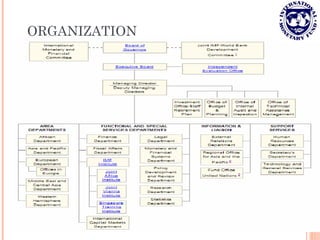

The International Monetary Fund (IMF) is an intergovernmental organization that oversees the global financial system and enforces economic policy on member countries. The IMF aims to stabilize exchange rates and facilitate development through loans and aid that liberalize economies. It monitors members' economic policies and provides short-term loans to help countries address balance of payments issues. The IMF is funded mainly through member quota subscriptions and has about 187 member countries.