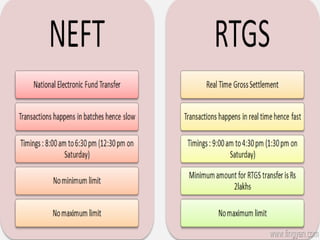

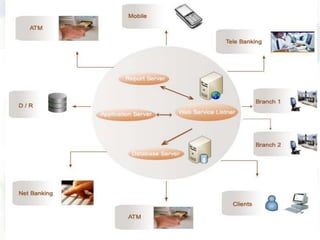

The document discusses the evolution of e-banking and various technologies used in the banking sector. It describes traditional banking services and the emergence of electronic delivery channels like ATMs, debit/credit cards, internet banking, mobile banking, RTGS and NEFT systems. While e-banking provides benefits like convenience, speed and lower costs, security issues remain a challenge. Both banks and customers must take steps to reduce security threats in order to increase popularity of e-banking.