate the account till the

time he/she is alive.The primary account holder can operate the account only after the death of

secondary account holder.

• Jointly:- In this type of account, all the transaction need to be signed and mandated by all the account

holders. If any of the account holder dies then the account cannot be further operated.

• Jointly (or) Survivor:- It is same as jointly option but the difference is, the survivor can continue to

operate the account.

• Minors:- Minor below 18 years old can open an account jointly with parent/guardian. For

e.g.:- SBI [pehla kadam (any age below 18) and Pehli Udaan (above the age 10)]

• HUF( Hindu Undivided Family)](https://image.slidesharecdn.com/savingaccountv2-161122105425/85/Saving-account-4-320.jpg)