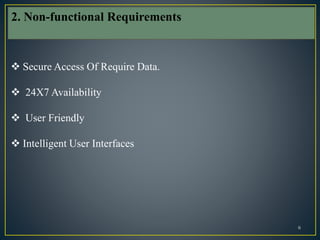

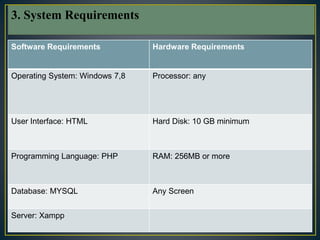

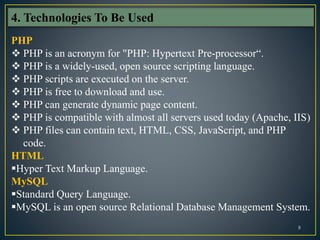

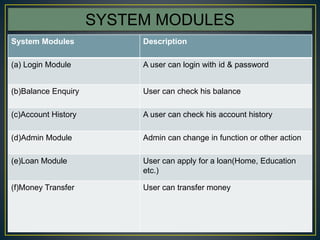

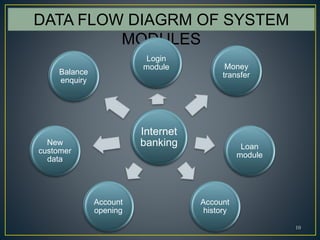

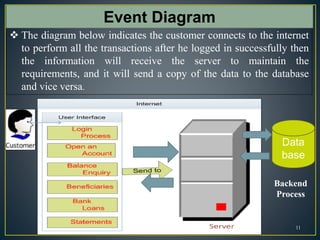

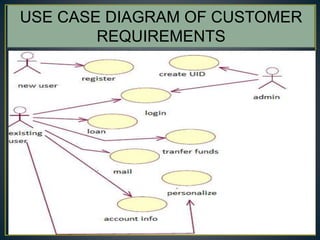

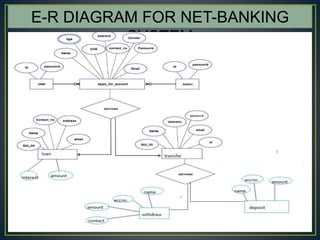

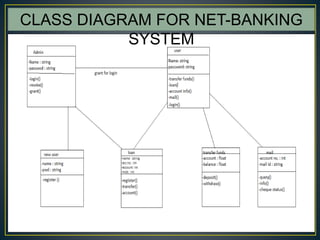

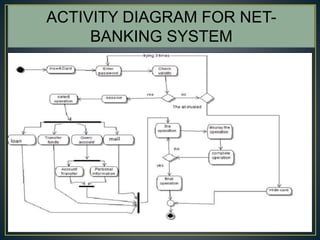

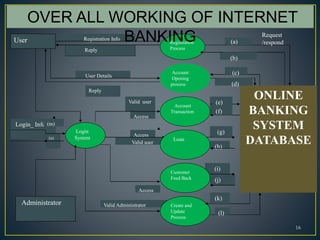

The document outlines the development of a net-banking system that allows bank customers to access their accounts online securely. It details project requirements, system modules, user interface specifications, and the technology used, including PHP and MySQL. The implementation aims to enhance convenience while discussing both advantages and disadvantages of the system.