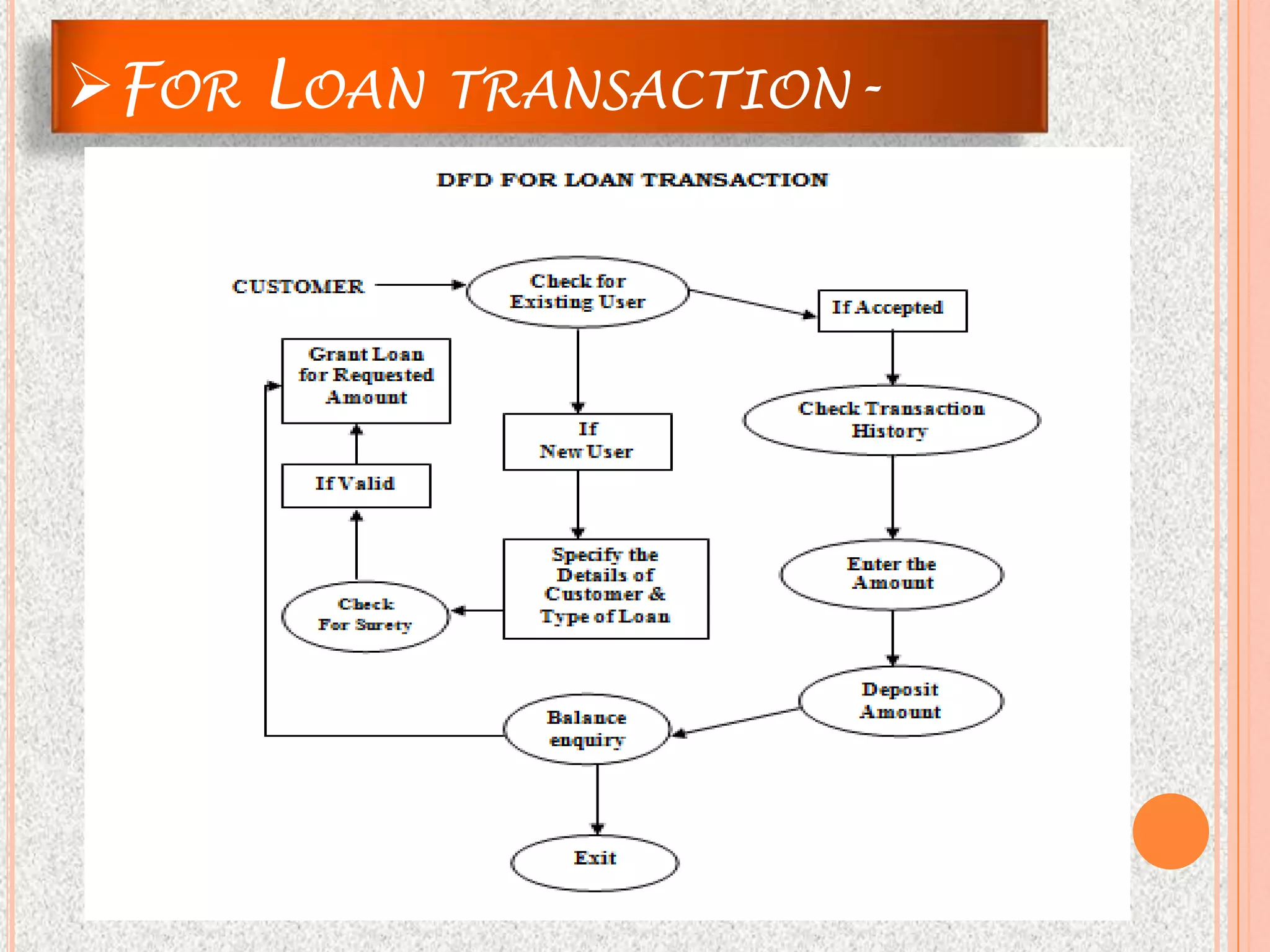

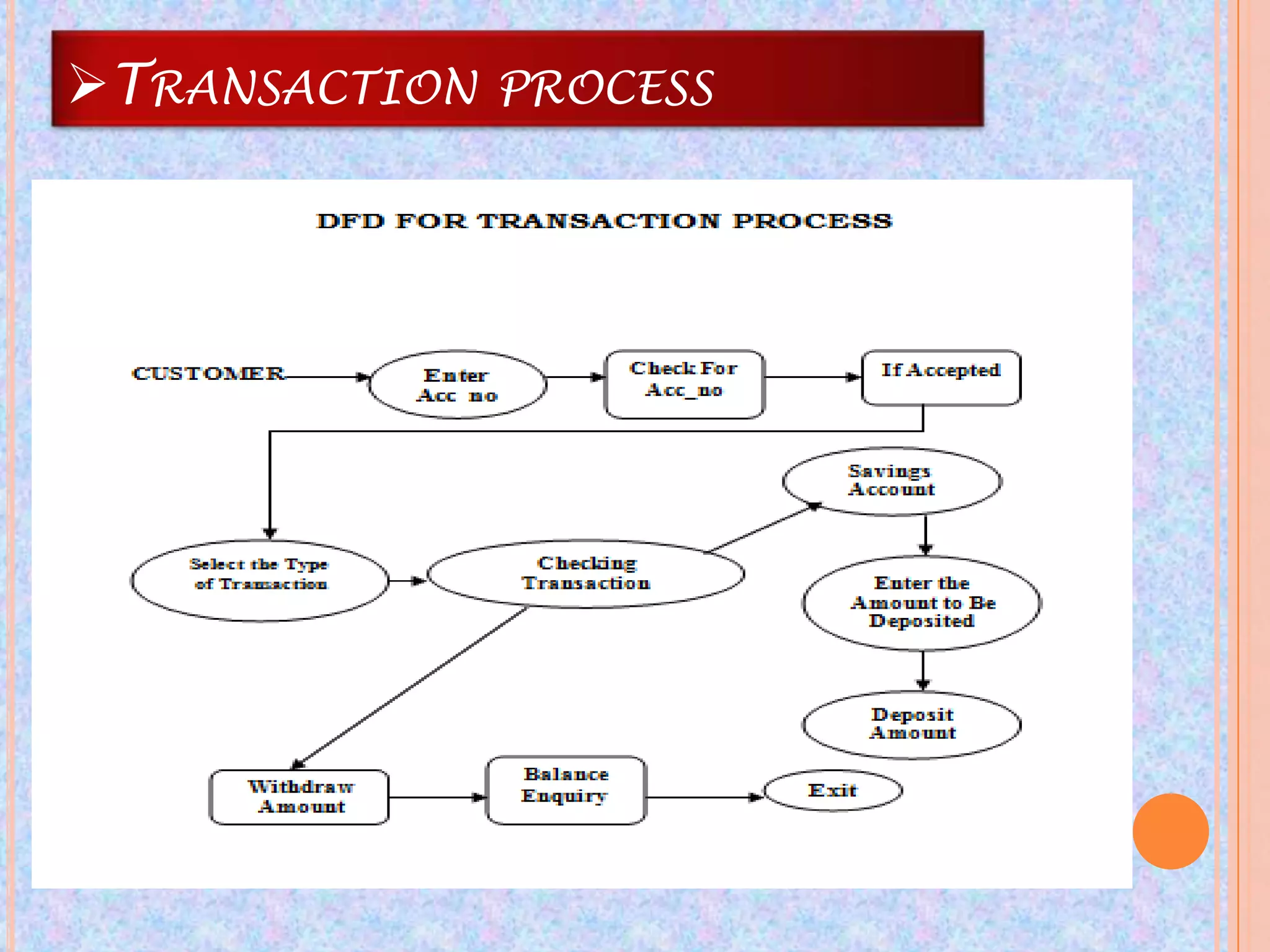

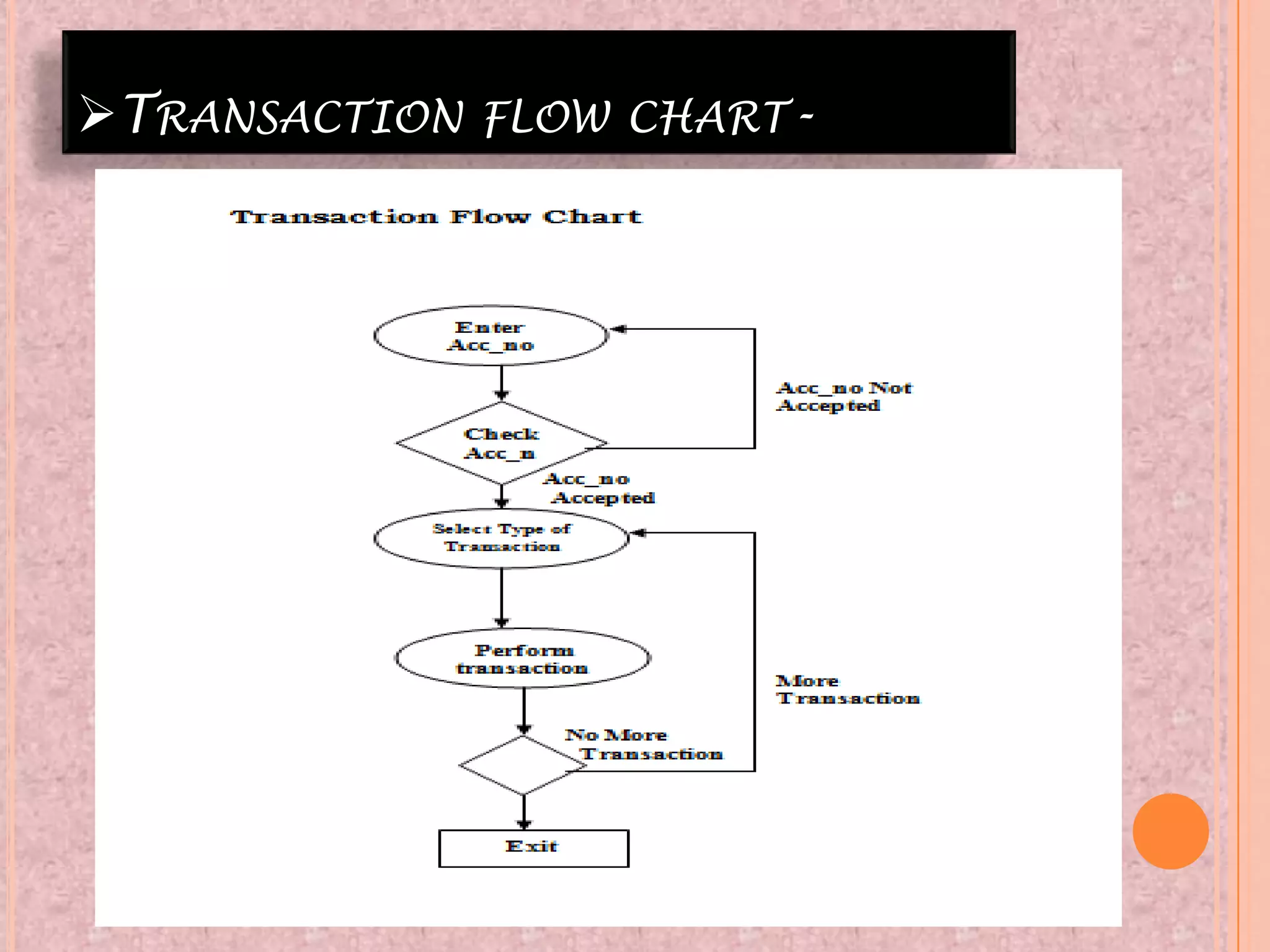

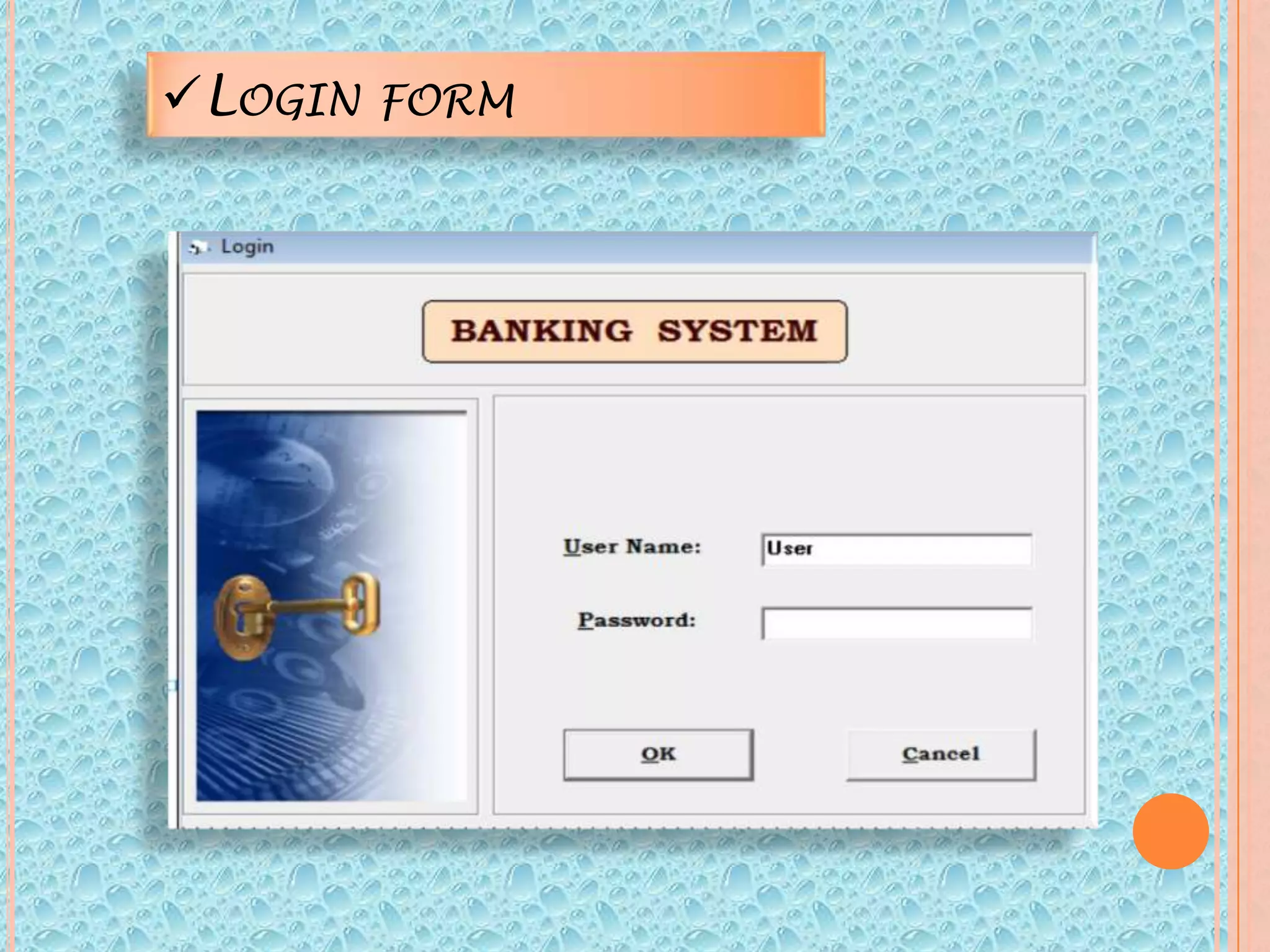

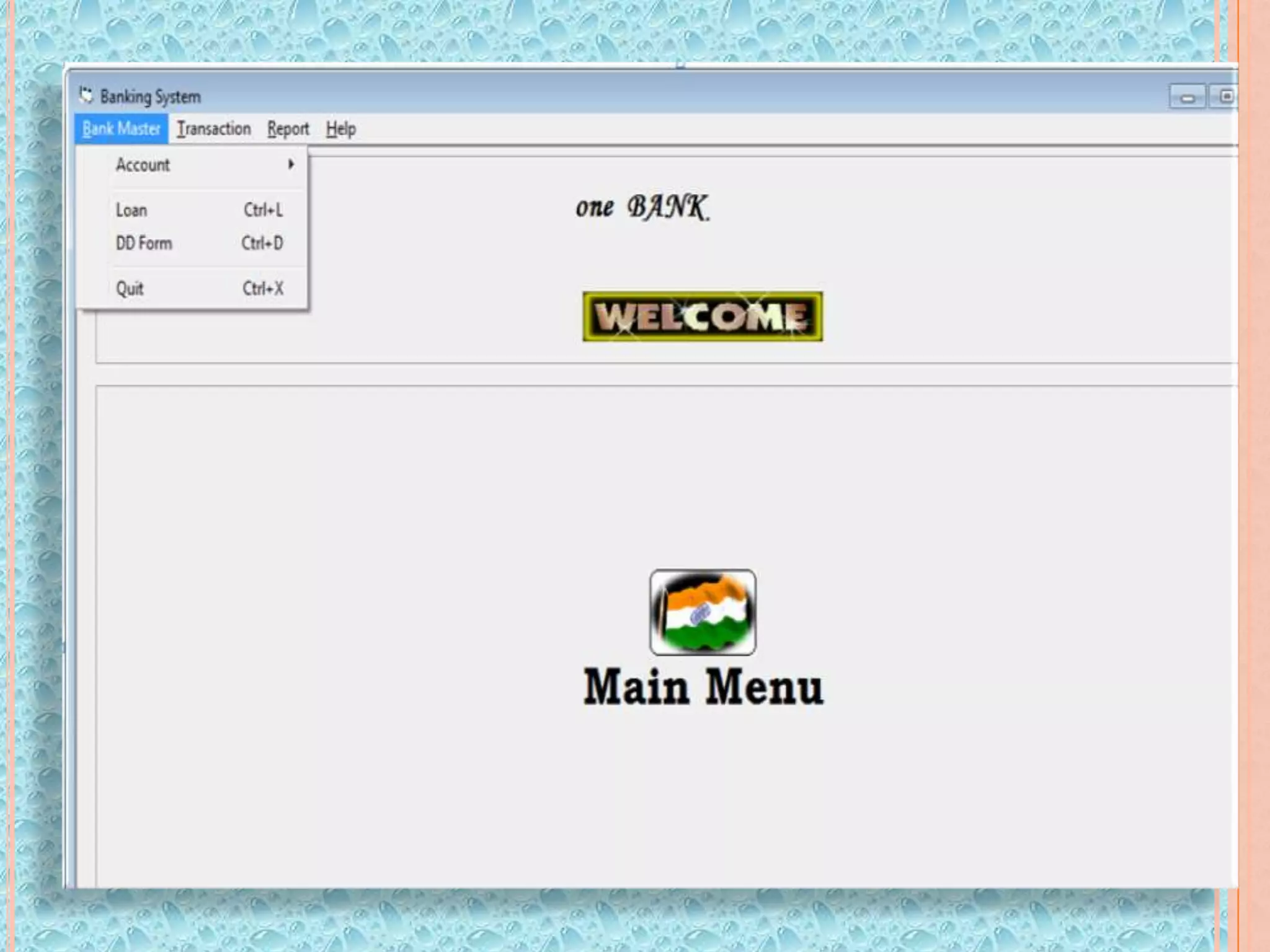

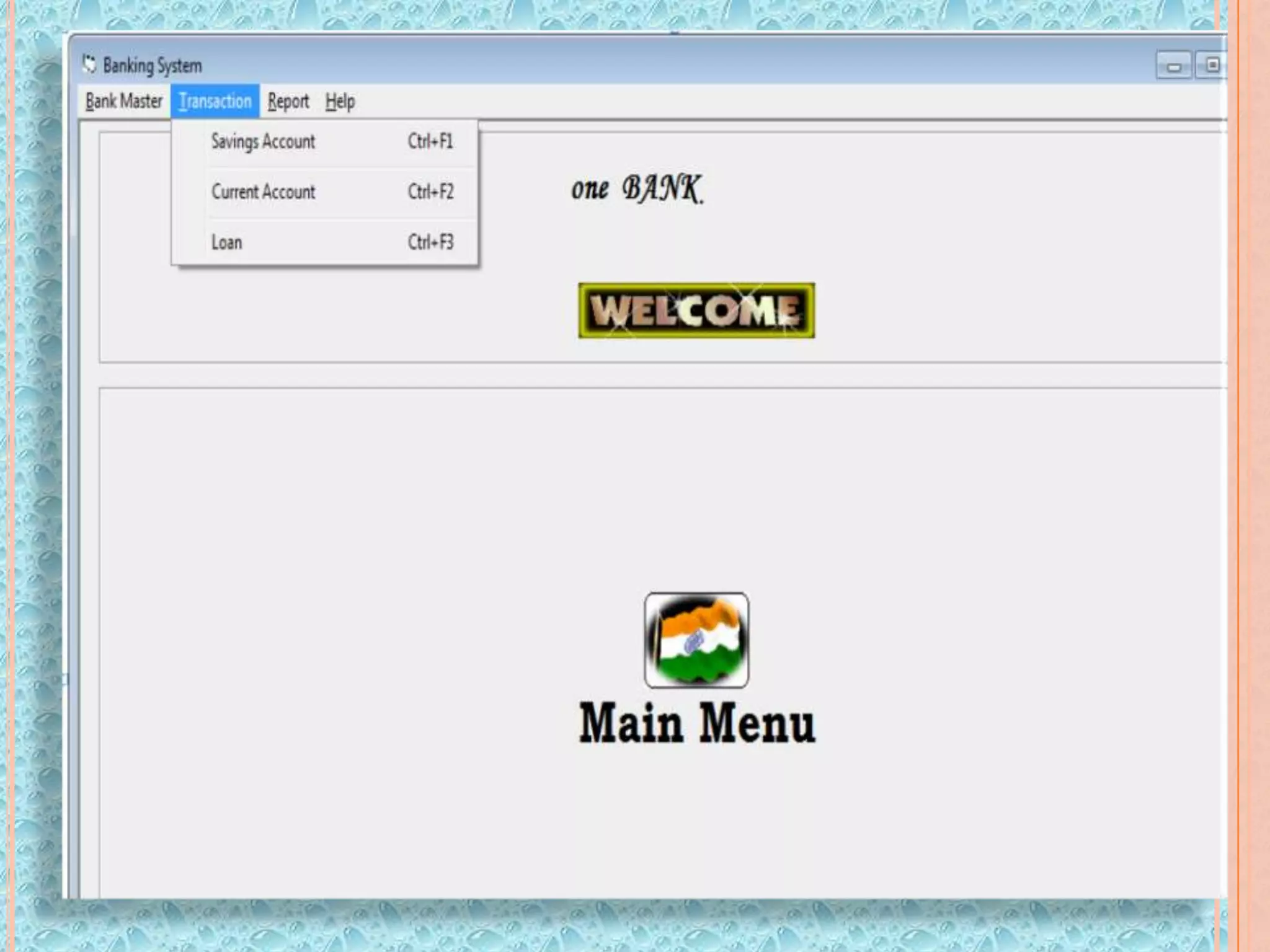

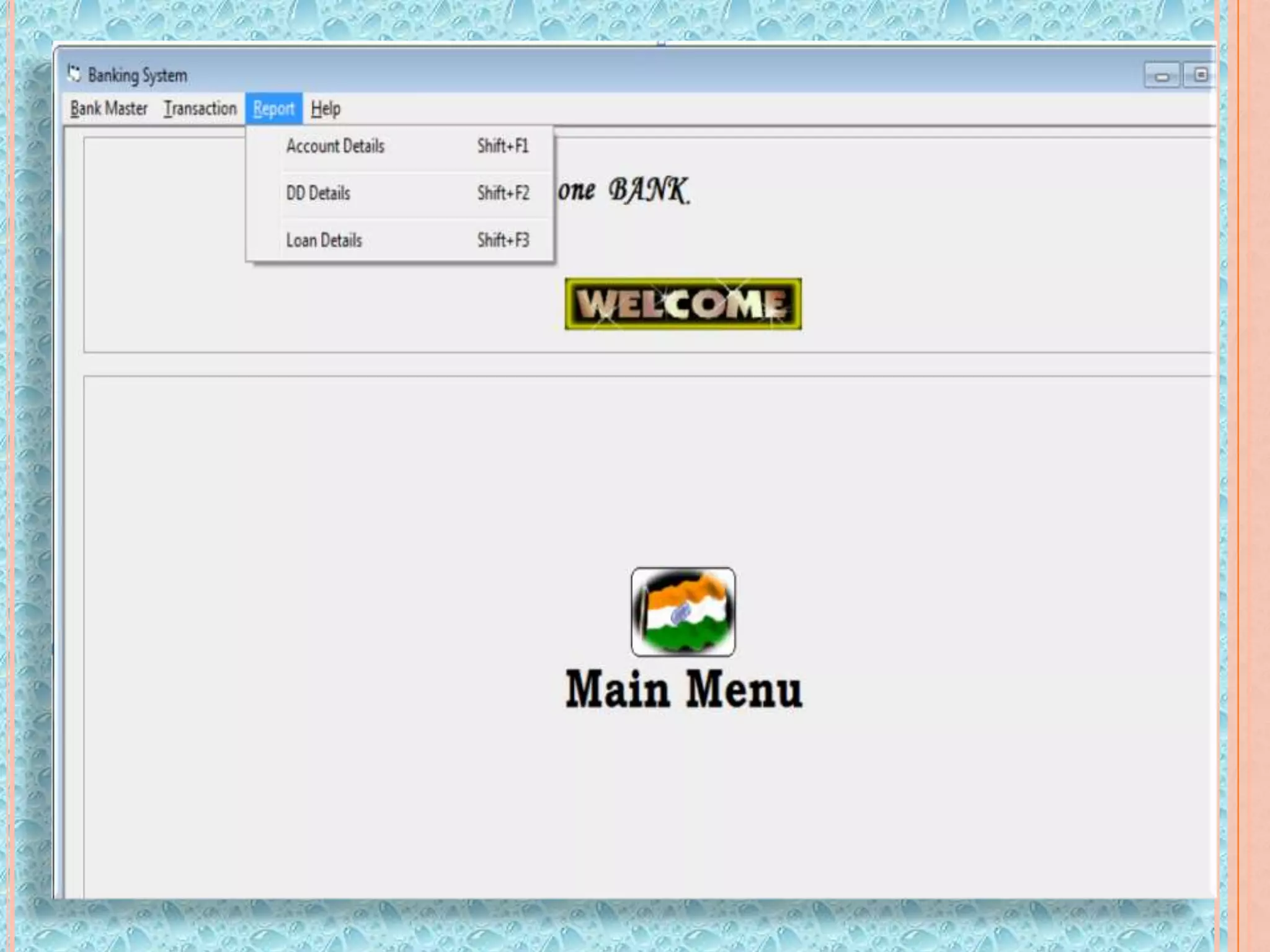

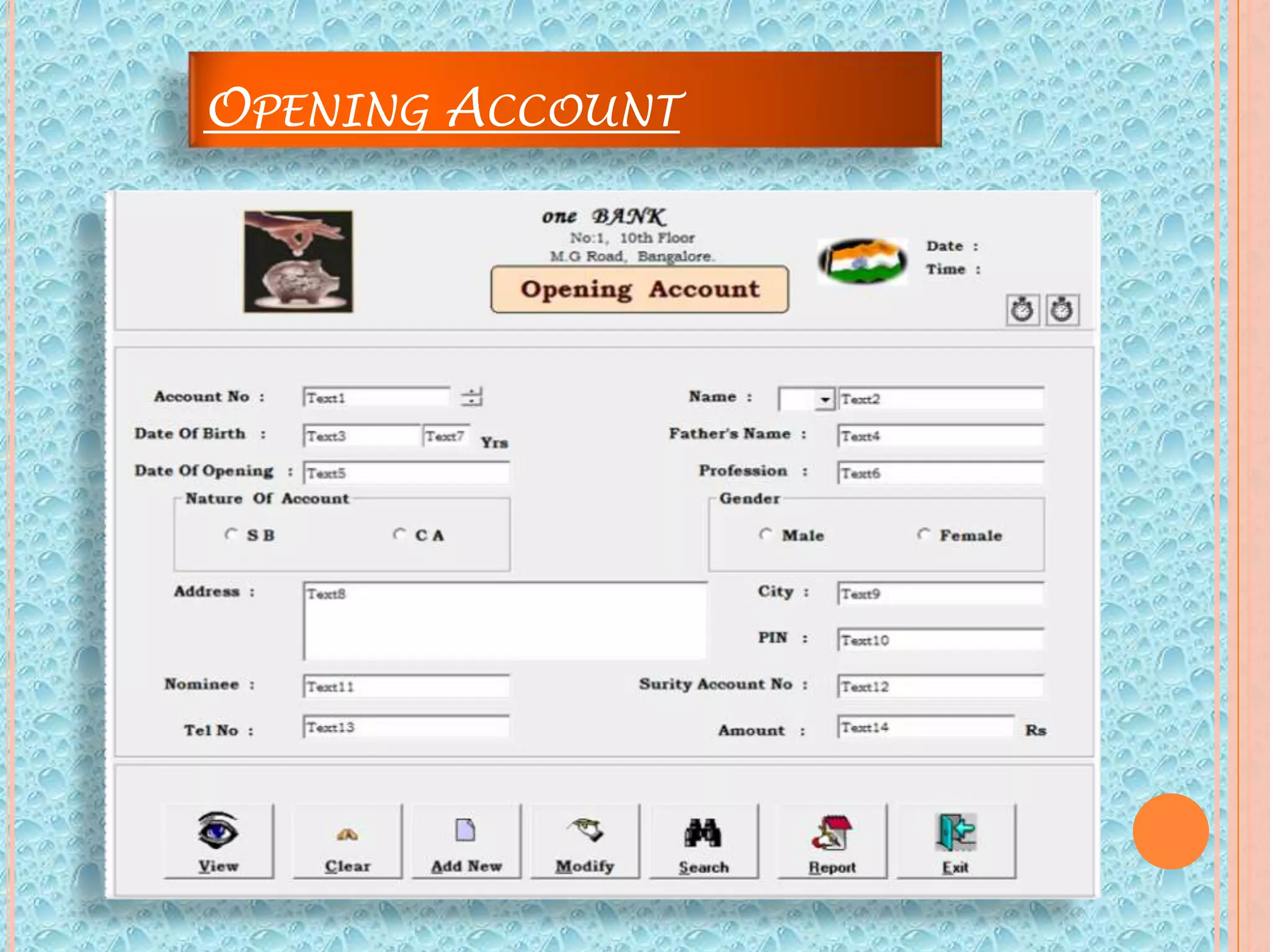

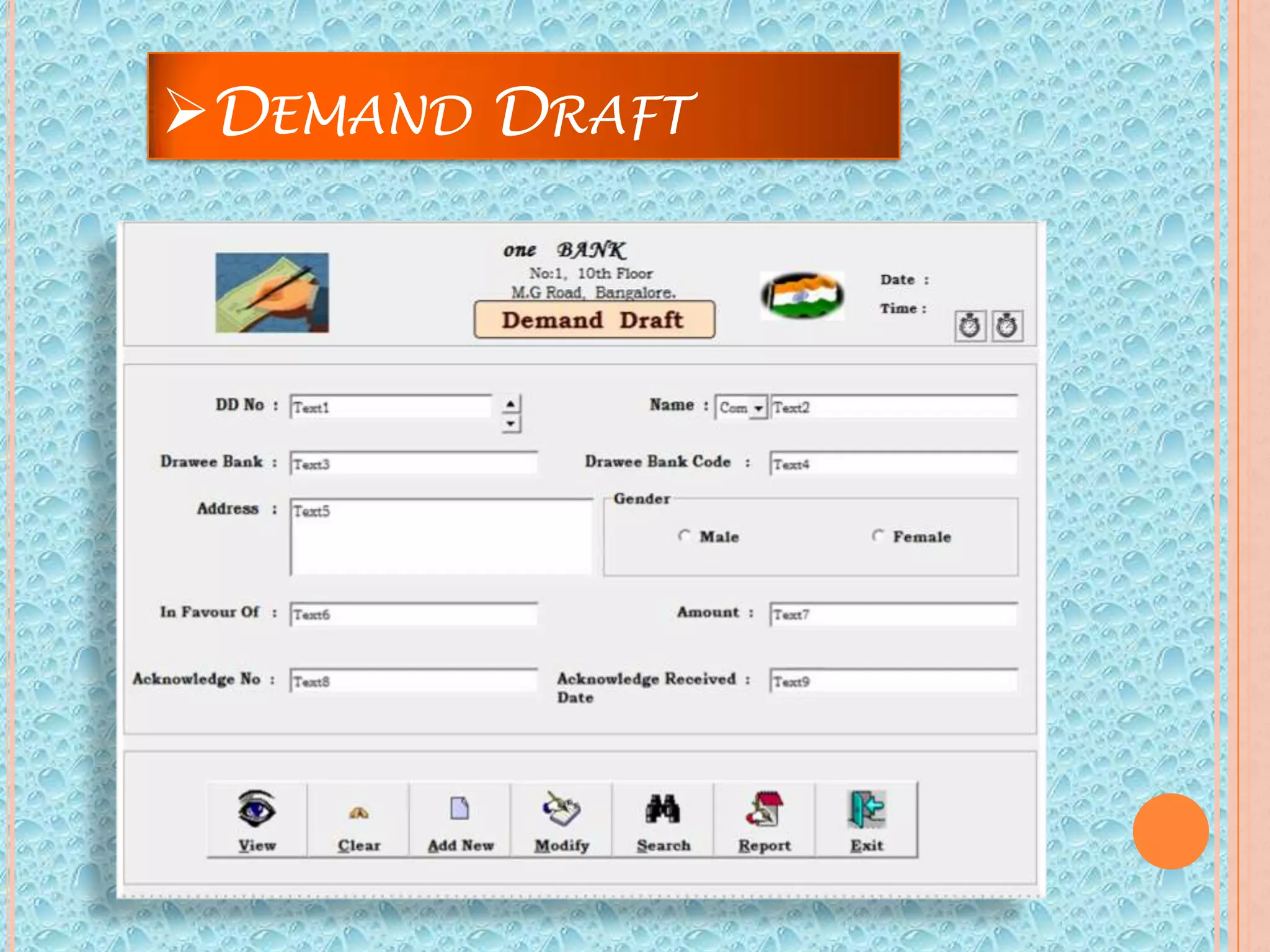

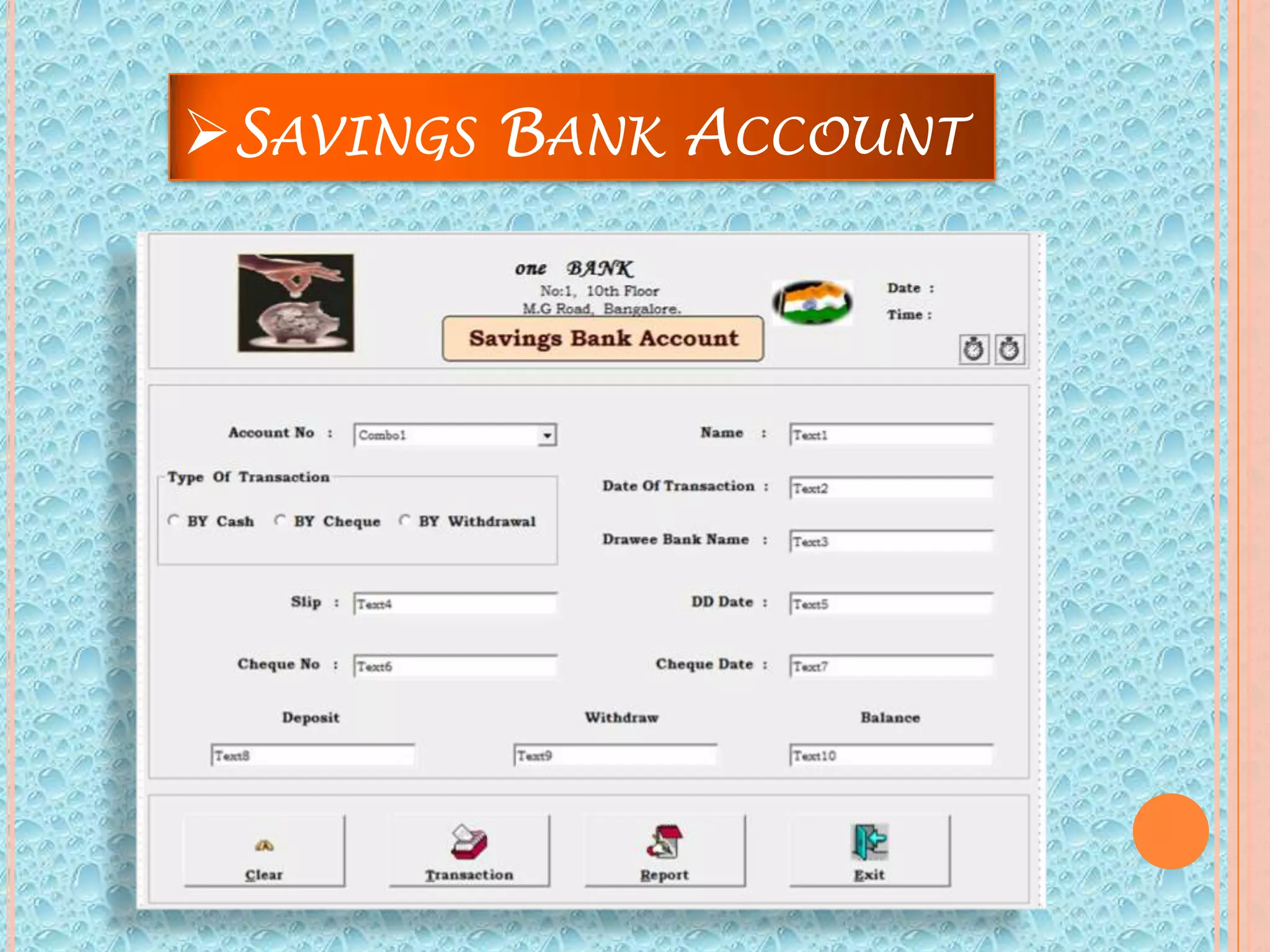

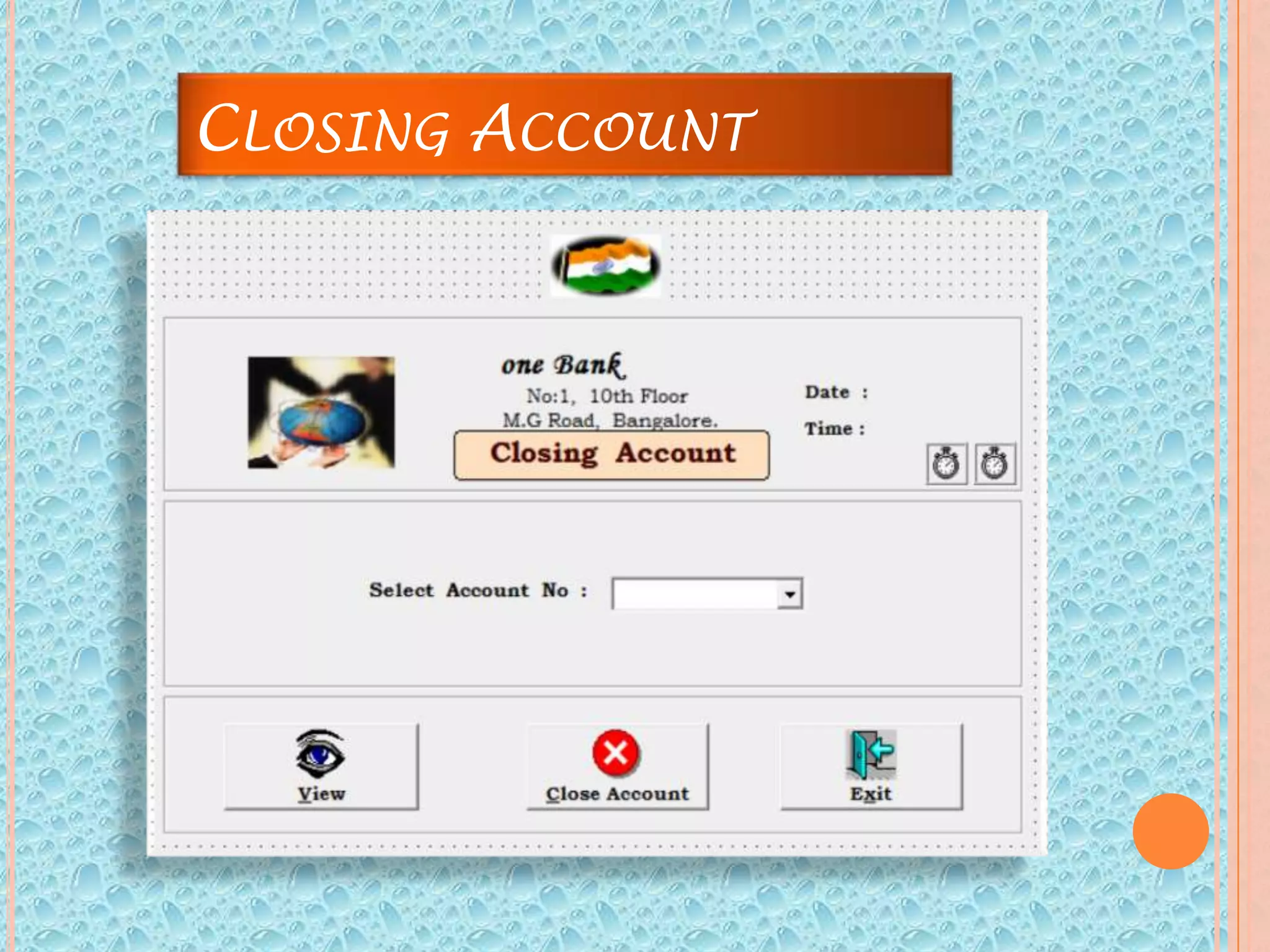

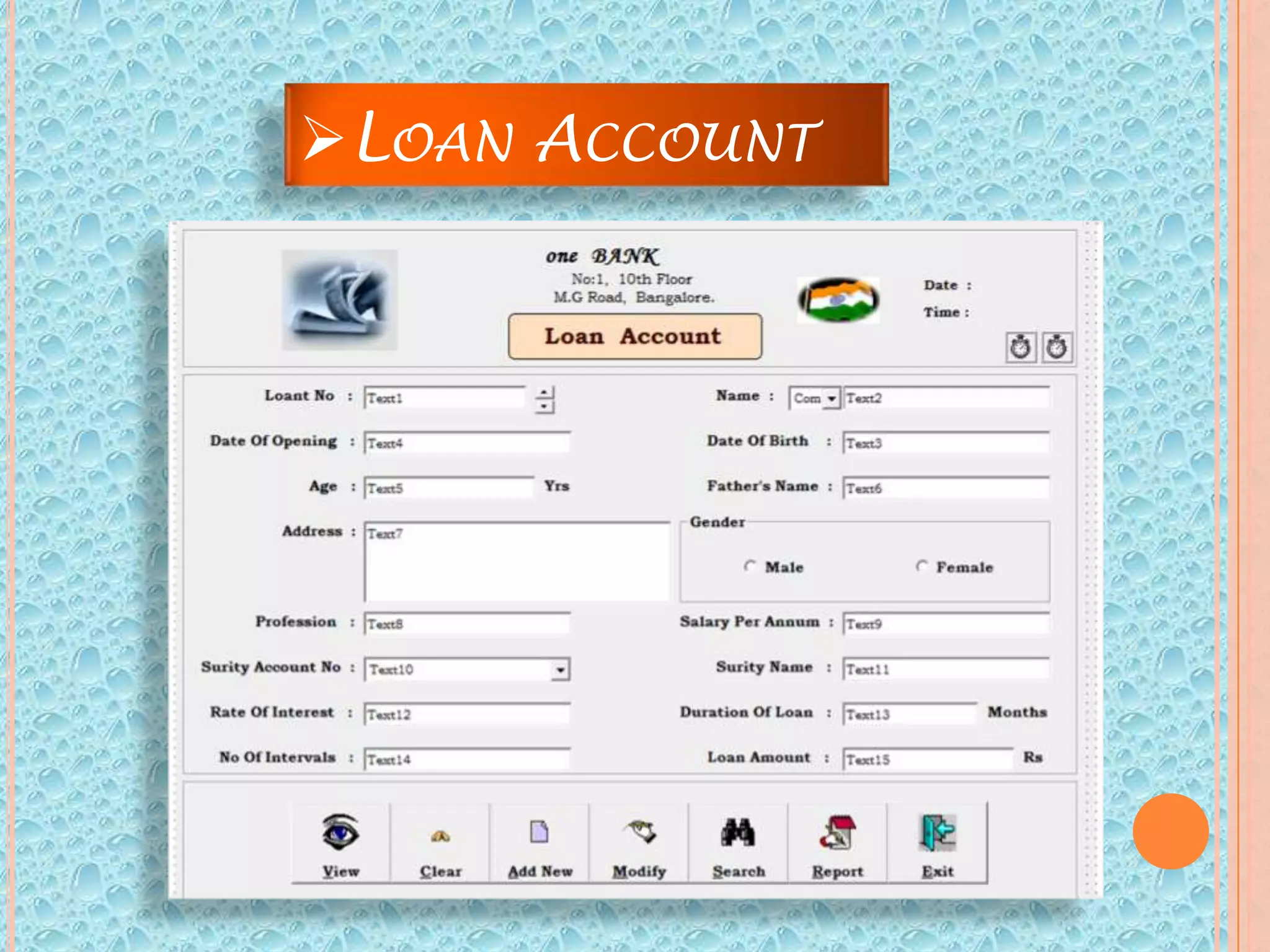

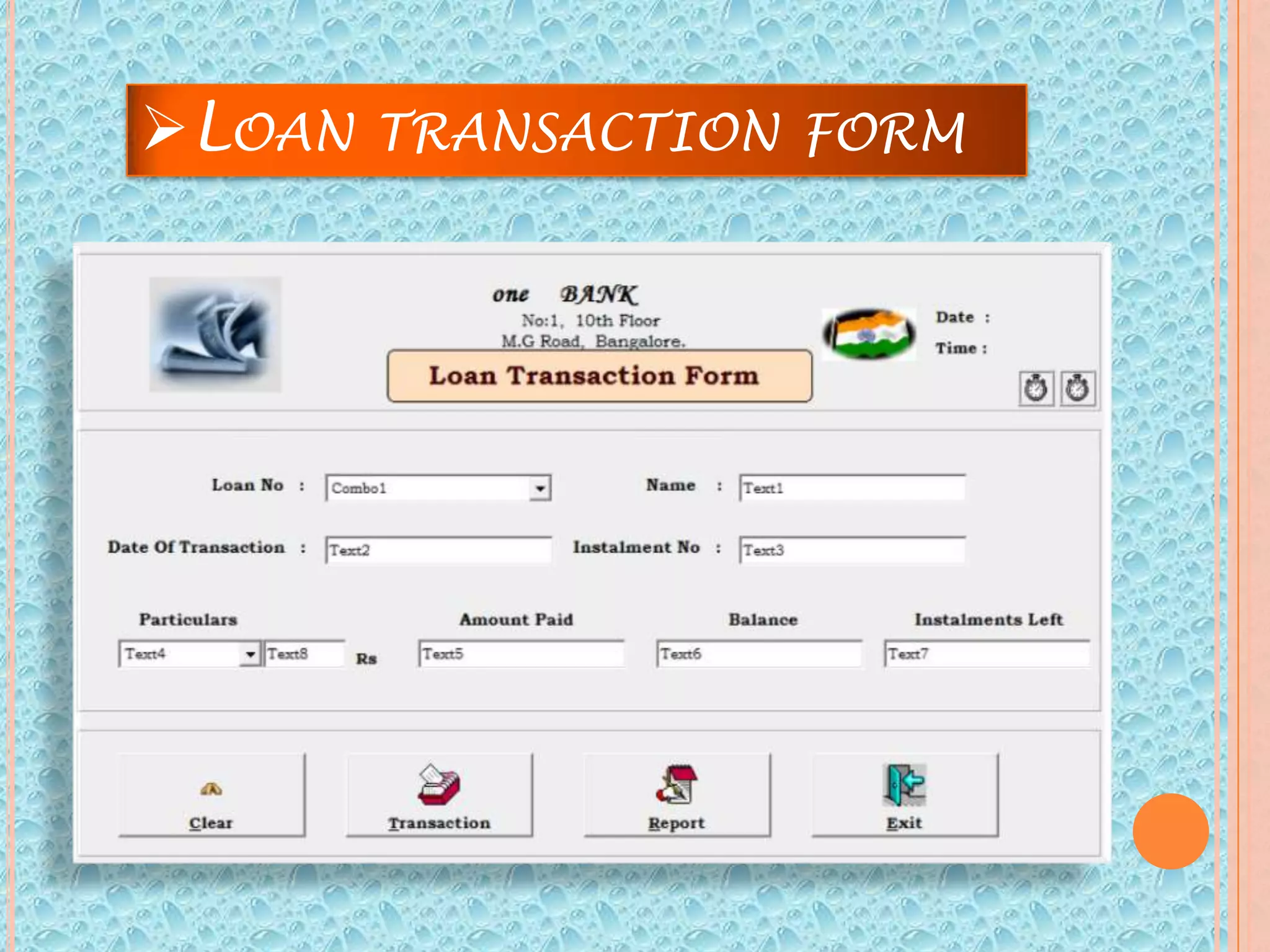

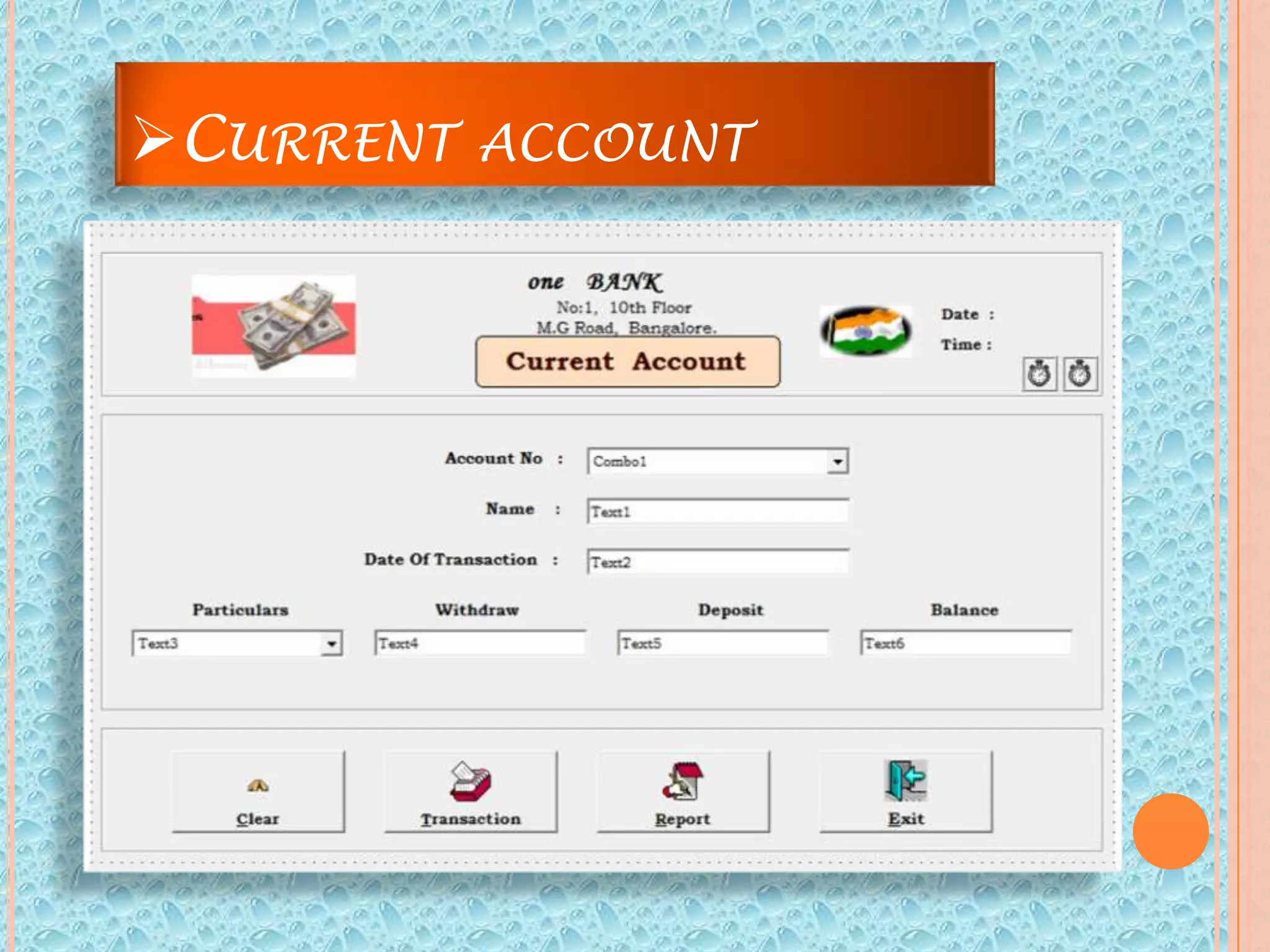

This document summarizes a banking system project. The project uses Visual Basic 6.0 for the front end and MS SQL for the back end. It allows for opening and closing accounts, processing transactions, and generating reports. The system exhibits relational database concepts to connect account details. It provides an efficient, reliable, and user-friendly alternative to previous systems with reduced possibility of data loss. Functions include login, main menu, account opening/closing, demand drafts, savings accounts, loans, current accounts, and future enhancements.