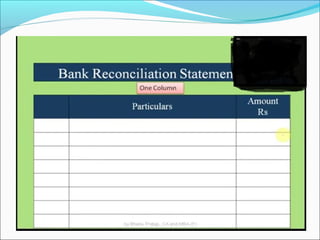

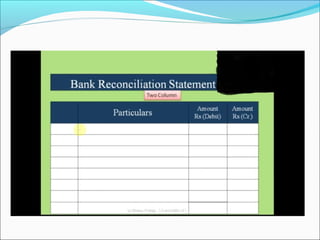

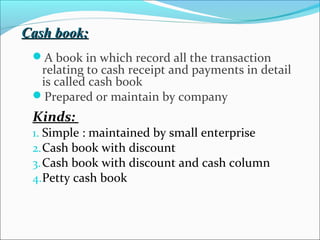

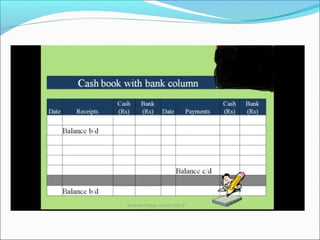

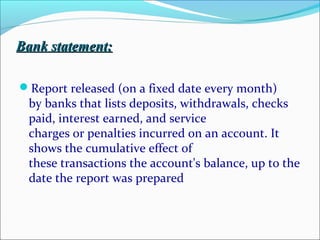

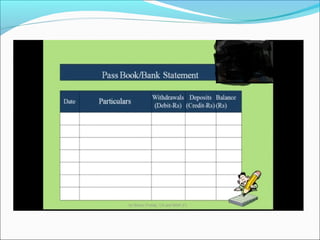

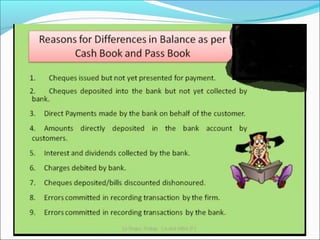

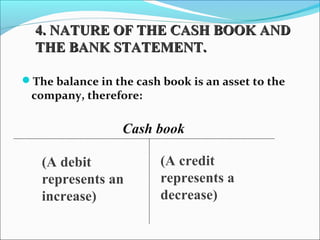

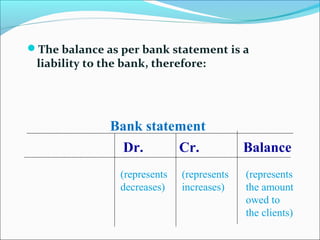

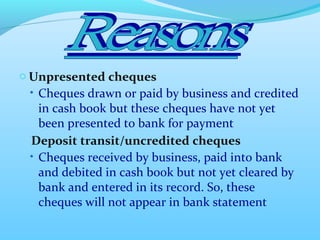

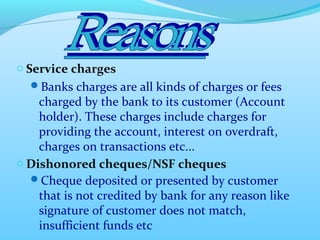

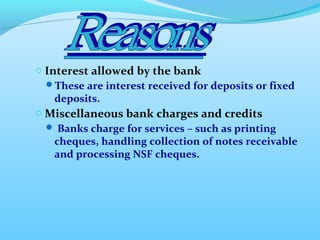

Group 2's bank reconciliation statement topic covers the definition of a bank reconciliation as explaining differences between a cash book and bank statement balances. It defines a cash book as recording all cash receipts and payments, while a bank statement is issued monthly listing transactions and the account balance. Common reconciling items include unpresented cheques, deposit transit cheques, service charges, dishonored cheques, interest allowed, and miscellaneous bank charges and credits.