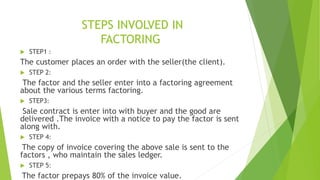

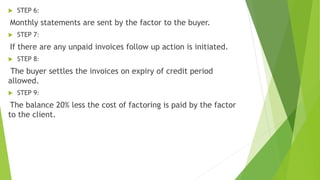

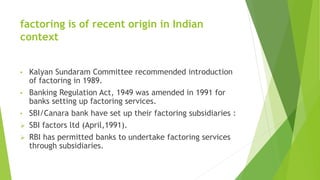

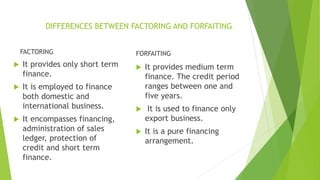

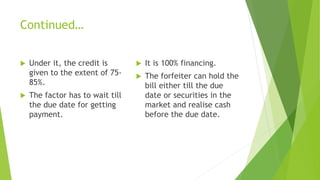

This document provides an overview of factoring presented by Pawan Singh Raikhola. It defines factoring as the financial transaction where a business sells its account receivables to a third party called a factor at a discounted rate. There are typically three parties involved - the factor, client/seller, and buyer/customer. The presentation describes the key features and types of factoring such as full factoring, recourse vs. non-recourse, and domestic vs. international factoring. It also outlines the steps in the factoring process and provides statistics on the factoring industry in India. Forfaiting is discussed as a similar process used to finance export receivables over medium terms of 1-5 years