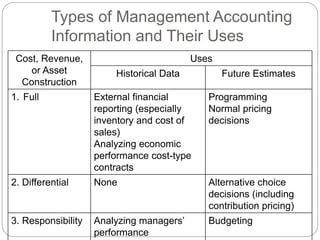

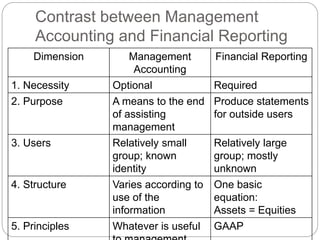

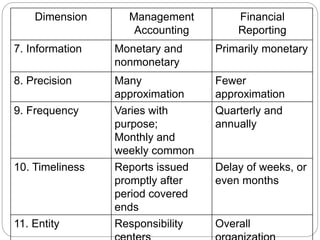

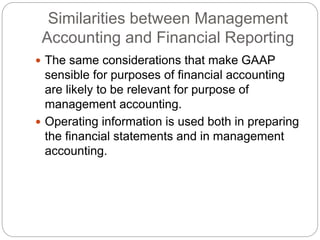

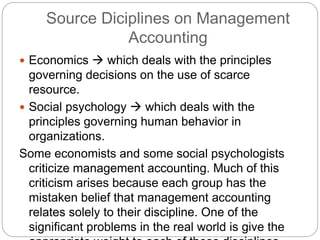

This document provides an overview of key concepts in management accounting. It discusses management accounting as a type of information that helps managers plan, coordinate, and control organizational activities. It contrasts management accounting with financial reporting, noting their different purposes, users, structures, and timeliness. The document also covers measurement of costs, revenues, and assets for control purposes and decision making. It emphasizes that accounting numbers are approximations and that management decisions rely on both quantitative and qualitative factors. People, not just numbers, drive organizational performance.