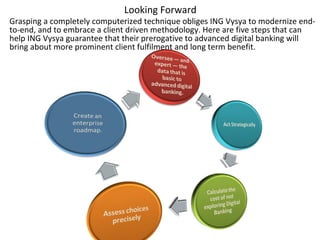

The document summarizes research on ING Vyasa Bank customers' use of internet and branch banking. 165 customers were surveyed about their banking habits and preferences. Their feedback was analyzed using statistical analysis tools like pie charts and histograms. A SWOT analysis was also conducted for internet and branch banking from the customer's perspective. The findings showed customers wanted an improved online banking experience and more branches/ATMs. Suggestions included expanding ING's branch network in Chhattisgarh, improving the mobile app, and increasing digital banking promotion. A roadmap was proposed for ING to transition further to digital banking.