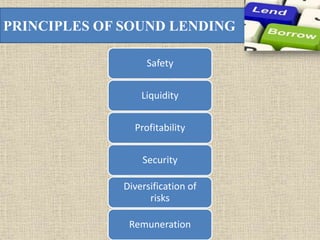

The document discusses various forms of lending provided by banks. It describes cash finance/cash credit, overdrafts, loans, purchase and discounting of bills, and hire-purchase/leasing finance. Cash finance allows borrowing up to a limit as needed, while overdrafts provide temporary adjustments. Loans involve lump sums paid for a period at interest. Purchase and discounting of bills advances money by deducting discount from bill values. Hire-purchase/leasing finance allows purchasing goods through installments. The principles of lending like safety, liquidity, security and diversification of risk are also outlined.