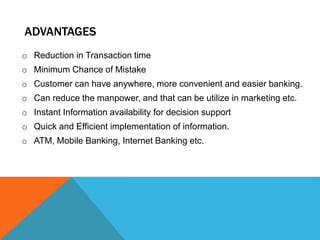

Computers are widely used in banks to help staff operate more efficiently and effectively. They track transactions, process customer information, and allow banks to offer good customer service daily. Key computer applications used in banks include automated teller machines (ATMs), cash deposit machines, mobile banking, internet banking, and core banking systems. These applications provide customers with convenient access to their accounts and allow banks to save time and costs.