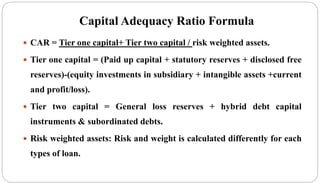

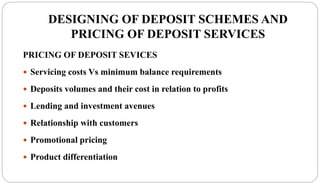

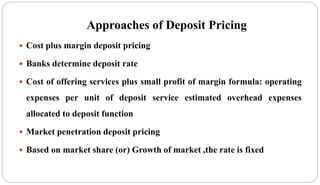

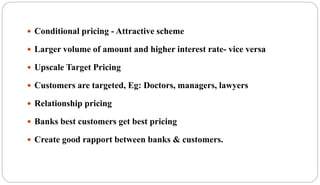

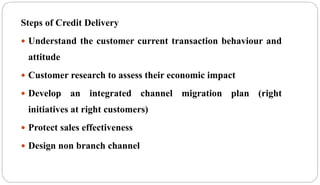

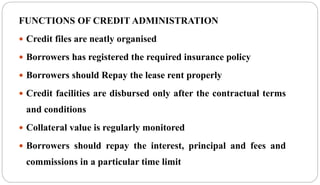

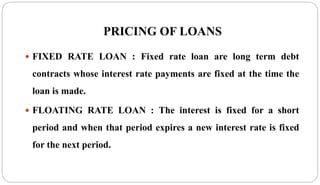

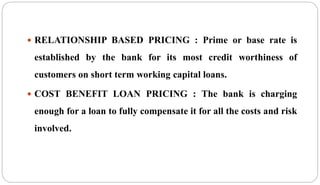

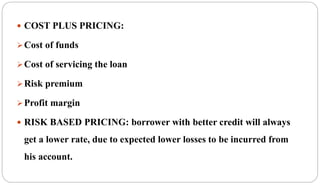

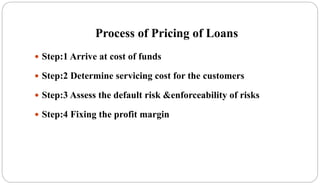

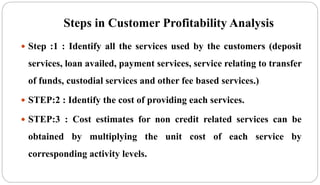

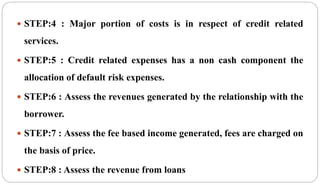

This document provides information on sources and application of bank funds, including capital adequacy, deposits, non-deposit sources, loan types, and credit analysis. It discusses capital adequacy ratios and their calculation. It describes various deposit types including transaction deposits and term deposits. It also outlines non-deposit sources of funds such as certificates of deposit, foreign funds, and money market funds. The document discusses designing deposit schemes, pricing deposits, and applying bank funds through lending and investments. It details various loan types including fund-based, non-fund-based, and asset-based loans. It outlines the major components of a loan policy and the steps involved in credit analysis, delivery, administration, and pricing of loans. It concludes with