The document describes an online banking system with the following modules:

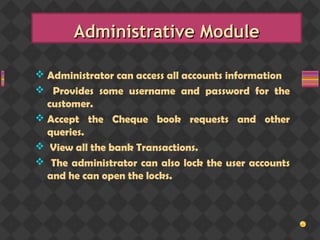

- Administrative module for administrators to access accounts, provide credentials, accept requests.

- Customer module for customers to transfer funds, access accounts, send requests.

- Transaction module containing transaction details.

- Security and authentication module for verifying users.

- Reports module for generating reports.

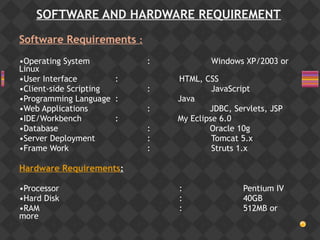

It discusses advantages like cost, speed but also issues like security, learning difficulties. Hardware requirements include a PC and software requirements include Windows, Java, databases.