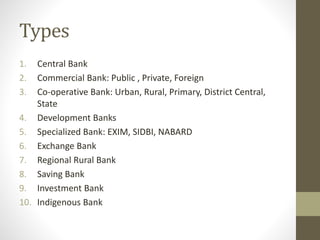

Banking originated around 2000 BC in ancient Mesopotamia where merchants made grain loans, and later in ancient Greece and Rome where temples made loans and accepted deposits; the origins of modern banking can be traced to medieval and Renaissance Italy where wealthy families like the Medicis operated banks; the document then defines banks, outlines their various types and functions including accepting deposits, lending, and more recent electronic banking services.