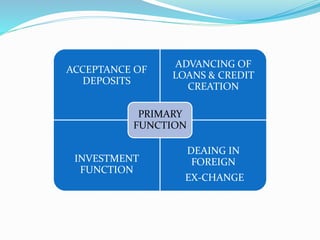

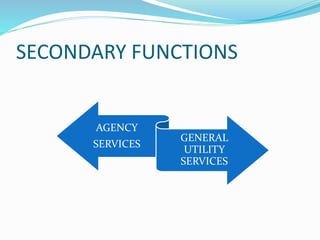

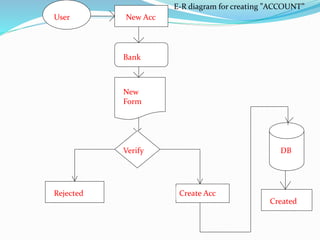

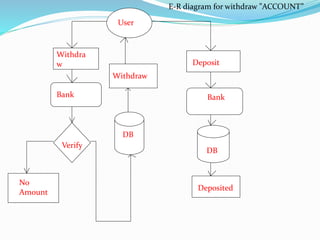

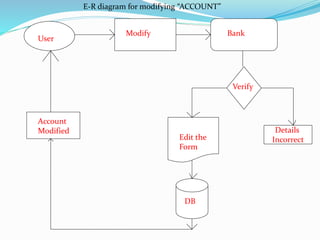

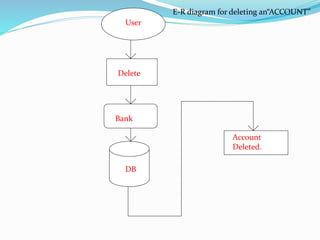

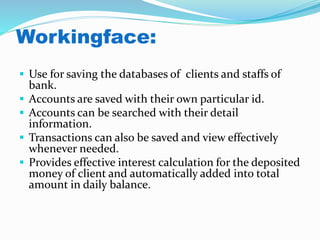

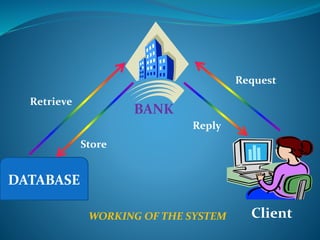

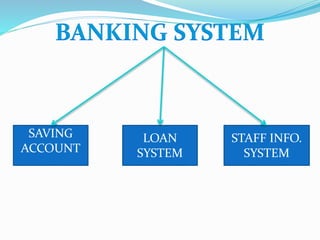

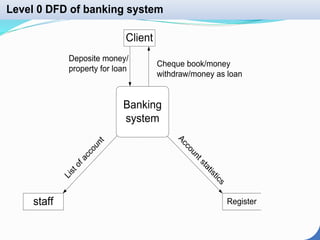

This document provides an overview of banking management software. It defines banking as accepting deposits from the public that are repayable on demand. The primary functions of a bank include accepting deposits, advancing loans and credit, and facilitating investment. The document then describes the user authentication process and includes flow charts demonstrating how the software would allow users to perform tasks like opening a new account, making deposits and withdrawals, and modifying account details. It also provides examples of how the software could store customer and staff data and manage transactions.