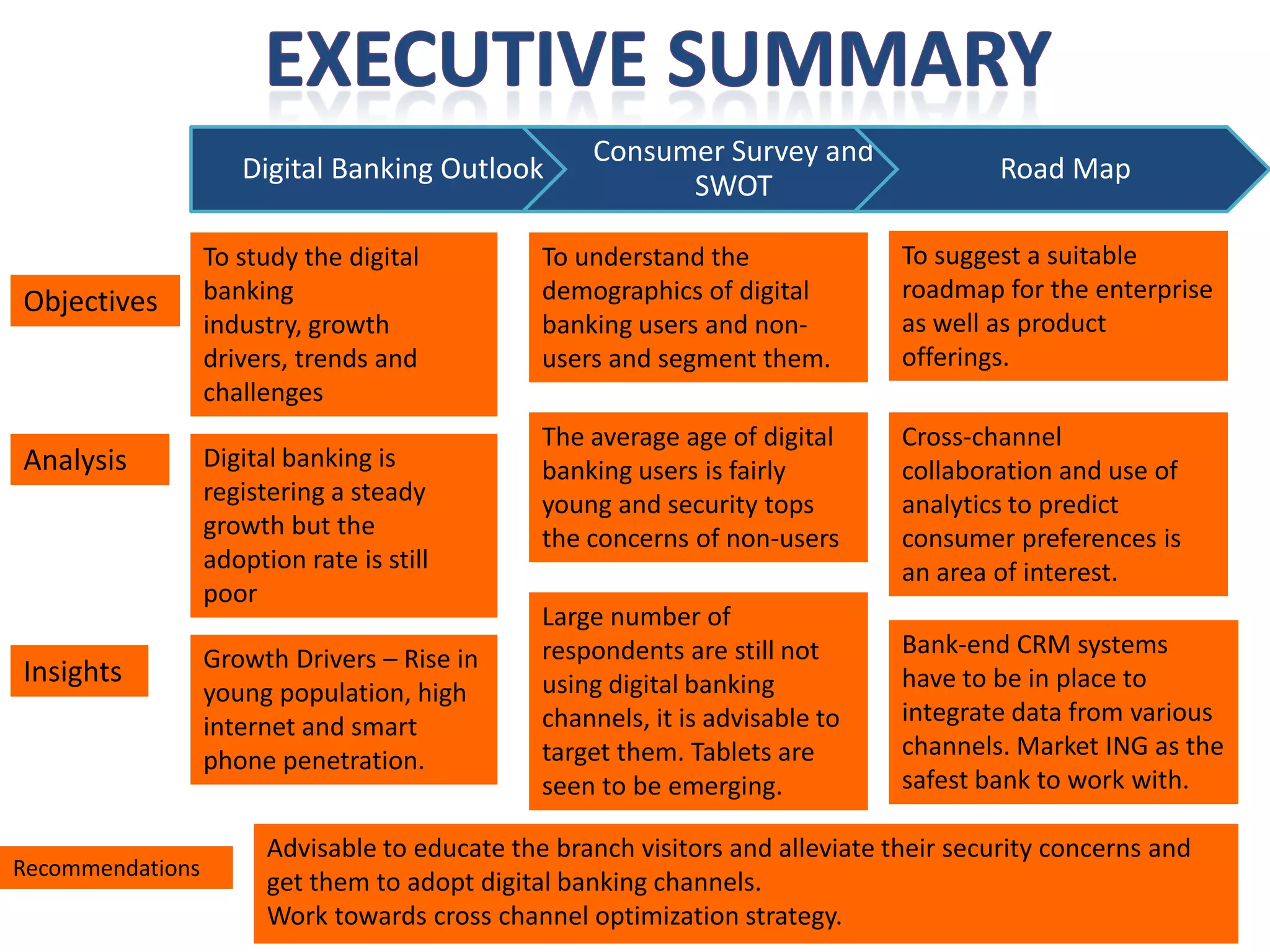

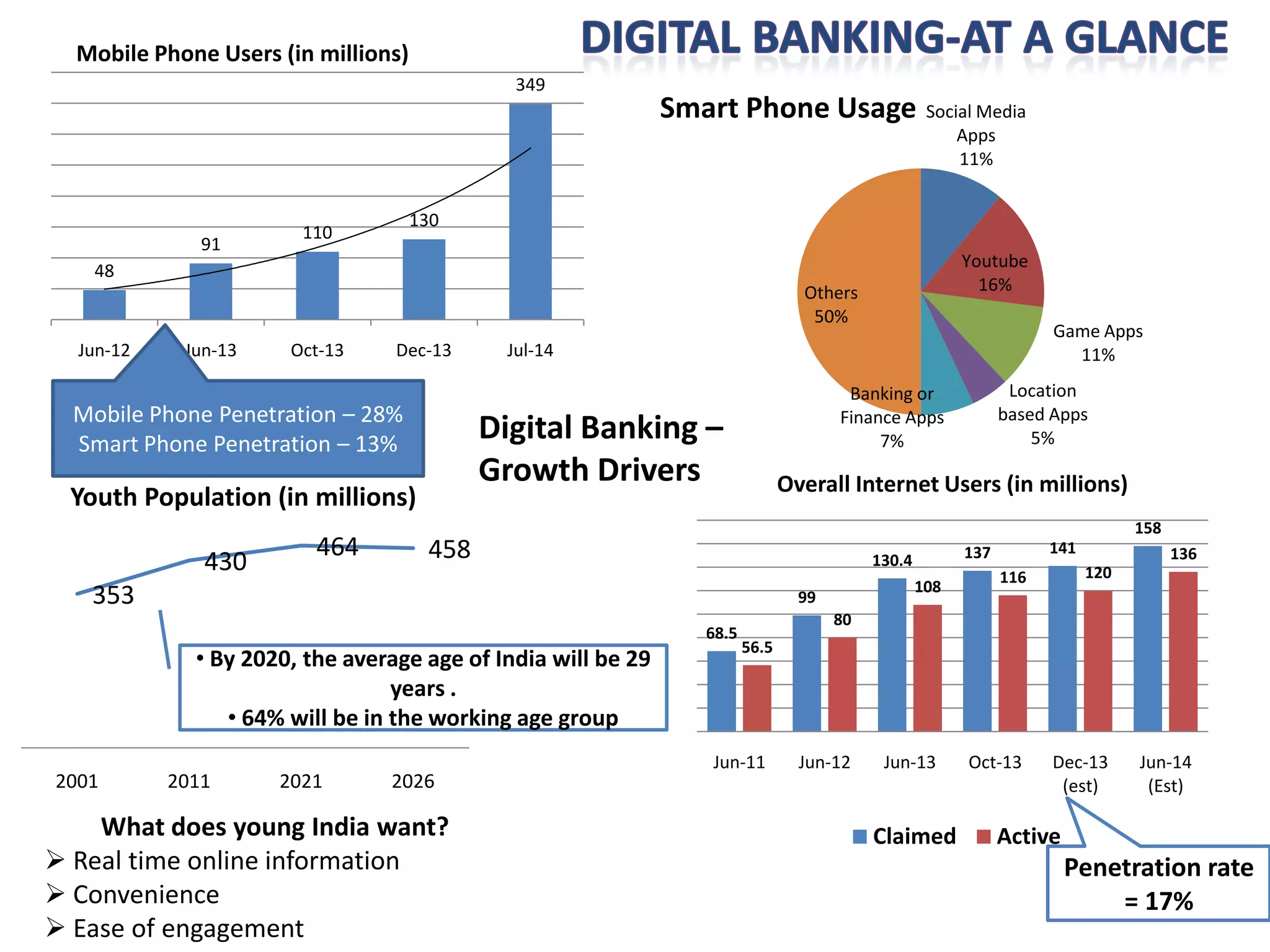

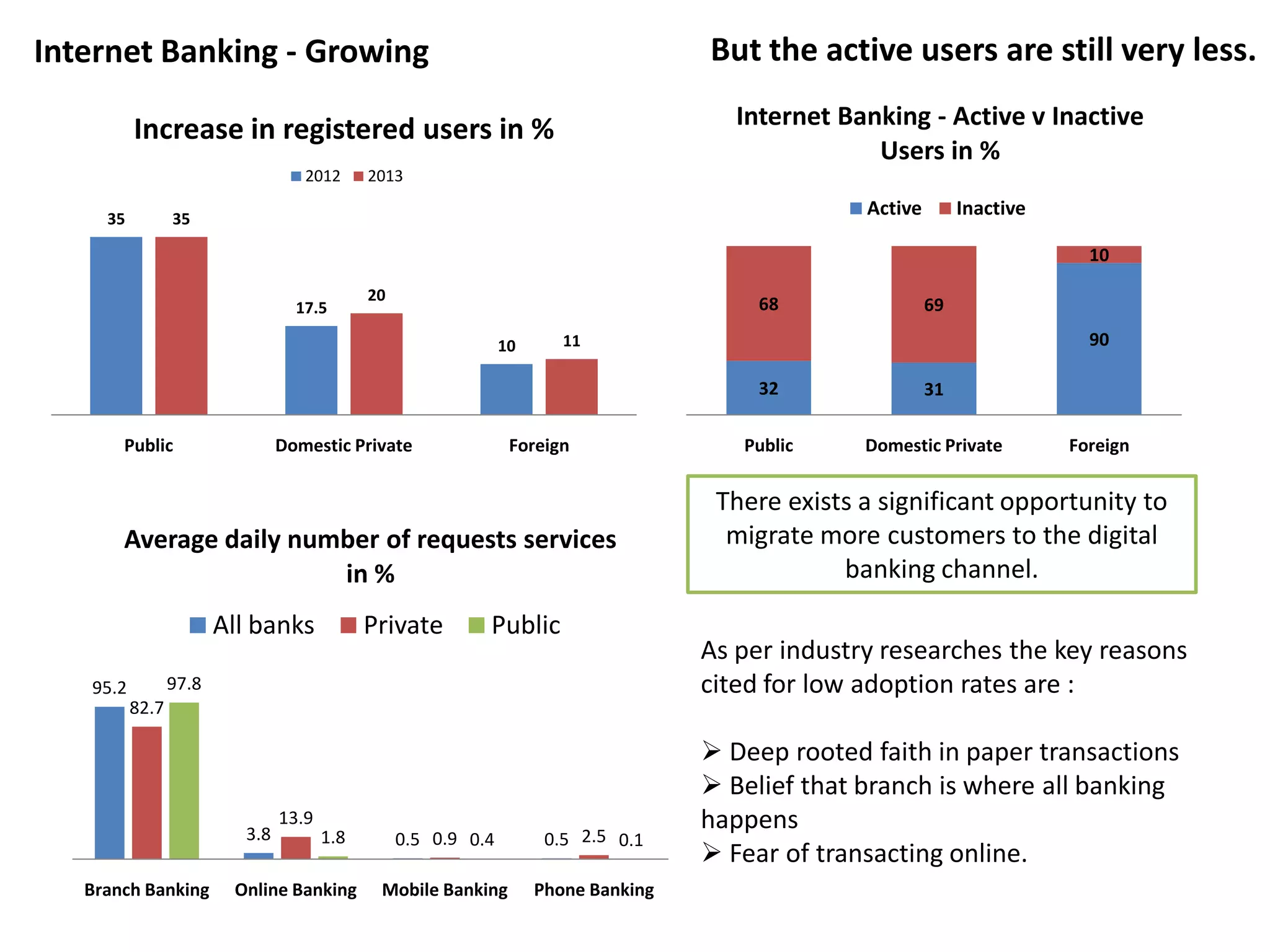

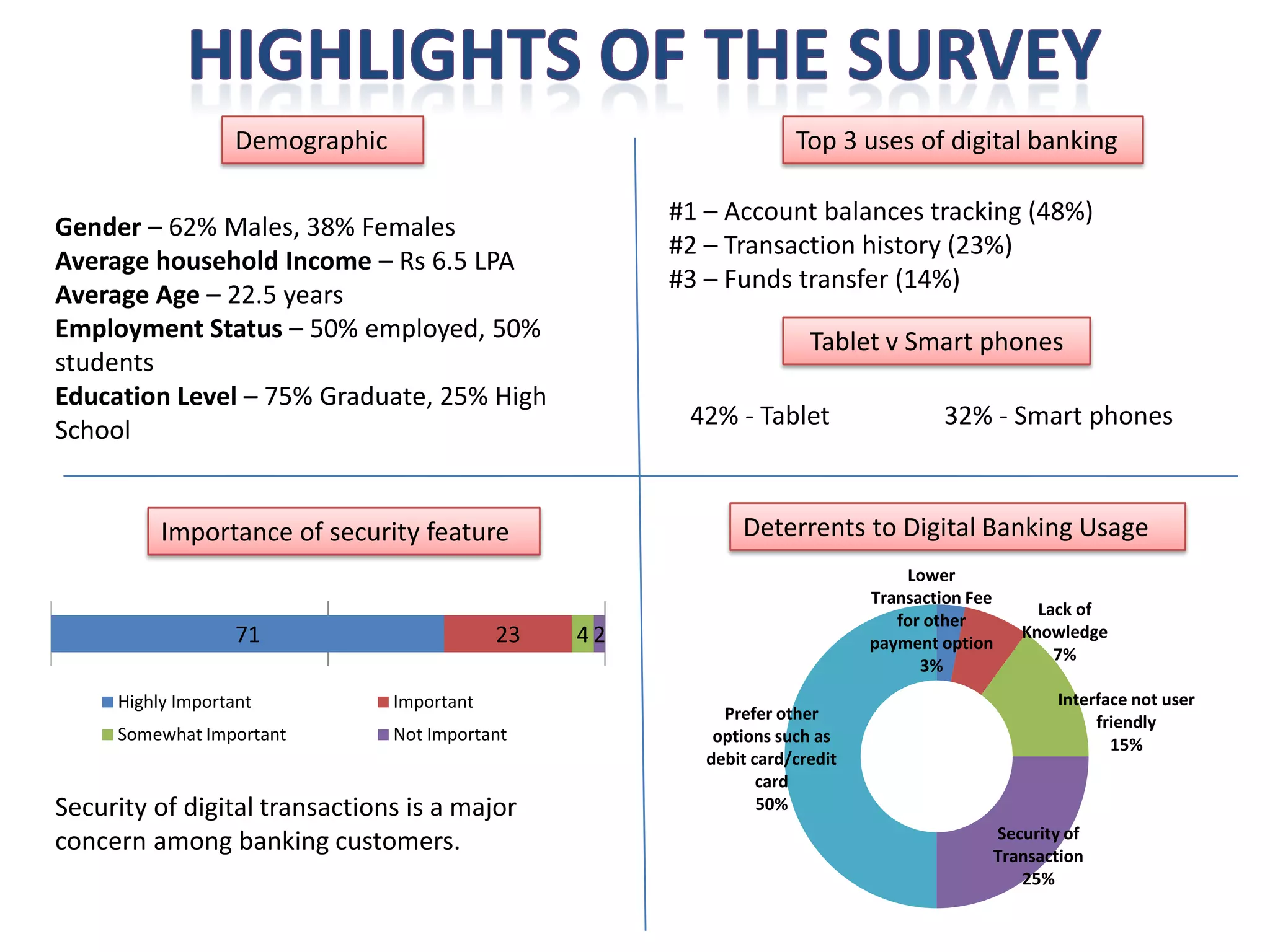

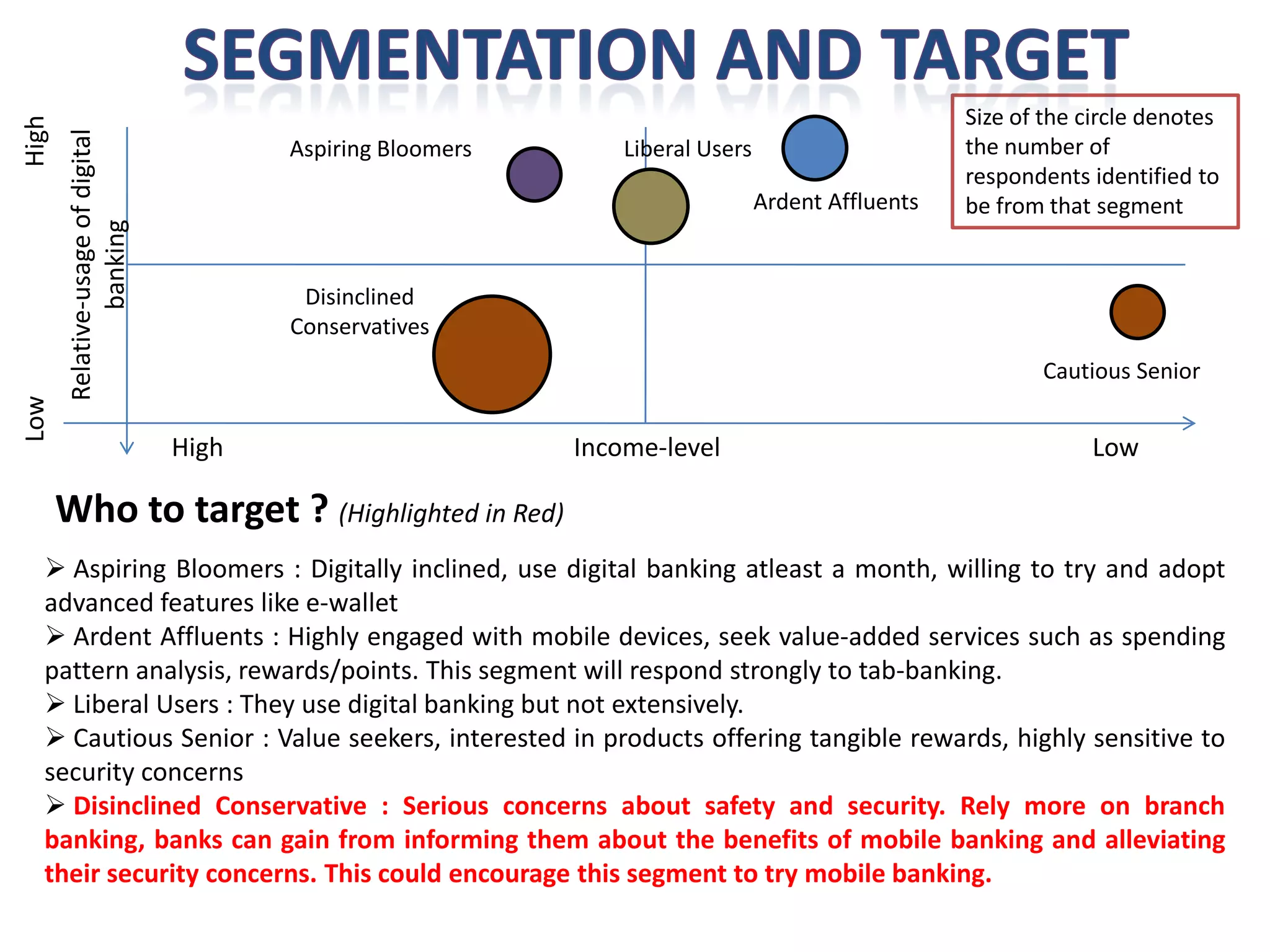

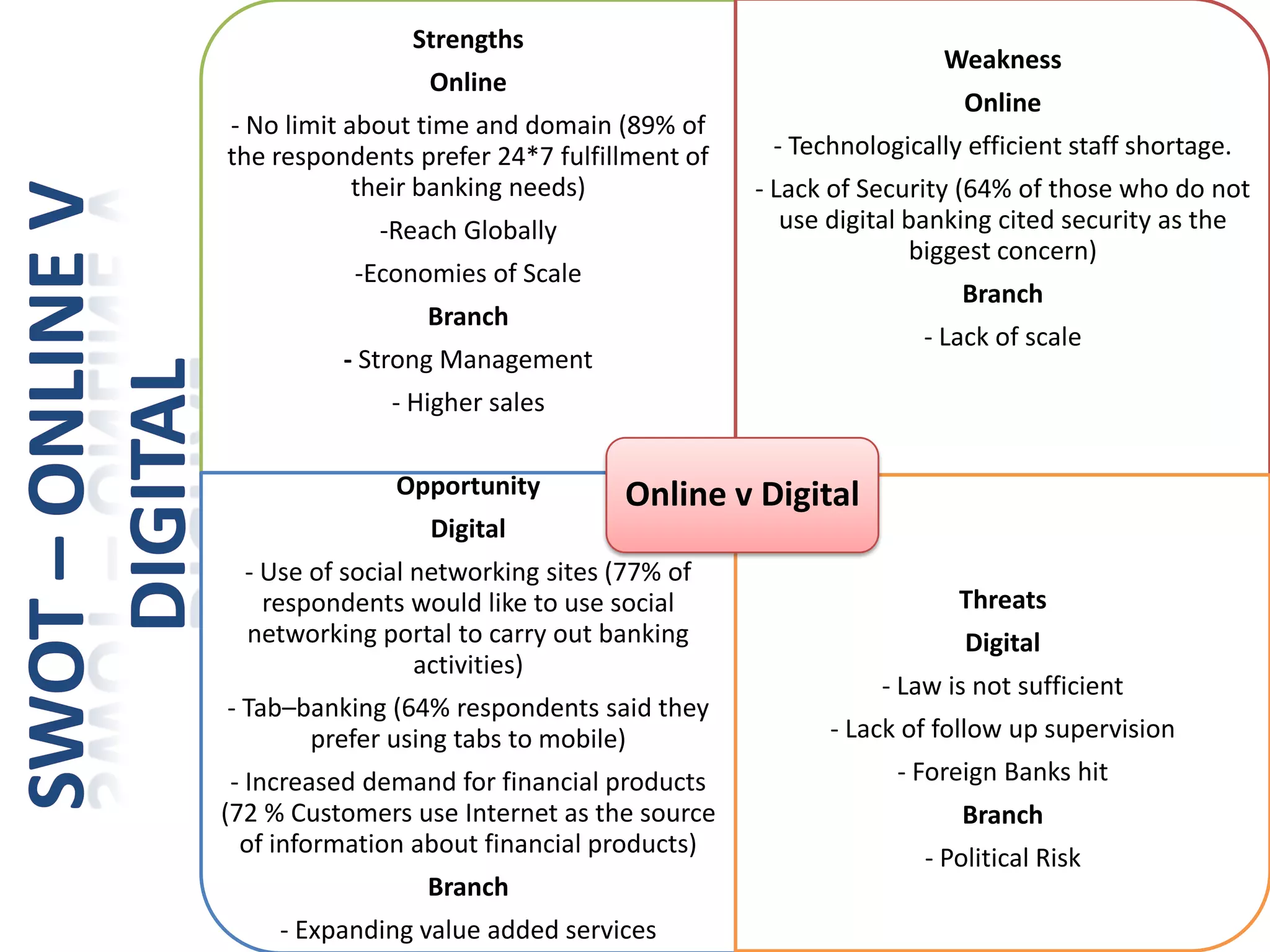

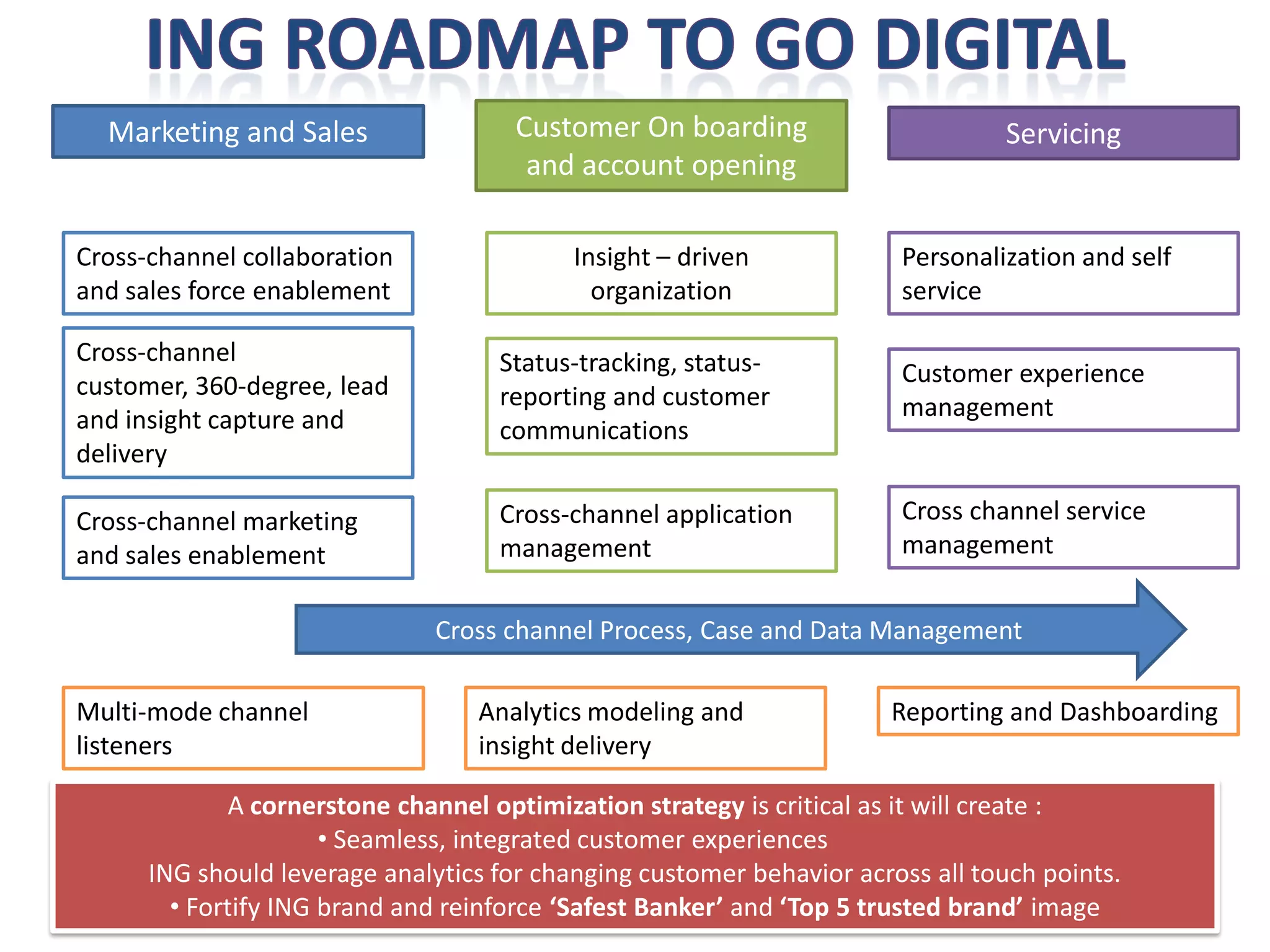

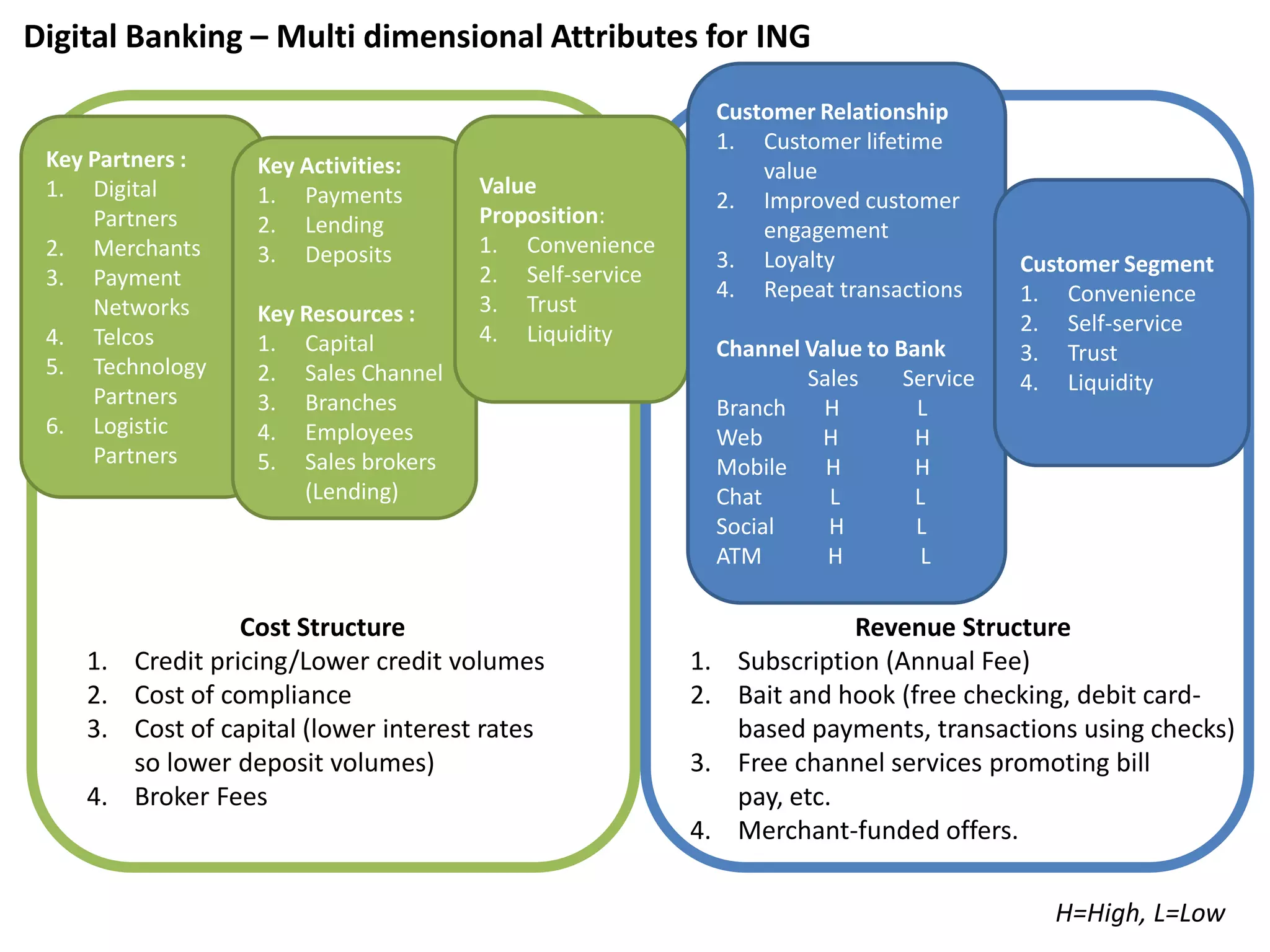

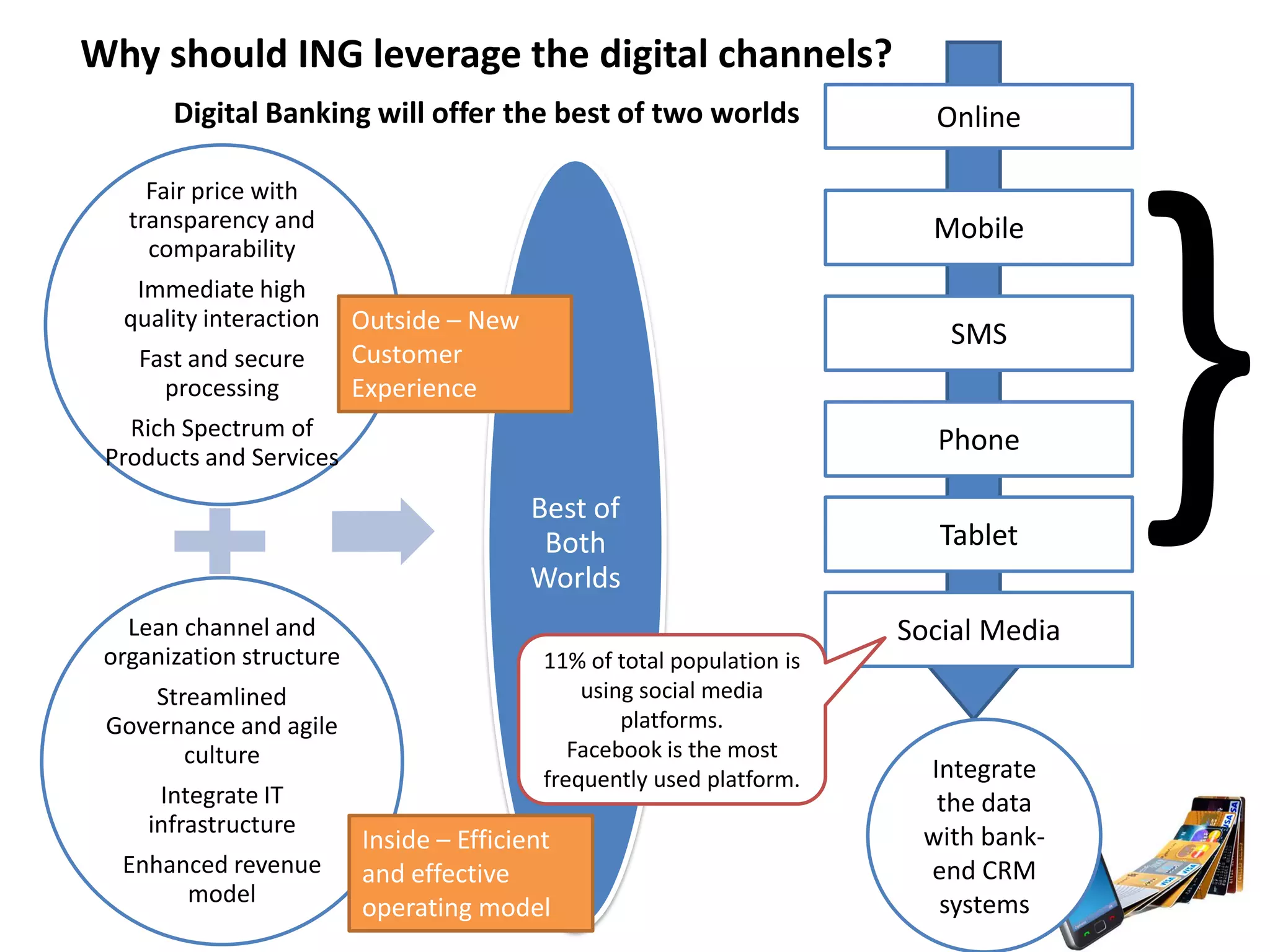

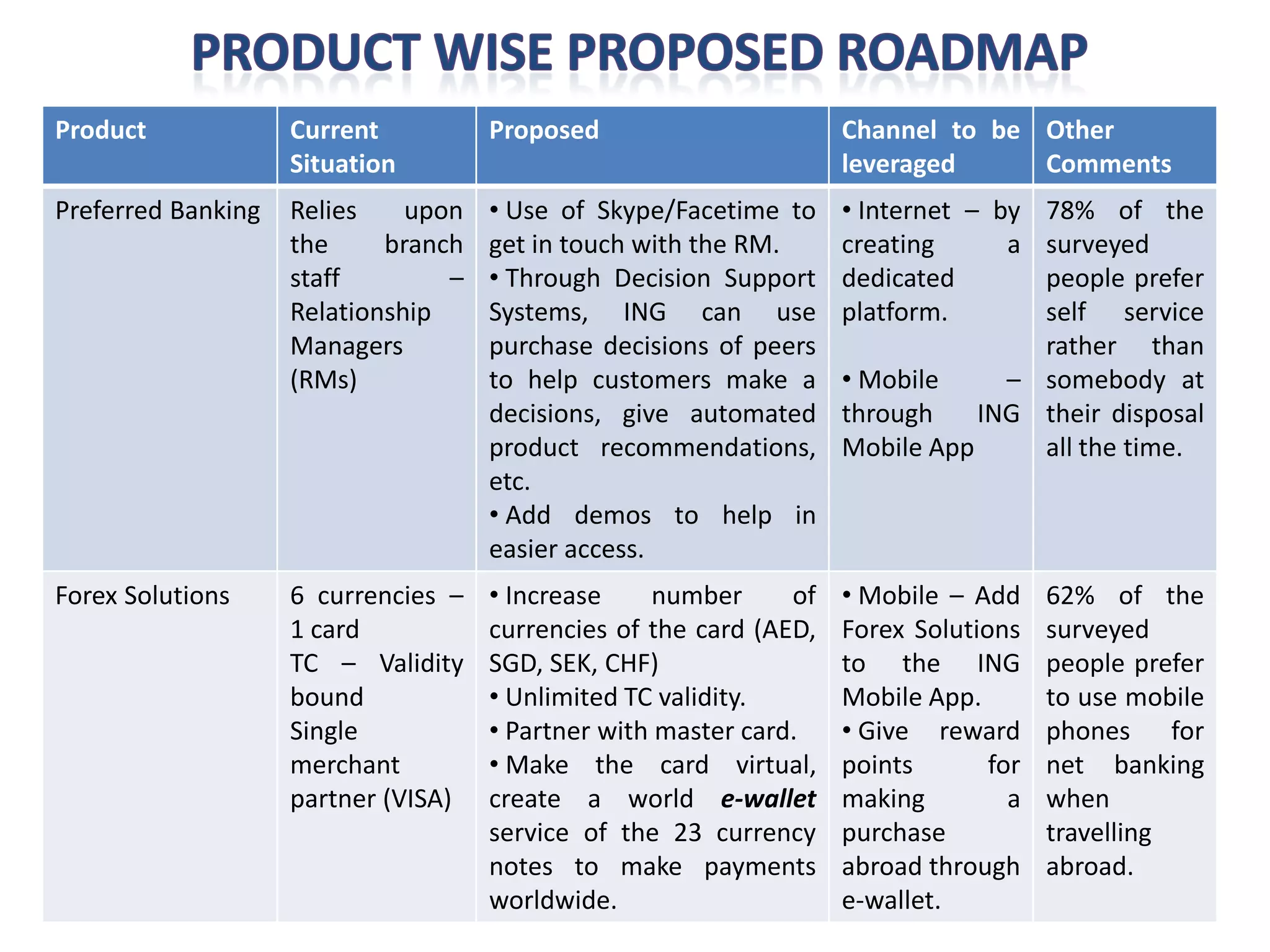

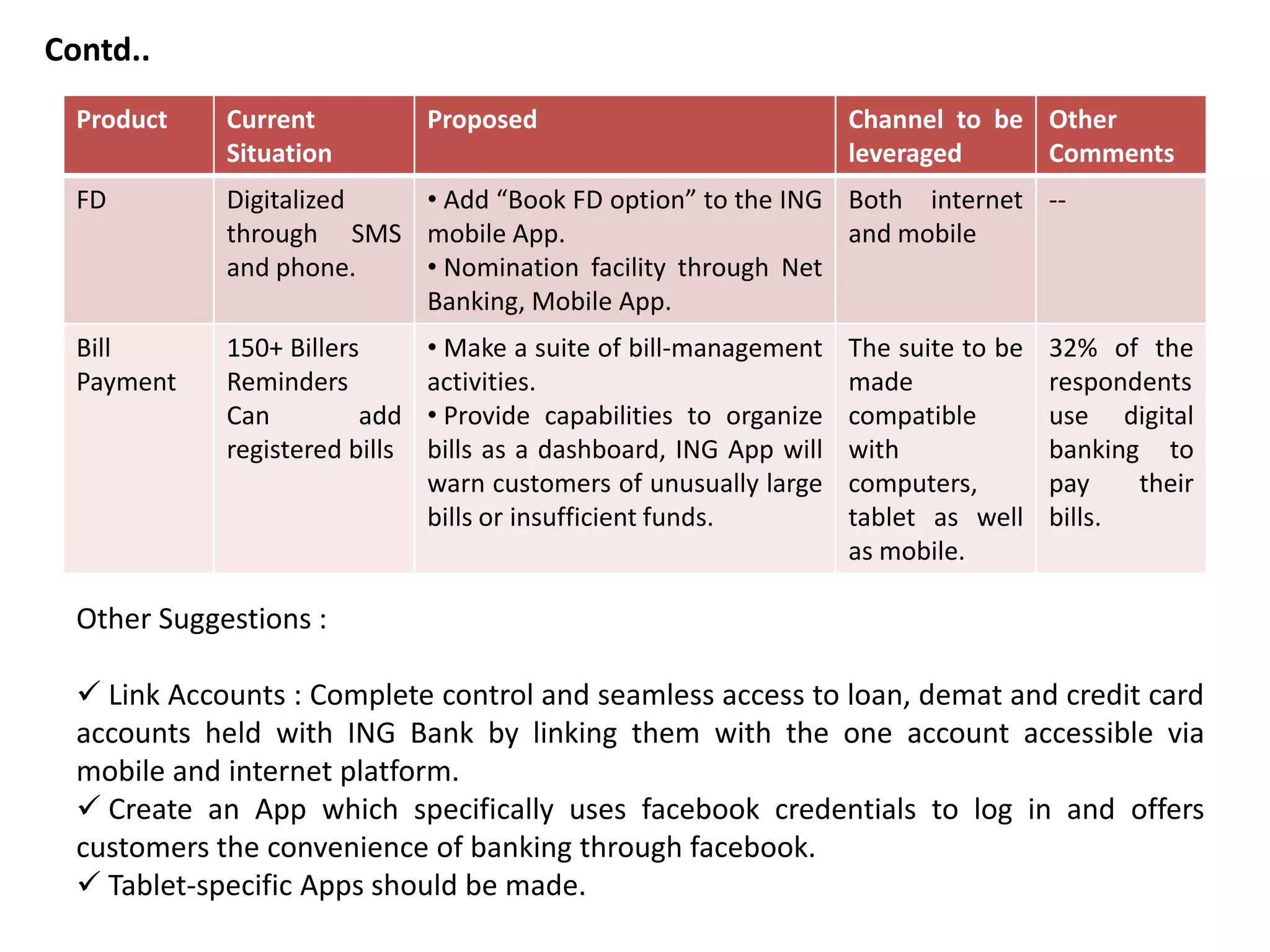

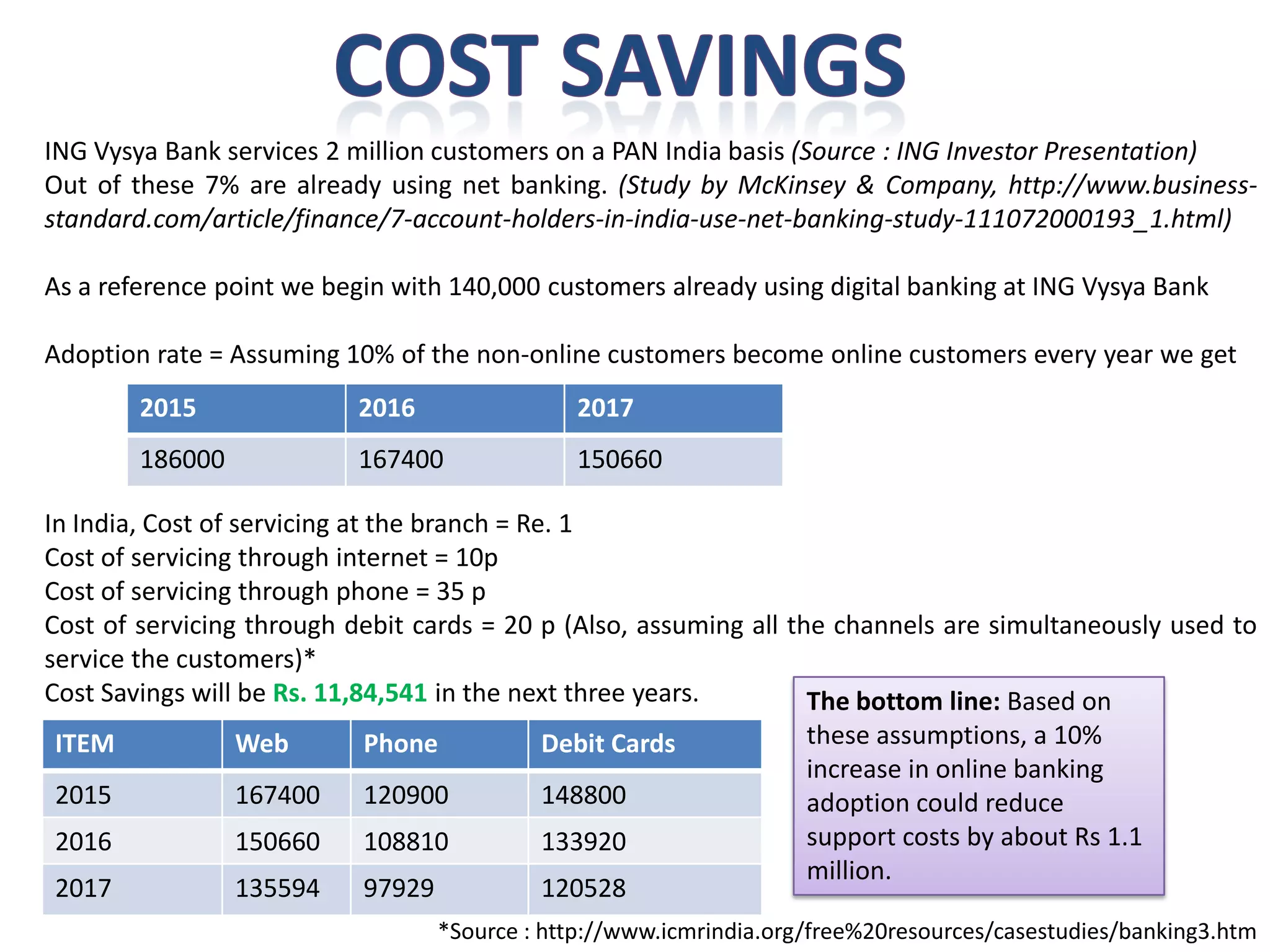

The document discusses a study conducted on digital banking in India. It analyzes growth drivers and trends, identifies customer segments, and examines the strengths, weaknesses, opportunities and threats associated with digital banking. Based on the findings, the summary recommends that ING Bank target aspiring and affluent customer segments who are more open to digital banking. It also suggests leveraging analytics to improve customer experiences across channels and strengthen the bank's brand image. A cornerstone channel optimization strategy is advised to create seamless customer experiences and an efficient operating model.