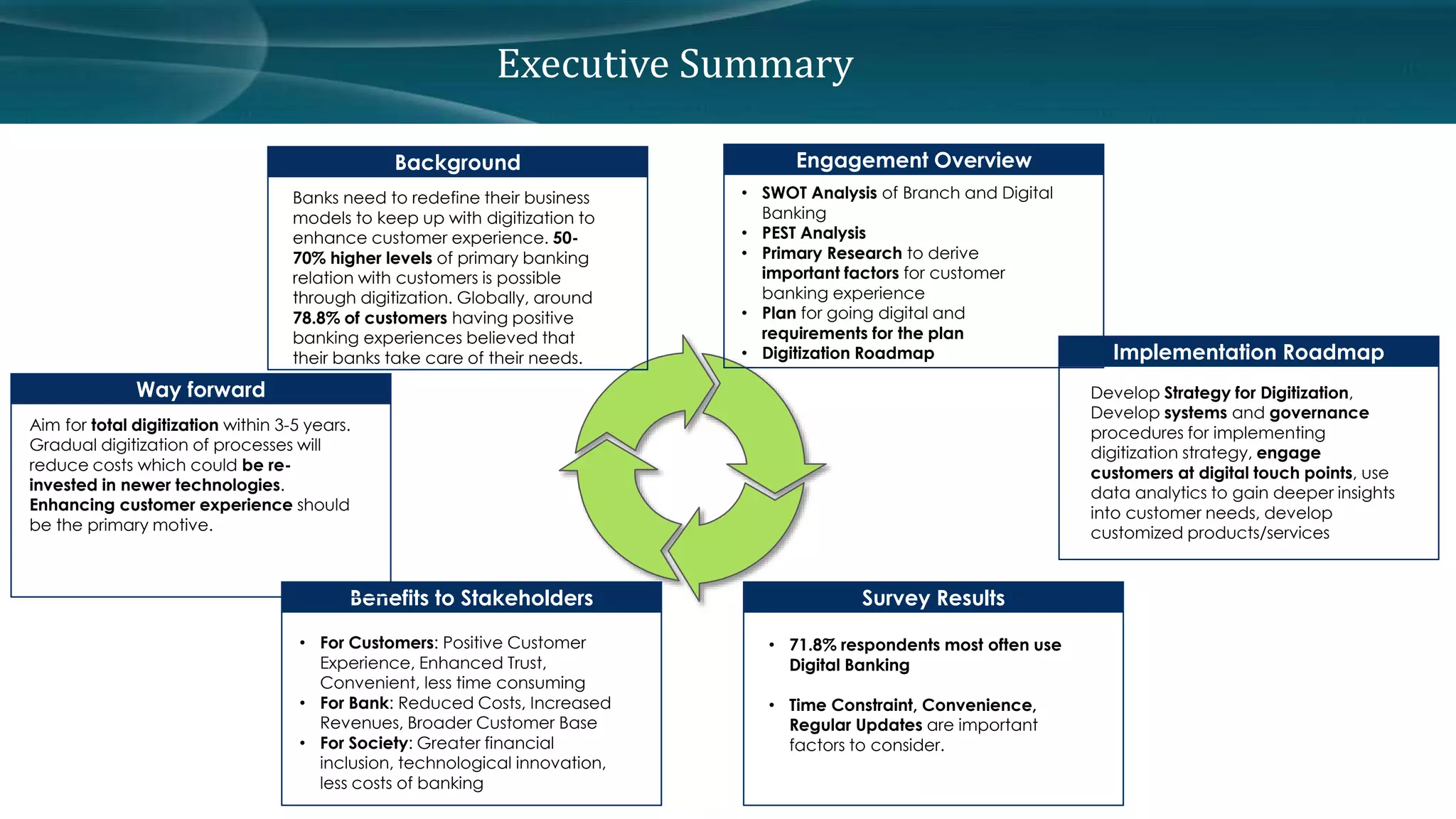

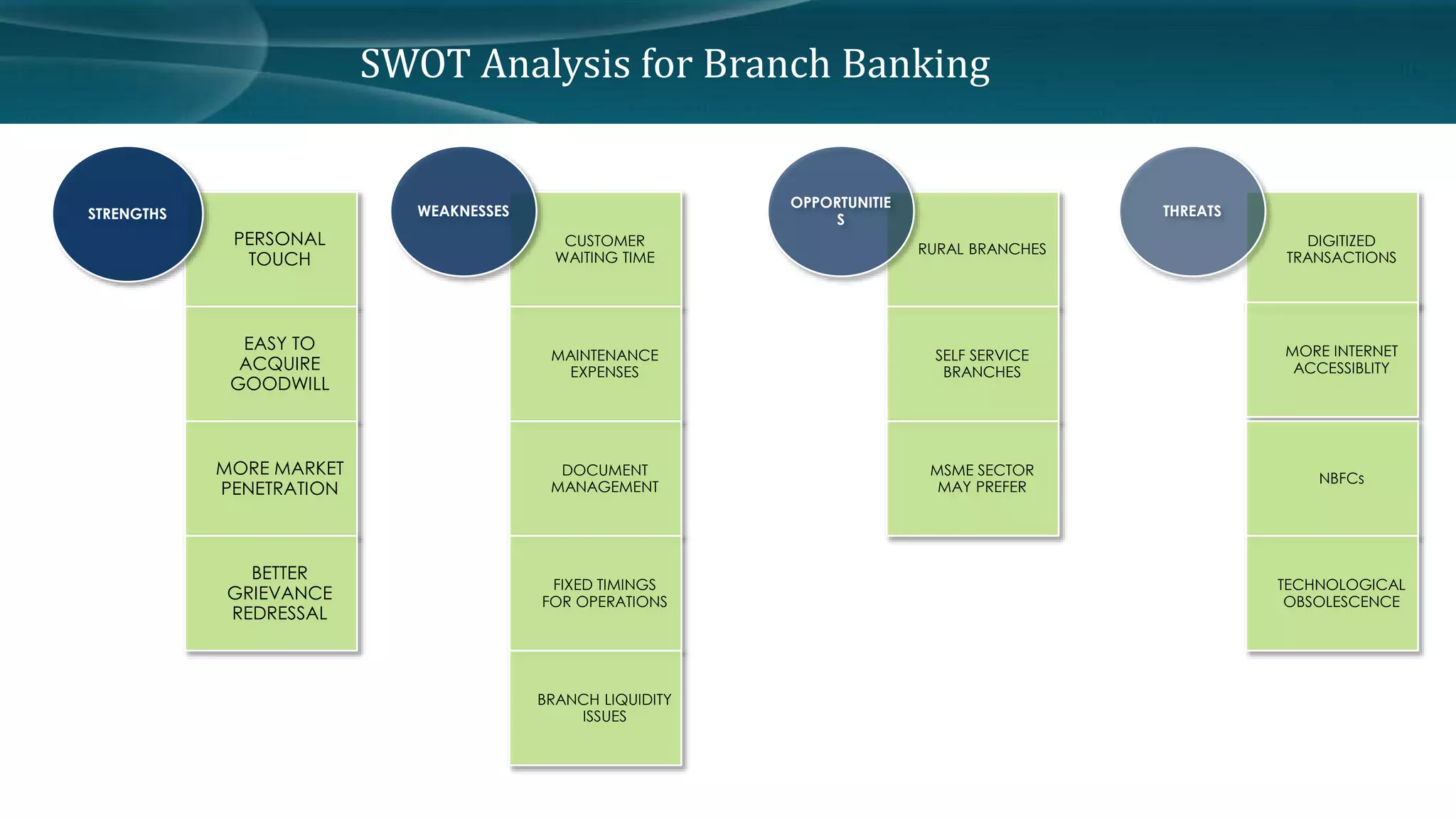

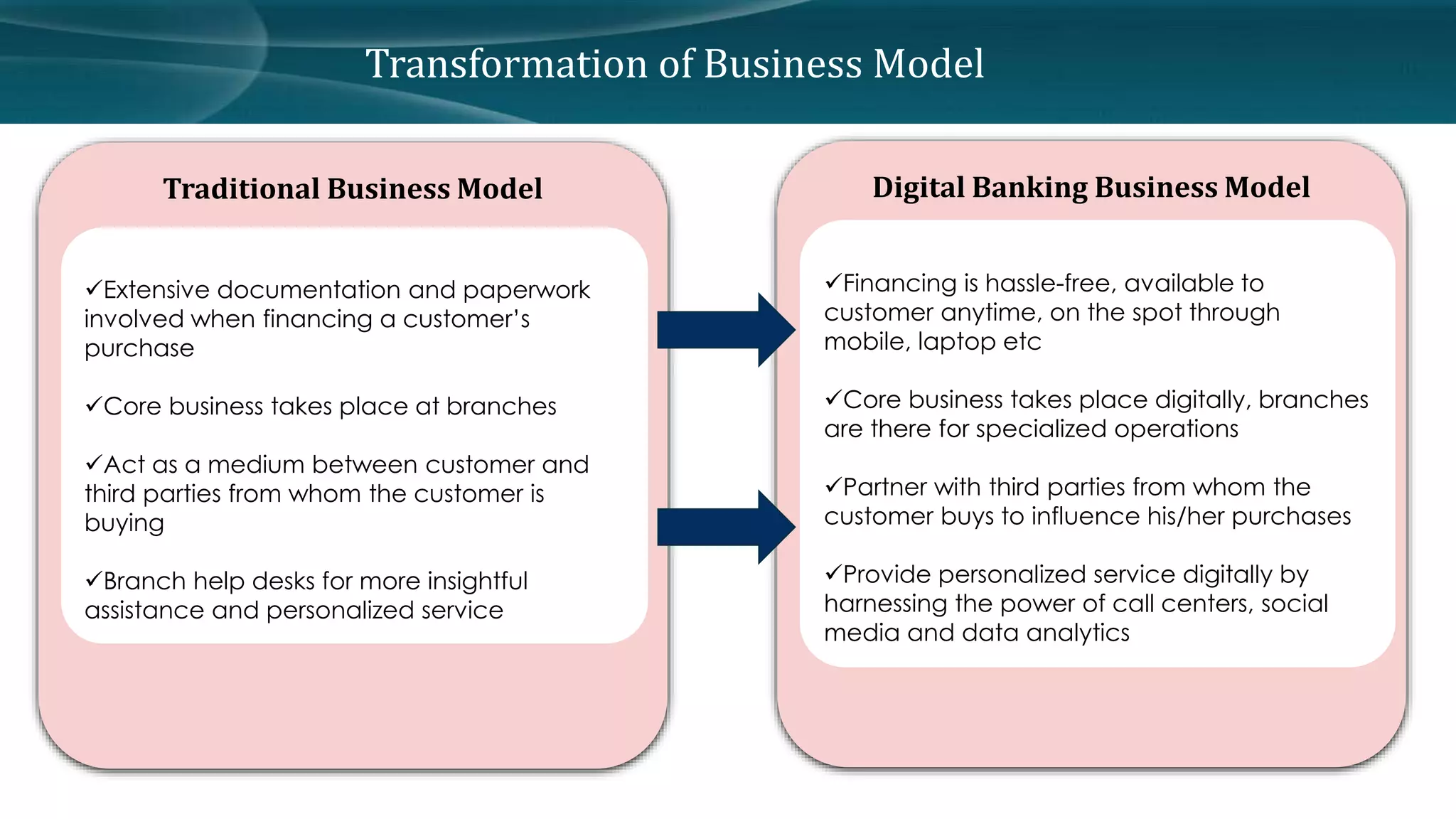

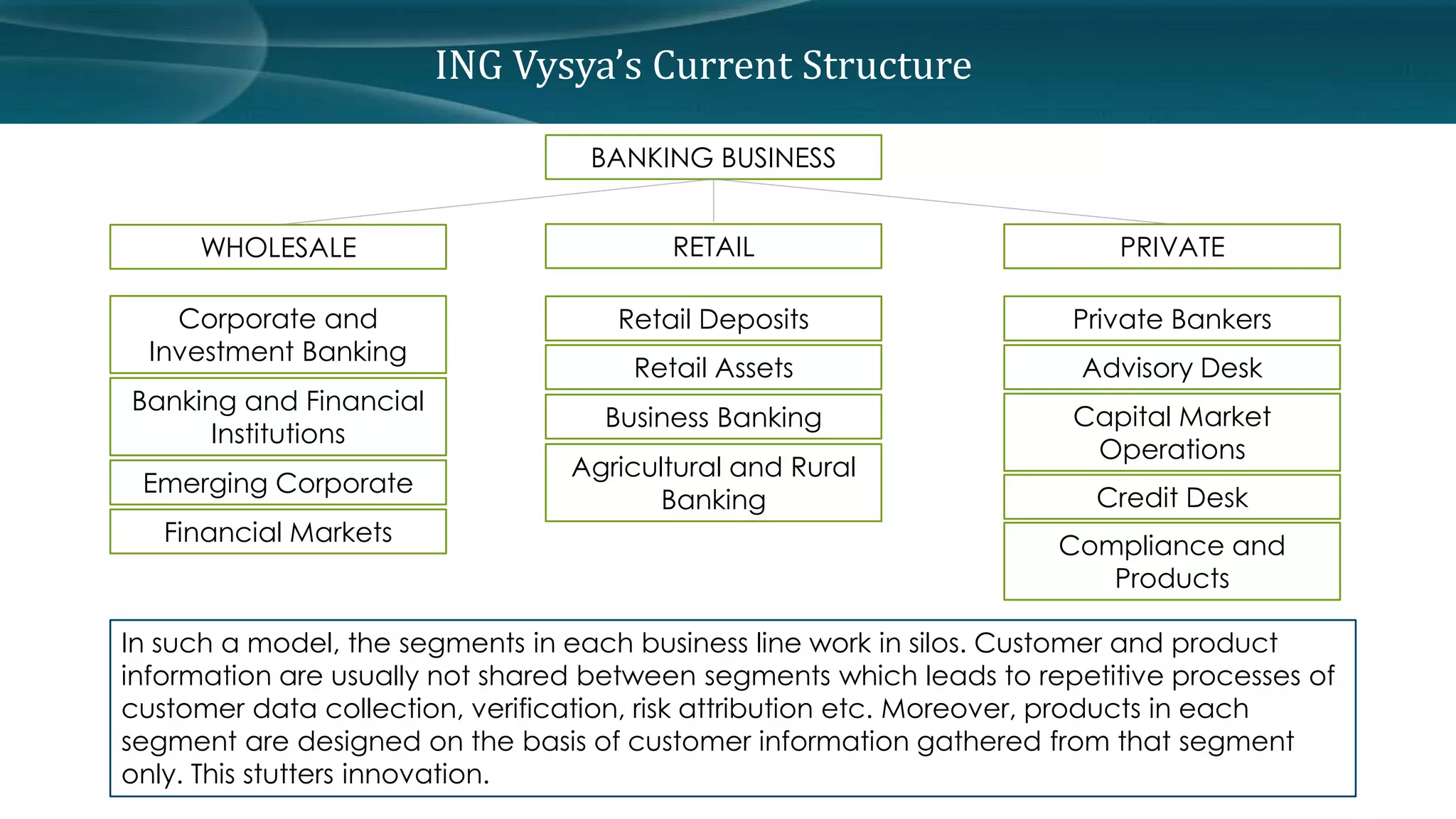

- The document discusses recommendations for digitizing banking services based on a comparative study of digital and branch banking.

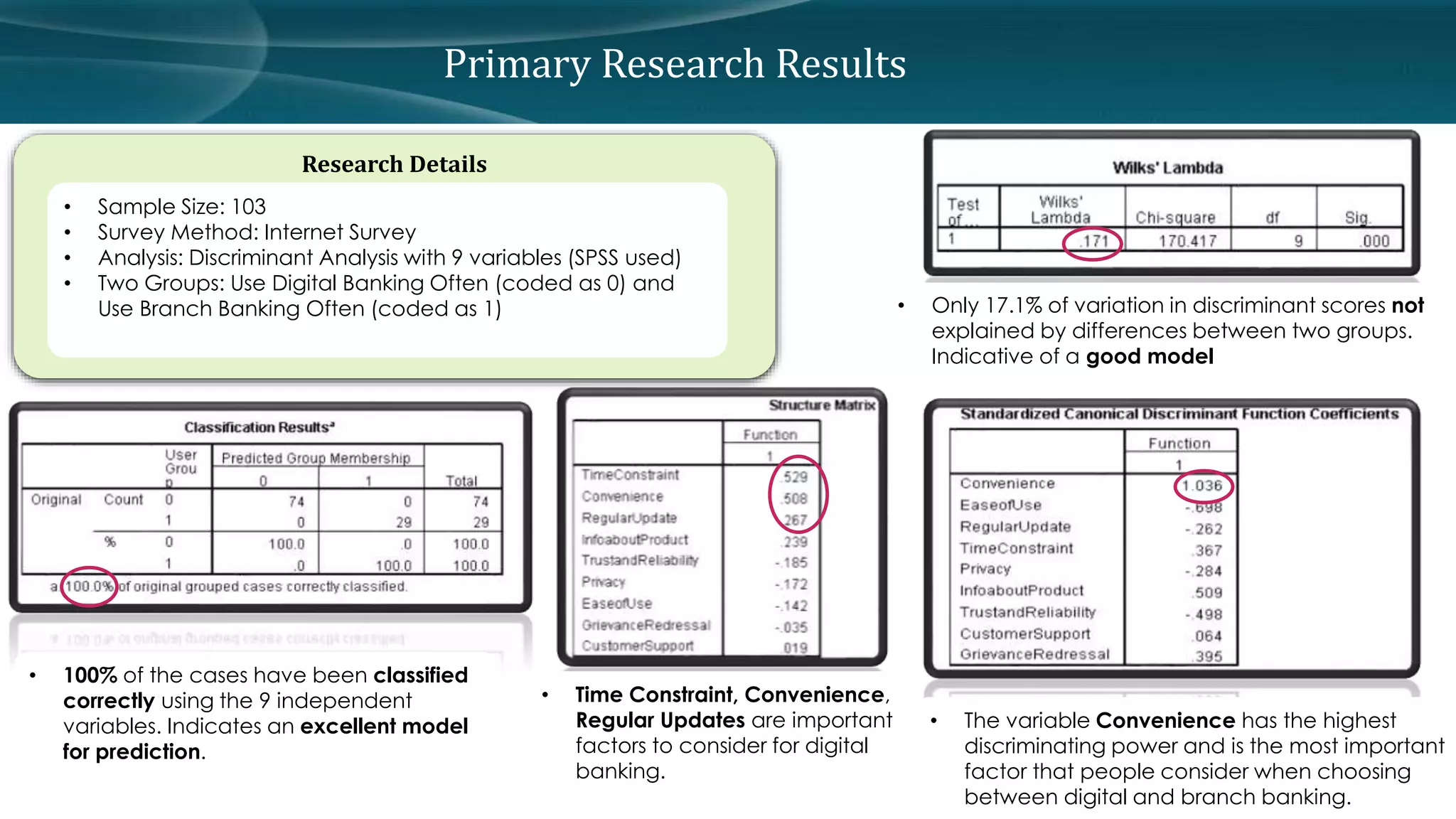

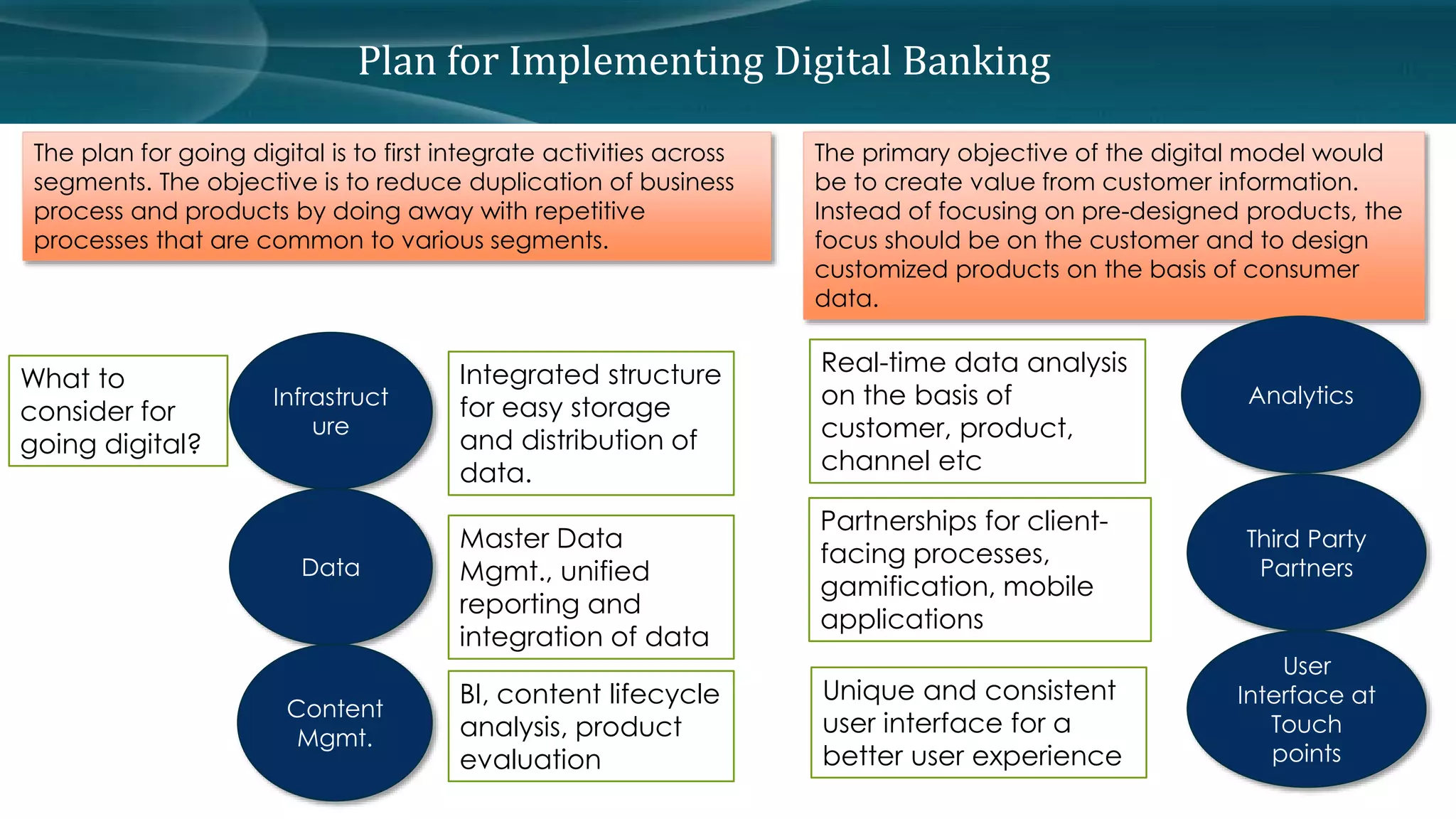

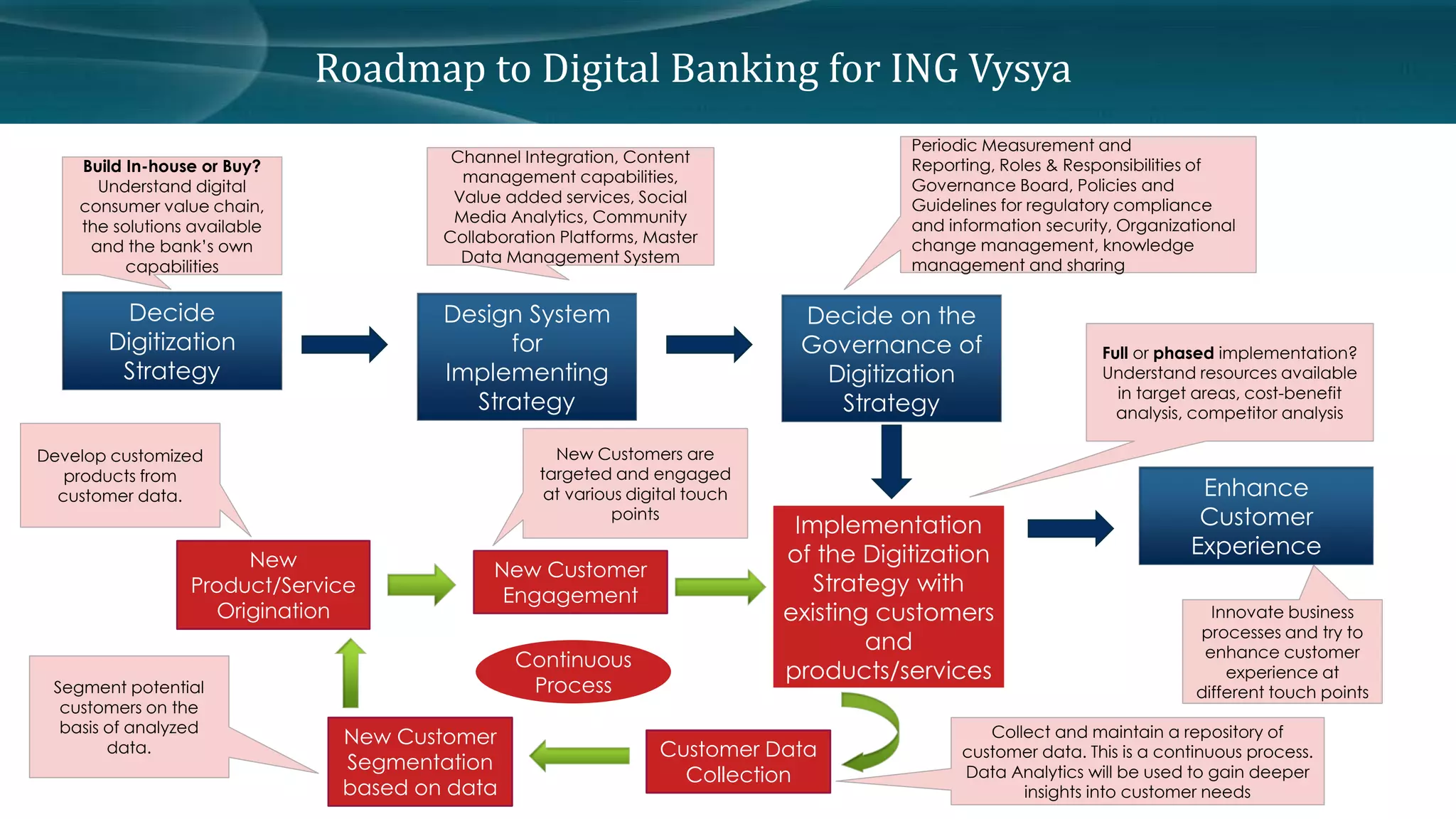

- A survey found customers prefer digital banking over branches due to convenience and time savings. Key implementation factors are infrastructure, data management, analytics, and user interfaces.

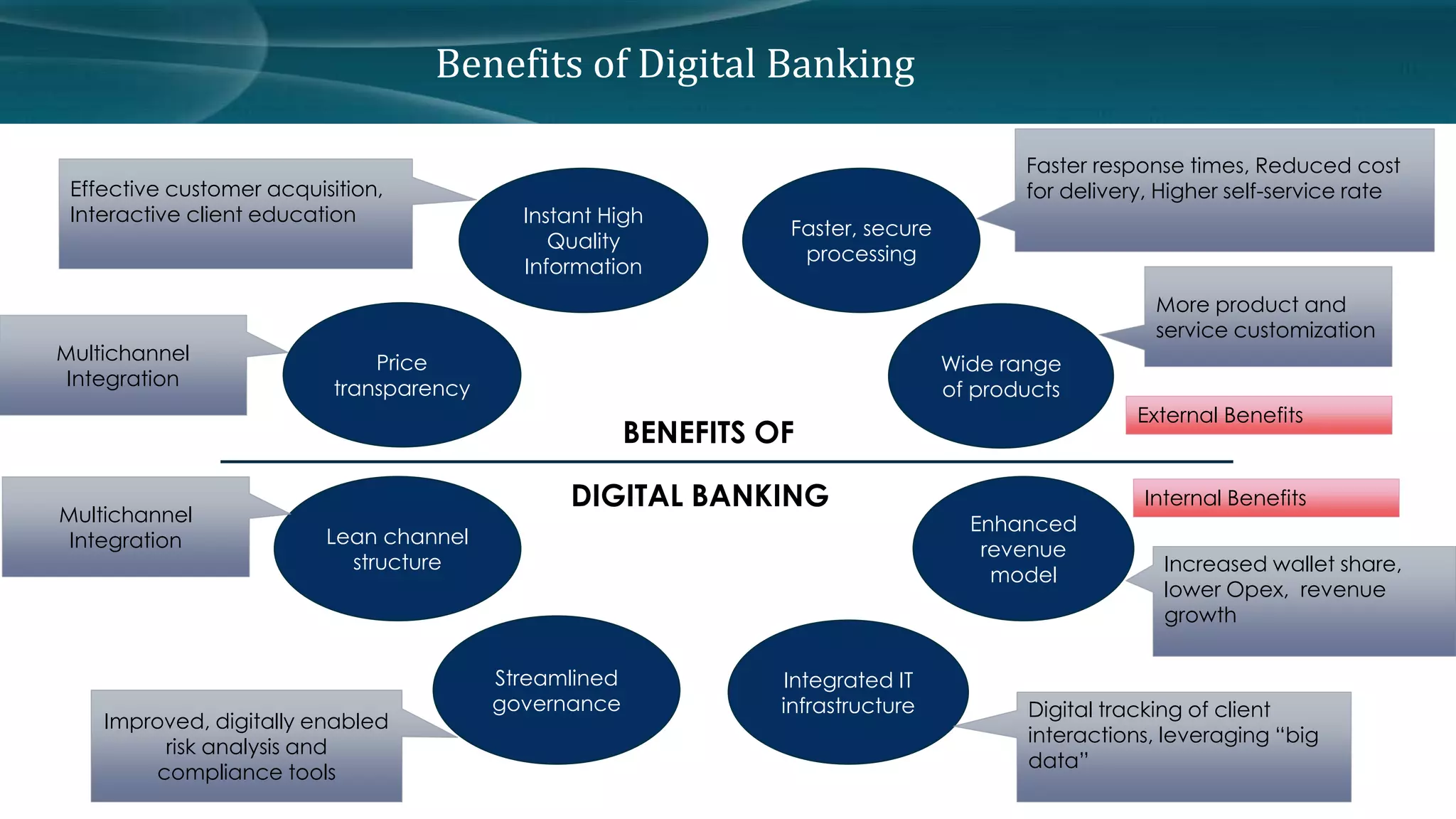

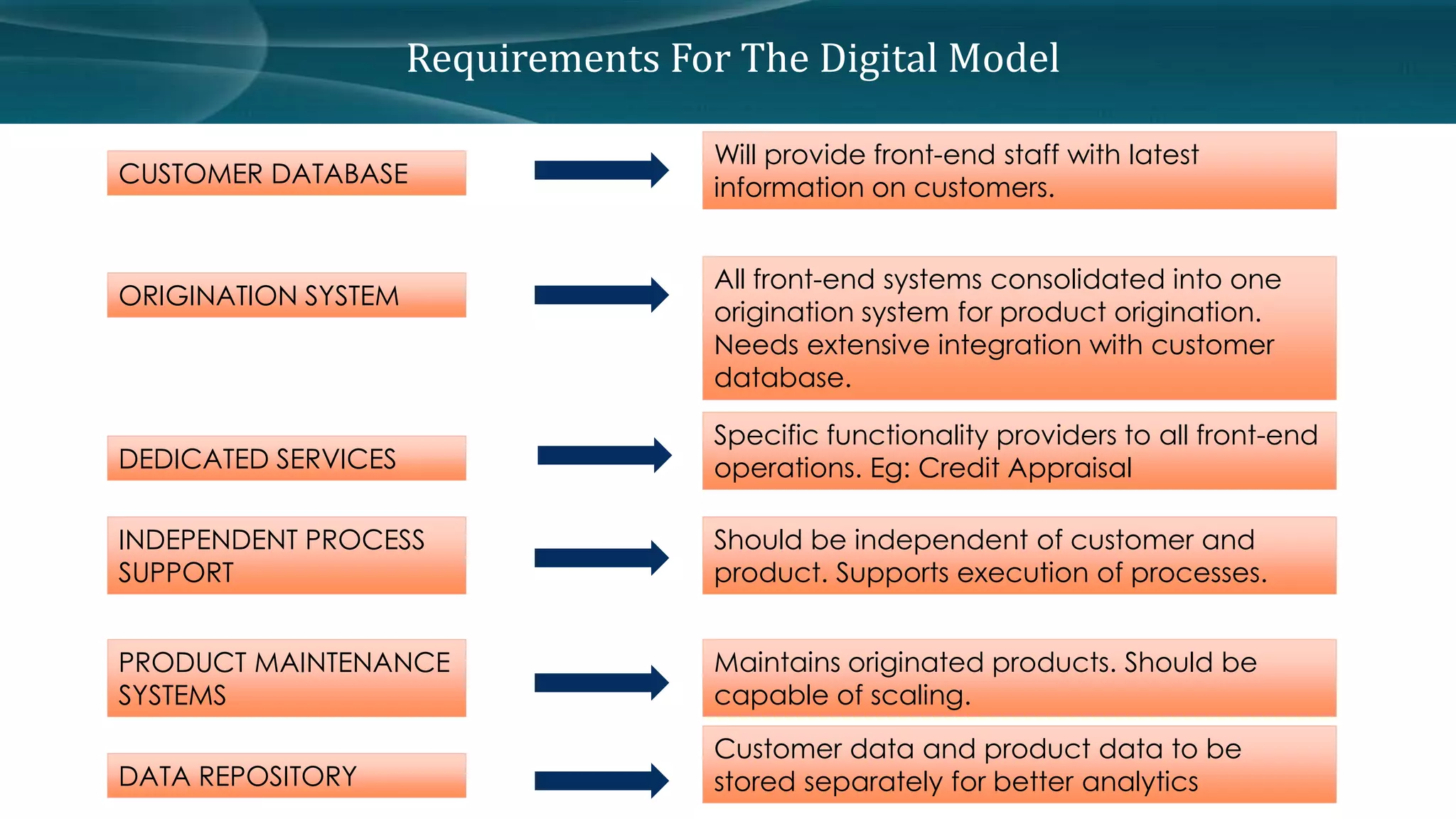

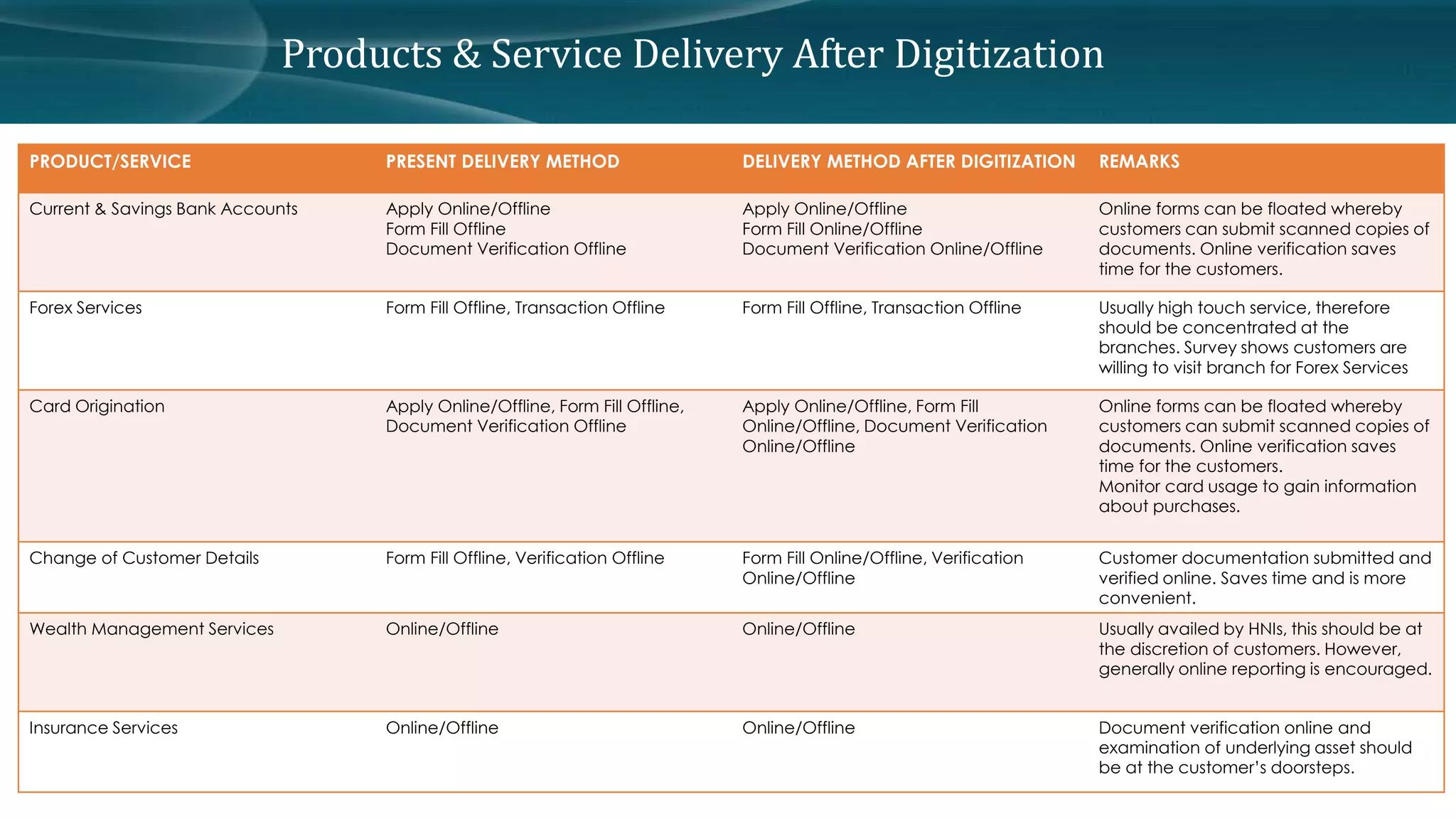

- The recommendations include creating an integrated customer database, origination systems, independent processing support, and data repository to power customized digital products and services.