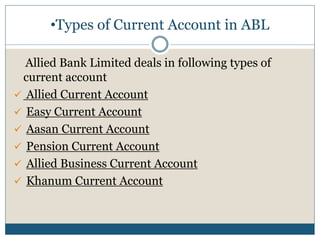

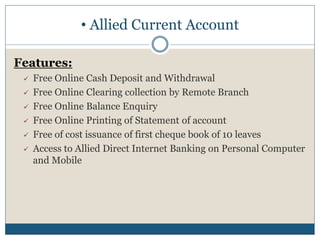

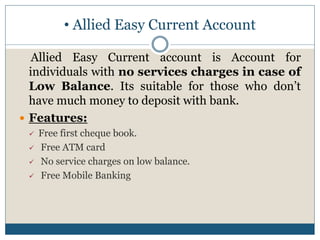

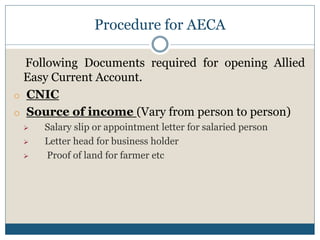

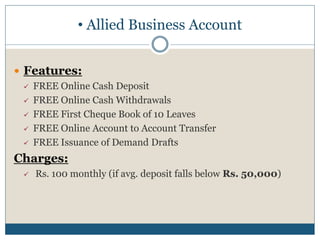

This document discusses various types of current accounts offered by Allied Bank Limited in Pakistan. It provides details on six main types of current accounts: Allied Current Account, Easy Current Account, Aasan Current Account, Pension Current Account, Allied Business Current Account, and Khanum Current Account. For each account type, it outlines the key features and requirements for opening the account. Overall, the document aims to explain the different current account options available to individuals and businesses through Allied Bank Limited.