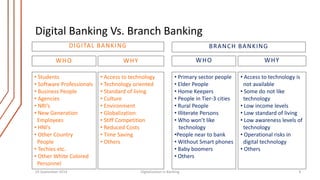

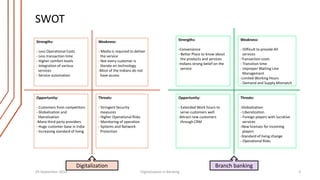

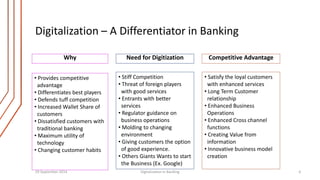

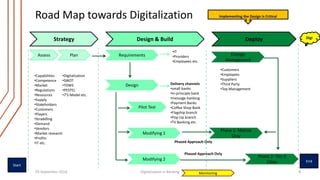

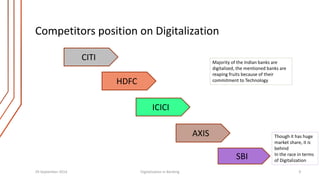

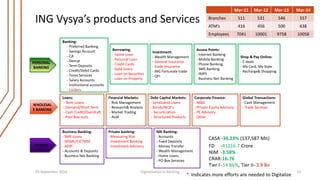

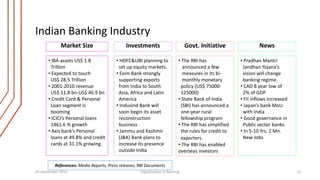

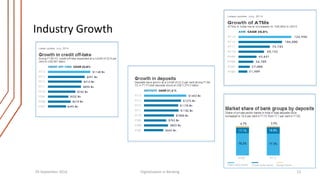

This document discusses digitalization in the Indian banking industry. It begins by comparing digital and branch banking, noting who prefers each and why. It then examines the SWOT of digital and branch banking. Several major Indian banks like SBI and ICICI are highlighted as leaders in digitalization efforts. The document outlines India's sentiment toward digitalization and banks' roadmaps. It also reviews ING Vysya Bank's products/services and the size and growth of the overall Indian banking industry. Competitors' digital products are listed and industry growth predictions are presented.